The Global Sukuk issued by the Indonesian government is higher than those issued by the Emirates of Dubai at US7 billion, the Malaysian government at US$6.9 billion, the Turkish government at US$4.8 billion and the Qatari government at US$4.7 billionJakarta (ANTARA News) - The Indonesian government has been the largest global sukuk (shariah bond) issuer issuing bonds worth US$13.1 billion after it routinely issued US dollar-denominated Islamic bonds since 2009, Director General of Finance and Risk Management at the Ministry of Finance, Robert Pakpahan, said here, Thursday.

He explained that the number of Global Sukuk issuance by the Indonesian government has reached 25.67 percent of the total US dollar-denominated sukuk issuances in the world market, which until March 29, 2017 has reached US$ 53.14 billion.

The Global Sukuk issued by the Indonesian government is higher than those issued by the Emirates of Dubai at US 7 billion, the Malaysian government at US$6.9 billion, the Turkish government at US$4.8 billion and the Qatari government at US$4.7 billion.

The realization of Indonesias global sukuk is also more than those realized by Bahrain which was at US$4.3 billion, Hong Kong amounting to US$3 billion, the government of Pakistan at US$2.6 billion and the Emirates of Ras Al Khaimah at US$2.3 billion.

Earlier, the Indonesian government has issued global sukuk amounted to US$3 billion, or the biggest US dollar-denominated Islamic bonds issuance outside the gulf area.

The Global Sukuk issuance by Indonesia is supported by favorable market conditions for the implementation of sharia (the Islamic Laws) and strong demand from investors.

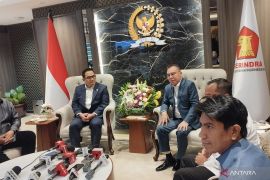

"The government has issued the Global Sukuk eight times and it has been appreciated by Middle East investors and it has madethem consider that "we are not the kind of hit and run player", Robert said.

The issuance of Islamic bonds by Indonesia is nearing the Global Sukuk value issued by the Qatari government which amounted to US$4 billion in 2012.(*)

Editor: Heru Purwanto

Copyright © ANTARA 2017