The workers were all young people wearing batik.

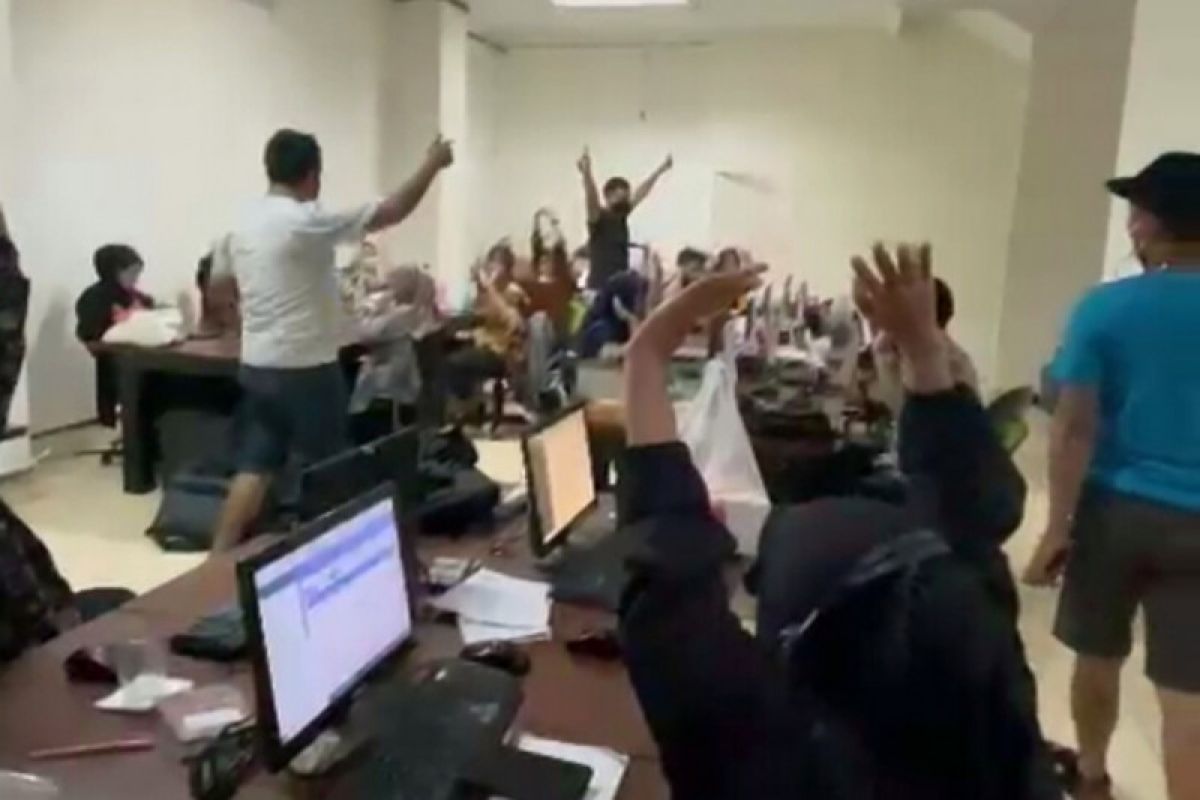

Hearing the police orders, they immediately raised their hands while facing their computer screens. At first, they feigned innocence, officials said.

The reason they became embroiled in a police raid in the first place was that they were working for an illegal online loan service, which often threatened borrowers for non-payment of dues.

One of the computer screens that were still on showed a threatening note that was just about to be sent to the victims before the raid. The note warned the borrower that if the debt was not repaid immediately, the borrower's photos and personal data would be made viral on social media and he would be labeled "The King of Debt".

A video of the raid was documented by a joint team of West Java Police and Yogyakarta Police on Prof. Herman Yohanes Street, Caturtunggal, Sleman District, Thursday night (October 14, 2021).

A total of 86 people, including operators, debt collectors, human resource personnel, and managers, were arrested in the raid. They were handed to the West Java Police the next morning along with evidence.

Of the 86 people examined, 79 were asked to return home to Yogyakarta. The remaining 7 people who worked as assistant managers, team leaders, HR personnel, and debt collectors remained under examination.

Finally, on Saturday, the West Java Police's Directorate of Special Criminal Investigation announced the name of the suspect in the illegal online loan case and it was revealed the suspect was operating in Yogyakarta.

Related news: West Jakarta expedite information dissemination on illegal loans

For the case, police applied Article 48 juncto Article 32 paragraph 2 and/or Article 45 juncto Article 29 of Information and Electronic Transactions (ITE) Law No. 19 of 2016 concerning Amendments to ITE Law No. 11 of 2008, and Article 62 paragraph 1 juncto Article 8 paragraph 1 of Law No. 8 of 1999 on Consumer Protection.

