"Bibit's involvement in the 'Berbagi Kasih' program is a manifestation of the company's commitment to making a positive contribution to the community," product marketing lead at Bibit, Olivia Budiono, said in a statement received in Jakarta on Wednesday.

Recently, mutual fund investment application Bibit.id and PT Majoris Asset Management (Majoris), an investment management company, made a donation through the "Majoris x Bibit Berbagi Kasih kepada Yayasan Bhakti Luhur" program.

The donation of Rp40 million (around US$2,519) was presented on behalf of Majoris and Bibit's management to representatives of Bhakti Luhur Foundation, which focuses on the rehabilitation of children with special needs.

According to data from the Ministry of Education, Culture, Research, and Technology, there were approximately 2.2 million children aged 5–19 years with disabilities as of August 2021. Of the total children, only 12.26 percent received formal education.

"We are grateful for being able to collaborate with Majoris Asset Management. We hope that this initiative could bring positive change to the children," Budiono said.

The company is committed to continuing its involvement in similar programs, she added.

"Because we care and want to contribute as part of our social responsibility," She said.

Head of operations at Majoris, Adrian, said that the donation was made by Majoris and Bibit to share happiness with the truly special and high-spirited children.

"In the future, we will continue to carry out these sharing activities sustainably as a form of our care to others," he added.

Meanwhile, Bibit PR and corporate communication lead, William, said that as a digital investment application used by nearly 5 million investors in Indonesia, Bibit is continuously innovating to provide the best services to its users in more than 500 cities across Indonesia.

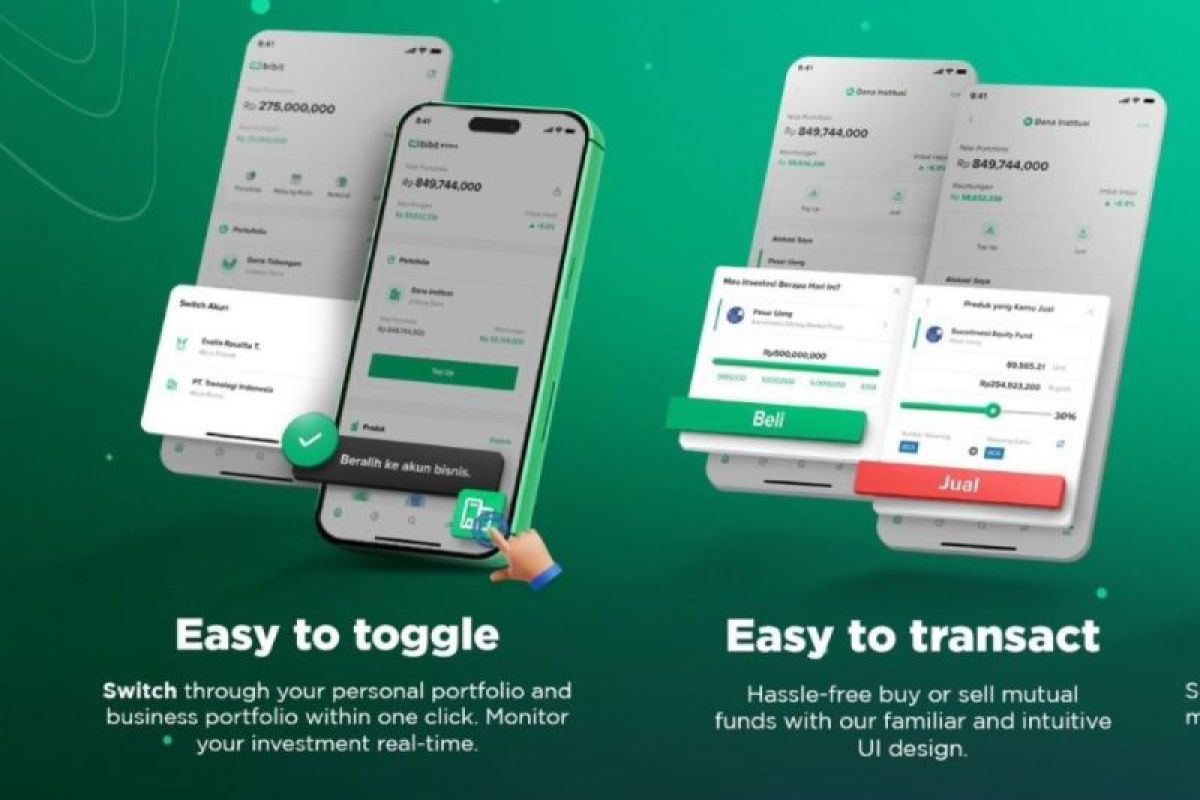

At the beginning of 2023, Bibit introduced the Bibit Bisnis feature for companies and business owners, including startup founders.

According to Bibit, one of the problems faced by business owners is that their idle cash is not managed optimally. For instance, as a company's assets grow, many business owners find themselves puzzled as they cannot optimize their idle cash effectively. Meanwhile, they are also hesitant to take risks with company funds.

The Bibit Bisnis feature was introduced to help companies optimize their surplus funds by investing in high-quality mutual fund products from various top investment managers in Indonesia. By investing in mutual funds, companies can achieve returns of up to 3–7 percent on idle cash.

At the end of March 2023, William noted, Bibit introduced Bibit Plus to make the purchase of Fixed Rate (FR) Government Bonds easier for the entire community.

In terms of security, FR Bonds are a safe investment instrument as the Indonesian government guarantees 100 percent of both principal and coupon payments, he said.

Unlike deposits that are guaranteed by the Deposit Insurance Corporation (LPS) and have a maximum limit of Rp2 billion (US$125,967) per bank per customer, the investment amount in FR Bonds is guaranteed by the state and is without a maximum limit.

Related news: Right investment crucial in building athletes' financial future: Bibit

Related news: Younger generation increasingly becoming investment-savvy: Bibit

Reporter: Azis Kurmala

Editor: Rahmad Nasution

Copyright © ANTARA 2023