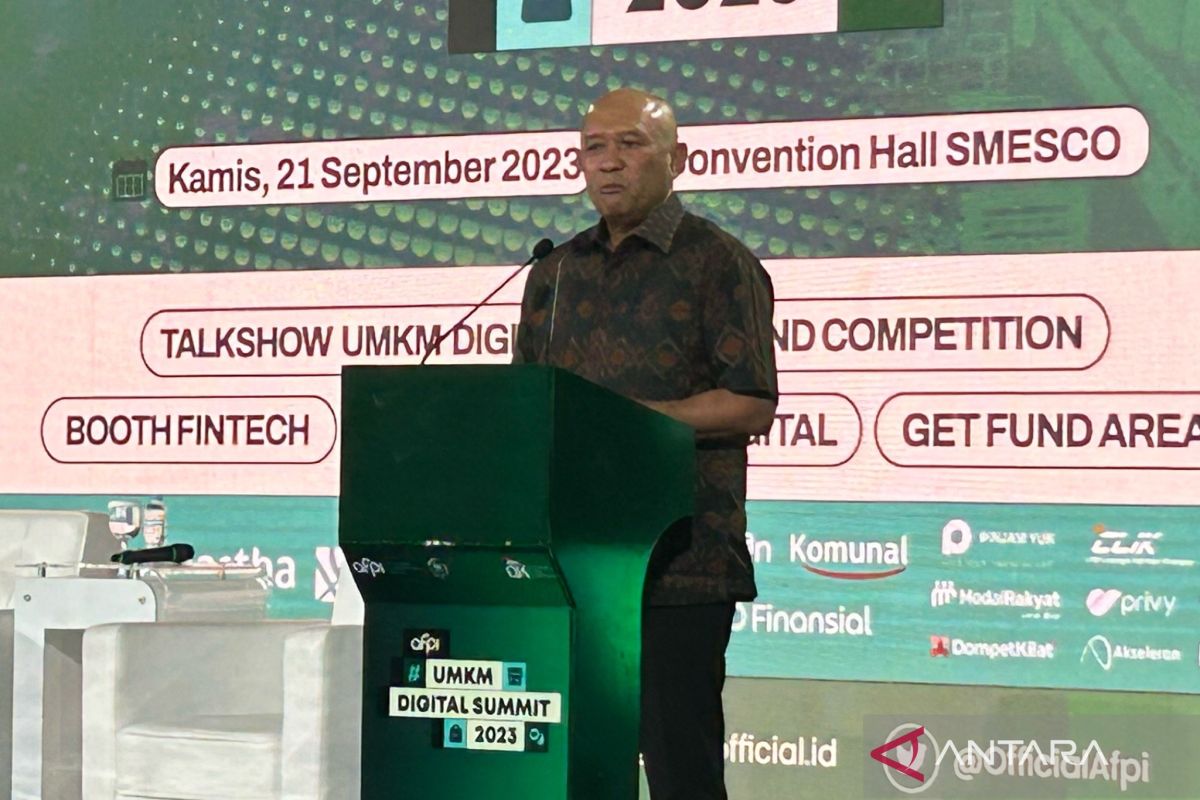

Fintech can play a role in facilitating MSMEs to get financing for working capitalJakarta (ANTARA) - Cooperatives and Small and Medium Enterprises Minister Teten Masduki urged peer-to-peer lending financial technology (fintech) companies to support micro, small, and medium enterprises (MSMEs) to become part of the government's industrial downstreaming program.

"Fintech can play a role in facilitating MSMEs to get financing for working capital," he noted in a written statement received here on Friday.

Minister Masduki affirmed that downstreaming efforts should not be focused only on major industries but should also take MSMEs into account since they have the potential to become part of the industrial supply chain.

He noted that MSMEs could optimize technology to transform raw materials, such as nickel, crude palm oil, and seaweed, into end products. MSMEs can take part in the downstreaming efforts by processing such materials into various products with higher added value, he remarked.

"Downstream will present new economic opportunities to MSMEs. We hope that fintech companies and financial agencies will also pay attention to Indonesia's advantages. It should be noted that we have abundant agricultural and aquacultural resources," he remarked.

Meanwhile, Secretary-General of the Indonesian Joint Funding Fintech Association (AFPI) Sunu Widyatmoko highlighted the existing gap between funding demand and funding capability in Indonesia.

He noted that based on a research conducted by AFPI and a consulting firm EY-Parthenon, the funding sector in Indonesia has a potential demand value of up to Rp4,300 trillion (US$279.5 billion) in 2026, but the current funding capability is only Rp1,900 trillion (US$123.5 billion).

"This (research) shows that the funding demand is growing by seven percent on an annual basis, but this also means that there is a gap of approximately Rp2,400 trillion (US155.9 billion)," Widyatmoko stated.

He noted that lending fintech companies had been striving to meet the funding demand despite not having been successful in closing the gap. Hence, he affirmed that AFPI is committed to coming up with optimal funding solutions and providing expanded access to MSMEs.

"It is expected that 30 million MSMEs will enter the digital market by 2024. All parties should work together to realize inclusive digital economic growth," he stated.

Related news: Government encourages fintech role to expand MSMEs' financing access

Related news: Tech winter spurring fintech players to innovate: survey

Related news: Minister Teten Masduki asks banks to ease credit access for MSMEs

Translator: Kuntum K, Tegar Nurfitra

Editor: Sri Haryati

Copyright © ANTARA 2023