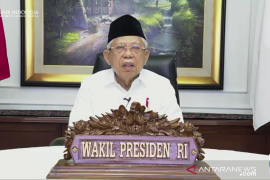

"The OJK must immediately issue a set of regulations that follow the digital trend, so that it can maintain the convenience of investing while upholding public trust," Amin noted in his opening remarks at a meeting of the Sharia Supervisory Board (DPS) 2021 here, Thursday.

The vice president additionally urged the National Sharia Council (DSN) of the MUI to act quickly in providing guidance related to sharia values in sharia economic development.

"The MUI DSN must also quickly to provide guidance on sharia values in the development of this digital economy, so that public trust in Islamic financial institutions and businesses is maintained properly," Amin, concurrently chairman of the MUI Advisory Council, affirmed.

Related news: Government extends LinkAja digital payments to sharia businesses

The support from various ministries and non-ministerial government institutions (K/L) as well as mass organizations (ormas) is deemed necessary to accelerate development of the Islamic economic and financial ecosystem in Indonesia, he affirmed.

"Economic digitalization forces market players to provide products and services for Islamic financial institutions and businesses that are more competitive, easier, effective, and efficient," Amin remarked.

All players in the Islamic economy and finance industry must also provide innovative products and services that make it easier for the public to access these Islamic financial institutions and businesses, he added.

"One of the functions of Islamic financial institutions and businesses is to serve the public, so that it is easier to fulfill their needs," Amin affirmed.

Related news: VP seeks greater digital literacy among Islamic economic actors

Translator: Fransiska N, Fardah

Editor: Suharto

Copyright © ANTARA 2021