The implementation of the ecosystem of halal value chain through the development of the economy of pesantren (Islamic boarding school), sharia Micro Small Medium Enterprises (MSMEs) to the industries, especially food, fashion, cosmetics, tourism andJakarta (ANTARA) - Economic development will continue to be encouraged along with Islamic finance, which is the new source of national economic growth, Bank Indonesia Governor Perry Warjiyo has said. "The implementation of the ecosystem of halal value chain through the development of the economy of pesantren (Islamic boarding school), sharia Micro Small Medium Enterprises (MSMEs) to the industries, especially food, fashion, cosmetics, tourism and pharmaceuticals, and the halal industry campaign will continue to be strengthened," Warjiyo was quoted as saying on the Bank Indonesia's website in Jakarta, Monday.

In addition to supporting the strengthening of national sharia banking, a deepening of the Islamic financial market will continue to be accelerated to strengthen liquidity management and Islamic financial financing, he explained.

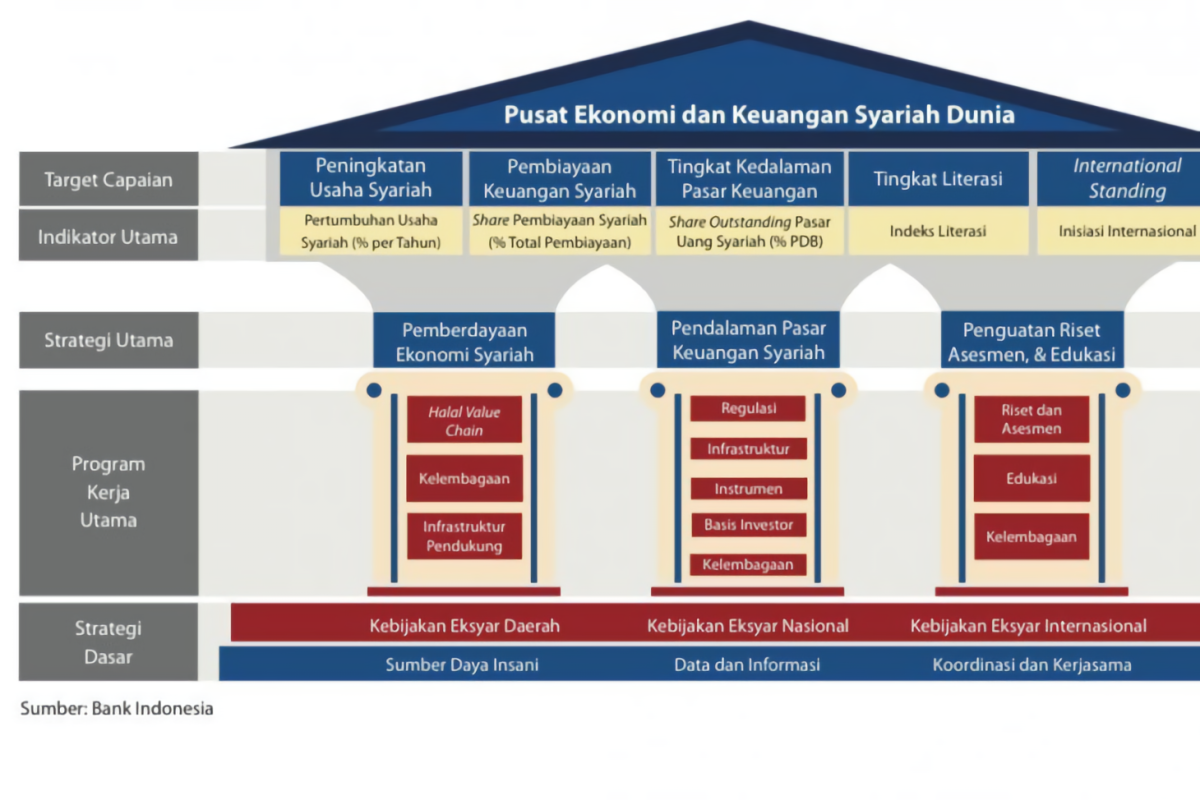

In the pillars of sharia economic and financial development, Bank Indonesia has set five achievement targets, namely sharia business improvement, sharia financial financing, financial market depth, literacy level and international standing, Perry said in his remarks at the 2019 Annual Meeting of Bank Indonesia with the theme "Synergy, Transformation, and Innovation Towards Advanced Indonesia" in Jakarta, on November 28, 2019.

Related news: Indonesia's advancement of Islamic Finance is transformative: IsDB

Related news: Islamic finance has potential for 'impact investment'

The main indicators of its development include the growth of sharia businesses, sharia financing, sharia money market, literacy index and international initiation.

Optimization of sharia social finance in the zakat and waqf sectors will be encouraged to increase inclusive sharia financing.

Besides, efforts to make Indonesia a major reference in the global Islamic economy and finance will also be encouraged.

The series of activities of the Indonesia Sharia Economic Festival (ISEF) including the Sharia Economic Festival (FeSyar) in three regions of Indonesia, which has been successful, will now be held every year on a joint platform to advance Islamic economics and finance in Indonesia.

The popularity of Islamic finance amid the community needed to be improved because the growth rate was considered to be stagnant and not too optimal, a member of the House of Representatives Commission, XI Anis Byarwati, earlier said.

A new ambassador can popularize sharia finance and articulate in an easy and popular language to the public about the economy of sharia finance, according to Byarwati.

Related news: Islamic finance future remains promising: OJK

Related news: Indonesia offers Islamic finance investment opportunities

Translator: Azis Kurmala

Editor: Yuni Arisandy Sinaga

Copyright © ANTARA 2019