The G20 (forum) continues to welcome CBDC as a cross-border payment instrument in line with (the strengthening of) the integrity and stability of the international financial and monetary system.Washington DC, U.S. (ANTARA) - Governor of Bank Indonesia (BI) Perry Warjiyo ensured that Indonesia’s 2022 G20 Presidency will continue to explore the possibility of using Central Bank Digital Currencies (CBDC) to conduct cross-border payments.

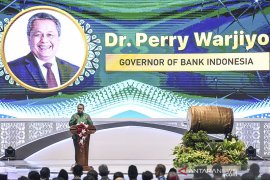

"The G20 (forum) continues to welcome CBDC, as a cross-border payment instrument, in line with (the strengthening of) integrity and stability of the international financial and monetary system," Warjiyo remarked while delivering the results of the 4th meeting of the 2022 G20 Finance Ministers and Central Bank Governors (FMCBG) here on Thursday afternoon local time.

The FMCBG meeting is organized by Indonesia’s 2022 G20 Presidency under the Finance Track to discuss various global economic and finance issues.

The BI governor stated that the G20 welcomed further discussions on establishment of the interconnected payment systems as well as development of CBDC access and interoperability options for the payment method.

The multilateral forum is also committed to advancing the implementation of the G20 Roadmap for Enhancing Cross-Border Payments to realize faster, cheaper, transparent, and inclusive payments, he remarked.

Meanwhile, regarding the regional implementation of payments, the central banks of the members of ASEAN-5 -- comprising Indonesia, Malaysia, Singapura, Thailand, and the Philippines -- will sign a General Agreement on Payment Connectivity among ASEAN-5 Central Banks on the sidelines of the ASEAN Summit in November 2022.

Cross-border payments had been discussed at the 4th 2022 G20 FMCBG meeting.

In addition to this issue, the meeting encouraged commitments to bolstering the Global Financial Safety Net, allocating the Special Drawing Right (SDR) to support vulnerable countries, as well as strengthening the capital of the Multilateral Development Bank (MDB).

Furthermore, discussions at the FMCBG meeting also centered on the progress in implementation of regulations and supervision of several financial sector issues, including the crypto market assets, inclusive economic sustainability, and digital financial literacy.

As the world recovers from the COVID-19 pandemic, the G20 looks forward to the final report on exit strategies and mitigation of the scarring effect on the financial sector as well as attempts to address vulnerabilities in Non-Bank Financial Institutions (NBFIs).

In addition, the G20 is committed to continuing to enhance the global financial sector by increasing financial risk monitoring and optimizing the implementation of technology and digitization.

Translator: Satyagraha, Uyu Liman

Editor: Fardah Assegaf

Copyright © ANTARA 2022