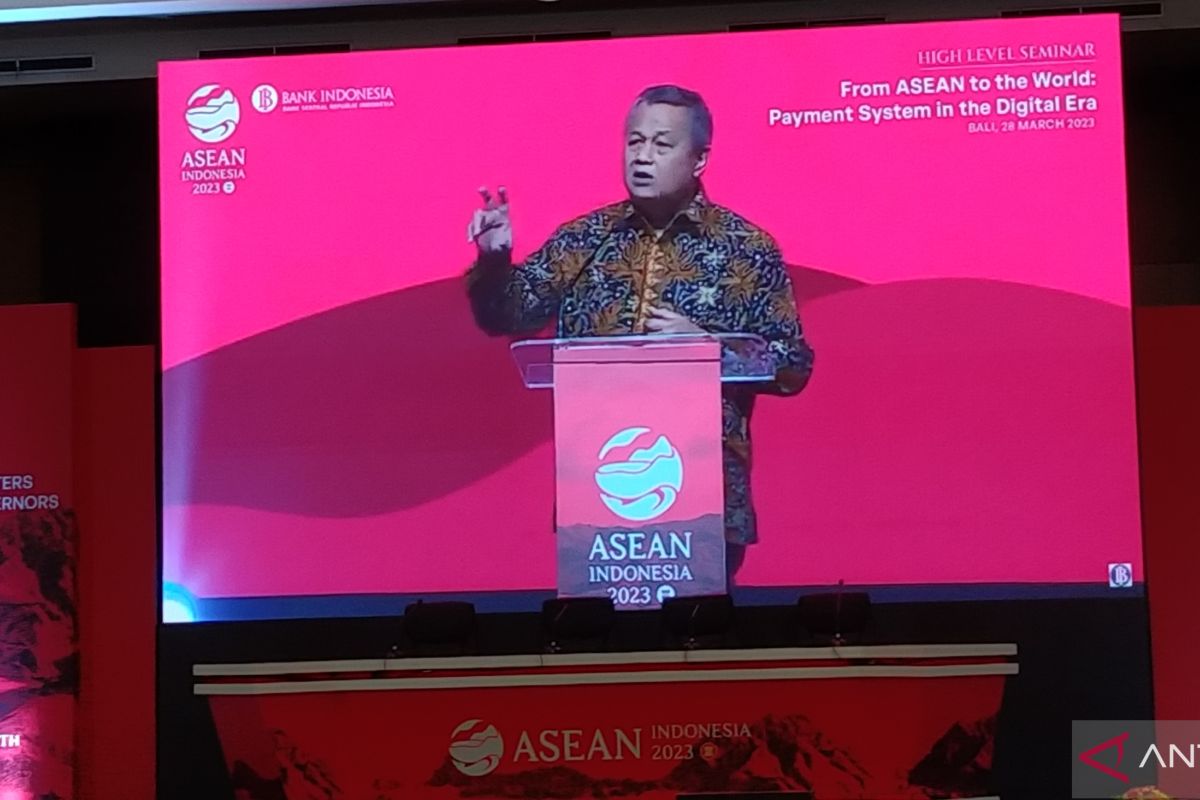

The methods comprise developing an integrated ecosystem, expediting digitalization, as well as improving financial literacy and consumer protection, he informed on the sidelines of the ASEAN Finance Ministers and Central Bank Governors’ Meeting in Nusa Dua, Bali, on Tuesday.

The first method to improve financial inclusion involves developing an integrated ecosystem to support small enterprises through the development of micro, small, and medium enterprise (MSME) clusters.

The method has already been implemented by BI, which has around 3 thousand MSMEs under its guidance through 46 representative offices, to increase the enterprises' scale.

The cluster guidance is being undertaken by providing technical and entrepreneurship assistance, supporting product improvement, and connecting enterprises to bigger ecosystems.

From a capital standpoint, as a central bank, BI is also creating policies in the form of fiscal incentives so that enterprises can be provided with interest subsidies within people's business credit (KUR).

The second method to improve financial inclusion involves expediting digitalization, for instance, through the use of the fast payment system QRIS since 2019.

The governor of the Indonesian central bank informed that in 2022, there were 30 million QRIS users and 80 percent of them were MSMEs.

This year, BI is aiming to have 45 million QRIS users, who are projected to still be dominated by MSMEs.

Despite this, the use of QRIS is still being pushed since there are around 65 million micro and small enterprises in Indonesia.

Meanwhile, digital transaction performance can also be an innovative method of credit assessment of prospective debtors for receiving financial access to develop their businesses.

The last method to improve financial inclusion concerns financial literacy and consumer protection.

There are still many MSMEs in Indonesia that require education concerning financial products and services, Warjiyo explained.

Moreover, the use of digital technology is also related to cyber security, specifically preventing personal data abuse.

According to data provided by the Financial Services Authority (OJK), the financial literacy rate in Indonesia rose to 85 percent in 2022 from 76 percent in 2019.

Meanwhile, financial literacy in Indonesia increased to 49.6 percent in 2022 from 38 percent in 2019.

Related news: OJK issues regulation to improve financial literacy, inclusion

Related news: University students need to know financial literacy, inclusion: OJK

Related news: Agent banks, QRIS expediting financial inclusion: Ministry

Translator: Dewa Ketut S W, Fadhli Ruhman

Editor: Azis Kurmala

Copyright © ANTARA 2023