Police officers also conducted similar raids in other areas, such as Tangerang, Banten, North Jakarta, and West Jakarta.

The raids got a boost after President Joko Widodo highlighted illegal online lending as highly threatening to the community in the midst of the COVID-19 pandemic.

During the recent OJK (Financial Services Authority) Virtual Innovation Day, the President said he could perceive the restlessness of the lower class community which had been deceived and trapped to pay high interest by illegal online lenders.

Widodo's remarks aligned with a report received by the West Java Police from a victim, identified as TM, who had reportedly been receiving threats from an illegal loan company.

As a result of these continuous threats, TM reportedly suffered from depression and was rushed to the hospital.

In early October, a housewife, identified as WPS (38), from Selomarto village, Wonogiri district allegedly committed suicide after online loans resulted in a high level of debt. She was also reportedly distressed over threats issued by debt collectors.

Youth behind illegal online lending

Those serving as debt collectors for illegal online lenders were found to be still young, on average, said public relations head of Yogyakarta Police, Senior Commissioner Yulianto.

Related news: Beware of illegal online loan services

The recruited employees were residents of the Yogyakarta Special Region. Some were from Sumatra, Sulawesi, Kalimantan, and regions in eastern Indonesia, he informed.

They registered as debt collectors based on jobs offered by the illegal company, he said.

Some had worked for two days to one month with salaries based on the minimum wage in Yogyakarta, he informed, adding their salaries started from Rp2.1 million. Ironically, some of them had not even received salaries, he pointed out.

On the night of the raid, Suga Pradana, one of the friends of an illegal loan employee was at the scene. He told police that he had come to pick up his friend, identified as RP.

RP said he would finish work at 7 p.m. WIB (Western Indonesian Standards Time), Pradana said. However, until 9 p.m. WIB, he had not shown up, he added.

Pradana said he had not expected the company where his friend had worked for just a day to be an illegal loan service.

He said RP had told him a different story. RP had said he worked as a call center executive for a legal company providing motor vehicle and mobile phone financing, he informed.

According to him, RP claimed to have never applied to work at the company. However, he suddenly got an interview call, he said. Without thinking, RP took the job considering he had just graduated from college and he did not want to lose such an opportunity, Pradana added.

Moreover, RP reportedly told Pradana that he had to collect debt worth Rp10 million from customers in a day.

RP had two mobile phones with new SIM cards, Pradana said. One of them was to threaten victims, officials said.

Soeprapto, a criminal sociologist from Gadjah Mada University (UGM), said he hopes that the community does not marginalize employees of illegal lenders. Some of them were victims as they were not aware of the company's work process and legality, he stated.

Soeprapto said he interviewed 7 debt collectors aged 25 to 35 in Yogyakarta for research. Two of them worked at illegal companies, he said.

Based on three-year research, he concluded there are three factors that are forcing the productive young generation to get trapped in illegal jobs.

First, they consider the job as just a stepping stone before getting the main job, especially since the selection process is not complicated, he pointed out.

Related news: AFPI supports police' crackdown on illegal online lenders

Second, they do not check the company's legality when applying, and the third is the few jobs opportunities during the COVID-19 pandemic, he explained.

Illegal loan workers are not all comfortable with the billing methods which require them to use abusive language, he said.

They feel obligated to follow the work process and are indoctrinated by the company's leader, he added.

The leader of the company instills the mindset that collecting debt requires issuing threats and bullying is nothing but a way to discipline or deter non-payment of loans, Soeprapto said.

Nevertheless, one of the interviewed employees chose not to obey the bullying method and be polite instead, he recalled. This employee chose to ask the borrower for help and revealed that he would be under pressure if he failed to obtain the payment, he said.

Illegal online loan companies have continued to thrive as more people want to borrow money instantly, and the process is very easy: they simply provide their identification card information and personal mobile number and the money is be instantly transferred to the borrower's bank account, he added.

Need for caution

Although job opportunities are currently small, the young generation needs to exercise greater awareness while choosing jobs, officials said.

According to head of job placement and expansion fat Yogyakarta's Labor and Transmigration Office, Elly Supriyanti, job-seeking people need to know a company's profile as well as the offered rights and obligations.

In addition to the company's legality, they also need to thoroughly scrutinize the employment agreement, she said. They must also ascertain whether the wages and working hours follow the regulations or not, she added.

Related news: House Speaker backs police crackdown on illegal online lenders

Supriyanti advised job seekers to directly ask the office, both at the provincial and district levels. Every job vacancy from a legal company is recorded by the office, she said.

Reflecting on the raid, the bane of illegal online lending should be judged from two sides.

Illegal online loan entities need to be eradicated and the young generation needs to be encouraged to obtain more information while seeking jobs.

Editor: Rahmad Nasution

Copyright © ANTARA 2021