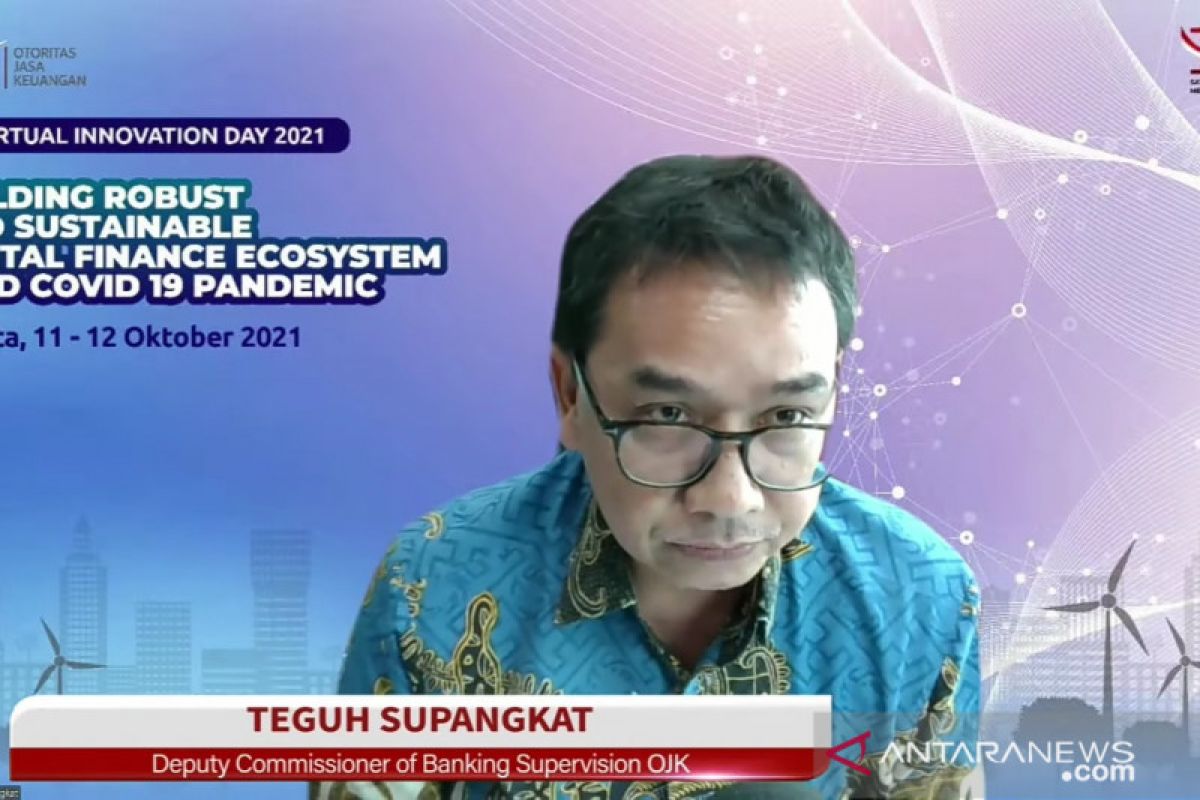

Outsourcing policies and standards of cooperation with third parties, as well as the institutional order that supports digital transformation, will also be contained in the blueprintJakarta (ANTARA) - The Financial Services Authority (OJK) is preparing a blueprint for the digital transformation of banking that will be launched in the near future, OJK's deputy commissioner of banking supervision, Teguh Supangkat, has informed.

"OJK is currently preparing a blueprint for digital transformation for banking that will provide a more concrete reference related to banking digitalization in the future," he said at the commemoration of the OJK Virtual Innovation Day 2021 here on Monday.

The blueprint is being created to accelerate digital transformation in the banking sector, he added.

The blueprint is also expected to become a policy breakthrough in mitigating the possible challenges and risks of banking digital transformation, he explained.

Related news: Digitalization can help nation achieve financial inclusion target: OJK

According to Supangkat, the blueprint for banking digital transformation will present a more detailed description of Indonesia's banking development road map.

"Some of the policies that will be outlined in this blueprint include the principles of data protection implementation and data transfer policies," he revealed.

Moreover, he said, policies related to data management or data governance will also be outlined.

Related news: Indonesia has 2,100 start-up companies: OJK

The book will also encompass information technology governance and architecture, as well as policies related to cybersecurity based on international standards.

"Outsourcing policies and standards of cooperation with third parties, as well as the institutional order that supports digital transformation, will also be contained in the blueprint," Supangkat added.

Meanwhile, to guarantee and improve banking security and defense against the risk of cyberattacks, OJK is also readying a framework to strengthen cybersecurity risk management in commercial banks, he highlighted.

"Cybersecurity risk management is structured in reference to international cybersecurity standards in many countries," he said.

Related news: OJK shares six tips to avoid financial fraud

In August 2021, OJK had published two new regulations -- OJK Regulation (POJK) No. 12/POJK.03/2021 regarding Commercial Bank and POJK No. 13/POJK.03/2021 regarding the Publication of Commercial Bank's Products, he said.

POJK No.12 is meant to serve as the foundation for the definition and operation of digital banks, Supangkat added. Meanwhile, POJK No. 13 is meant to streamline licensing and regulation, which would facilitate digital banks to create innovative products or services, he explained.

Related news: 83 COVID-19 cases detected at XX Papua PON

Related news: Visitors from 18 countries, excluding Singapore, can visit Indonesia

Translator: Sanya S, Kenzu T

Editor: Fardah Assegaf

Copyright © ANTARA 2021