He attributed this growth to the rapid progress in economic transformation since 2013.

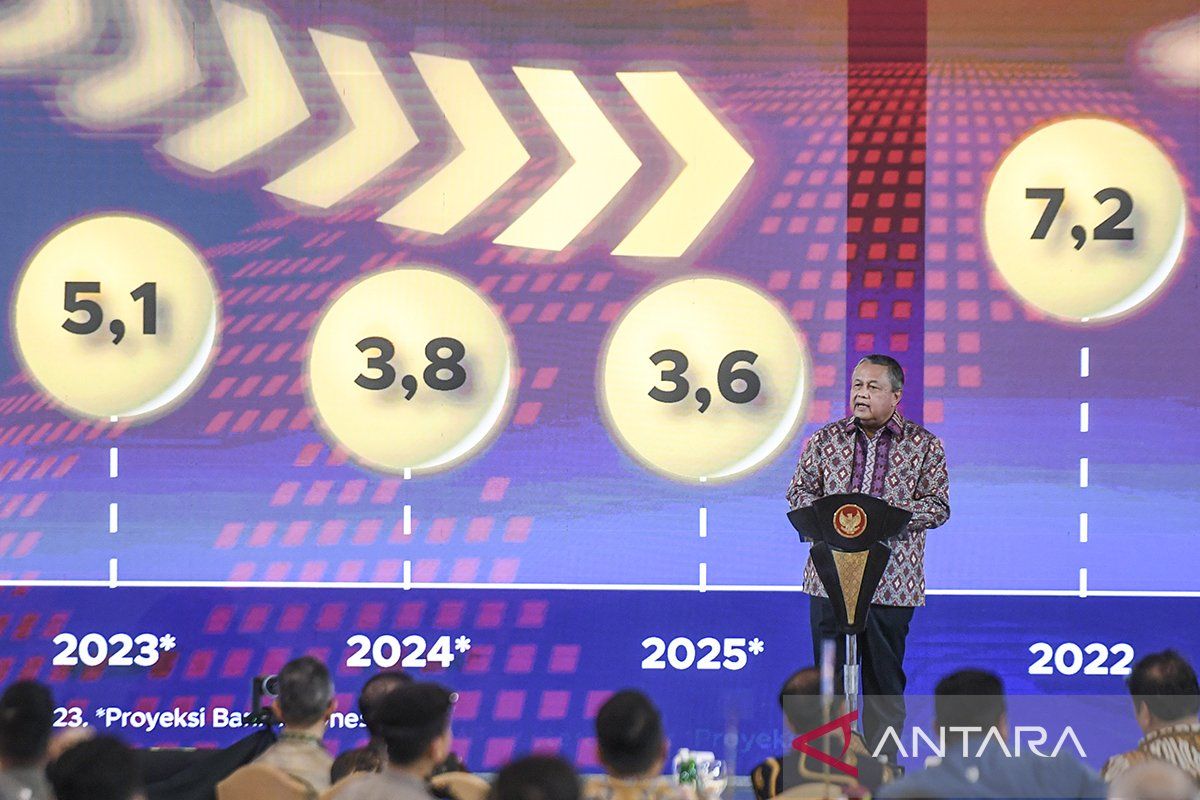

This growth will be accompanied by a maintained low inflation rate and a balance of payments that remains healthy, he said during the central bank's 2023 Annual Meeting in Jakarta.

BI will continue to improve policy coordination with the government, the Financial System Stability Committee (FSC), and other stakeholders, Warjiyo added.

He stated that the synergy of BI's policy mix will continue to be promoted to strengthen Indonesia's economic resilience and foster higher economic growth, ensuring economic stability in the future.

Key factors for economic revival include the real sector, infrastructure, physical and digital connections, mining, agriculture, farming, cattle, fishing, tourism, creative economy, digitization, and business and investment-friendly licensing.

Warjiyo expressed gratitude that BI could help safeguard the national economy from the threat of a crisis due to COVID-19, maintain economic resilience amid global turmoil, and make a tangible contribution to the national economy.

"We will continue to support sustainable economic growth through different measures in compliance with the Bank Indonesia Act and the Financial Sector Development and Strengthening Act," he said.

These measures include the monetary policy to meet inflation targets and stabilize the currency exchange rate, the payment system policy, and macro-prudential policies for optimum loan financing and financial system stability.

Related news: Digital payments accelerate digital economic growth: BI

Related news: RI's economic projection among the highest in ASEAN, G20 countries

Translator: Agatha, Alita, Azis Kurmala

Editor: Anton Santoso

Copyright © ANTARA 2023