Financial technology provides an alternative for Indonesian residents to access financial services efficiently and economicallyJakarta (ANTARA) - Financial technology will continue to play an essential role in enhancing financial inclusion and digital transformation in the Republic of Indonesia (RI), an official of the coordinating minister of economic affairs stated.

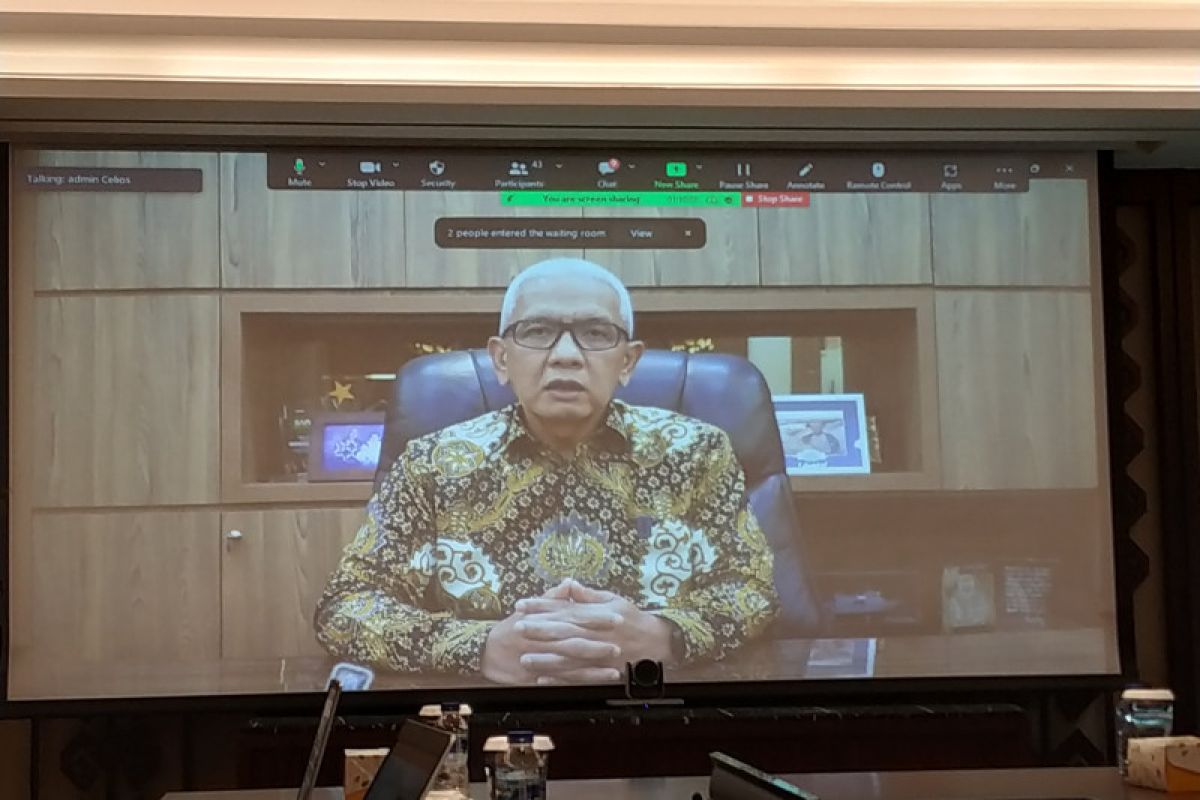

"Financial technology provides an alternative for Indonesian residents to access financial services efficiently and economically," the ministry's Deputy for Digital Economy, Manpower, and Micro, Small, and Medium Enterprises Coordination Department, Rudy Salahuddin, stated here, Tuesday.

While speaking through virtual means during the launch event of the Center of Economic and Law Studies (CELIOS) economic report, the official said that financial technology facilitated the distribution of investment products and gave rise to new domestic investors.

Related news: Push for growth of Islamic financial technology industry: Amin

The fast growth of retail investors has also been recorded at the Indonesia Stock Exchange, which is proportional to the increasing trend of transaction value and frequency at the stock exchange, he noted.

According to the CELIOS report, the national stock exchange recorded 8.86 million retail investors at the end of May 2022, an increase of 18.9 percent on a year-on-year basis.

Moreover, the Financial Services Authority (OJK) stated that millennials constituted most of the 9.1 million retail investors recorded by the institution.

Salahuddin opined that the growth of retail investors has strong causality with economic development, and the high number of investors in the financial markets could enhance national economic resilience in facing internal and external pressures.

Related news: E-commerce transaction value to reach Rp530 trillion in 2022: BI

"The economic effect caused by the growth of retail investors among the millennials is expected to support the creation of new development sources and stimulate economic activities through the development of financial independence, domestic financial market stability, and infrastructure development funding," he noted.

The ministry's official also noted that factors bolstering financial technology utilization and retail investors in Indonesia were the presence of retail multi-asset investment applications, integration of payment platforms, reference code promotions, as well as low initial investment amount and affordable transaction fees.

Related news: Cyber security, metaverse, fintech are future businesses: Uno

Related news: VP urges Indonesia to build fintech governance

Translator: Agatha Olivia V, Nabil Ihsan

Editor: Fardah Assegaf

Copyright © ANTARA 2022