The Governor of Bank Indonesia, Perry Warjiyo, has outlined Indonesia’s Payment System (IPS) 2025 Visions to ensure the current trend of digitalisation develops within a conducive digital economic and financial ecosystem.

The visions are a response to the recent proliferation of digitalisation that has significantly altered the risk landscape, through cyber threats, monopolistic competition and shadow banking, which could undermine the effectiveness of monetary controls, the stability of the financial system and sound payment systems, according to a statement released here on Thursday.

The statement was delivered during an international seminar, entitled Digital Transformation of the Indonesian Economy, which was held on Monday (27/5) in Jakarta.

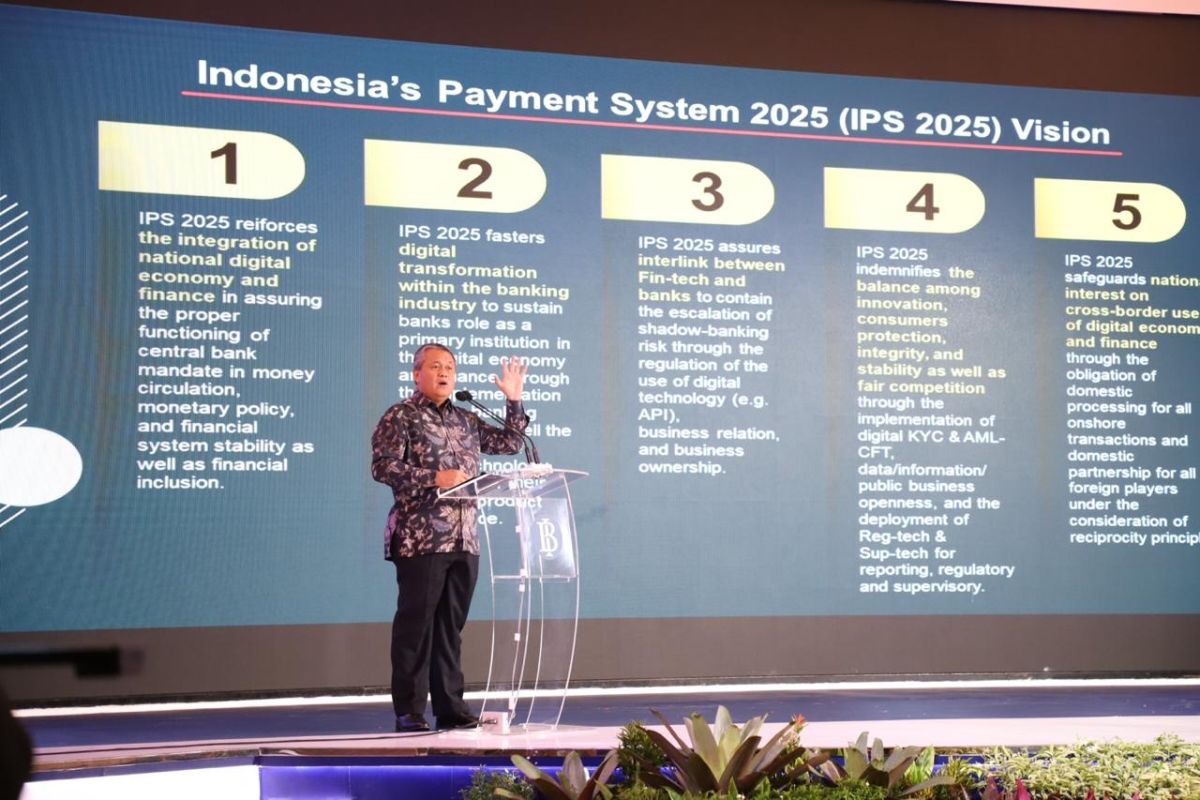

The IPS 2025 Visions are: First, reinforce the integration of the national digital economy and finance to ensure the proper functioning of the central bank mandate in money circulation, monetary policy, and the stability of the financial system, as well as financial inclusions.

Second, work for faster digital transformations within the banking industry to sustain the banks’ role as a primary institution in the digital economy and finance, through the implementation of open-banking standards, as well as the deployment of digital technology and data in their financial products and services.

Third, ensure the interlinks between Fin-Tech and banks to contain the escalation of shadow-banking risks through the regulation of the use of digital technology (e.g. Application Programming Interface-API), business relations, and business ownerships.

Fourth, indemnify the balance among innovation, consumer protection, integrity, and stability, as well as fair competition, through the implementation of digital Know Your Customer (KYC), Anti-Money Laundering and Combatting the Financing of Terrorism (AML/CFT), data/information/public business openness, and the deployment of Reg-tech and Sup-tech for reporting, regulatory and supervisory tasks.

Fifth, safeguard national interests on the cross-border use of the digital economy and finance through the obligation of domestic processing of all onshore transactions and domestic partnerships for all foreign players, under the consideration of the principles of reciprocity.

The five IPS 2025 Visions will materialise through five initiatives, to be carried out directly by Bank Indonesia in pursuance of the central bank’s duties and jurisdiction, as well as implemented through productive collaboration and coordination with relevant government ministries and institutions, along with the industry.

As a preliminary step towards digital transformation of the national payment system, and to help accelerate digital economic and financial development, Bank Indonesia held a soft launching of the QR Code Indonesia Standard (QRIS).

QRIS will allow all QR payments to interconnect and become interoperable using one standard QR Code.

Initially, Bank Indonesia will introduce QRIS in the Merchant Presented Mode (MPM), with implementation commencing in the latter half of 2019.

(INE)

Translator: Azis Kurmala

Editor: Fardah Assegaf

Copyright © ANTARA 2019