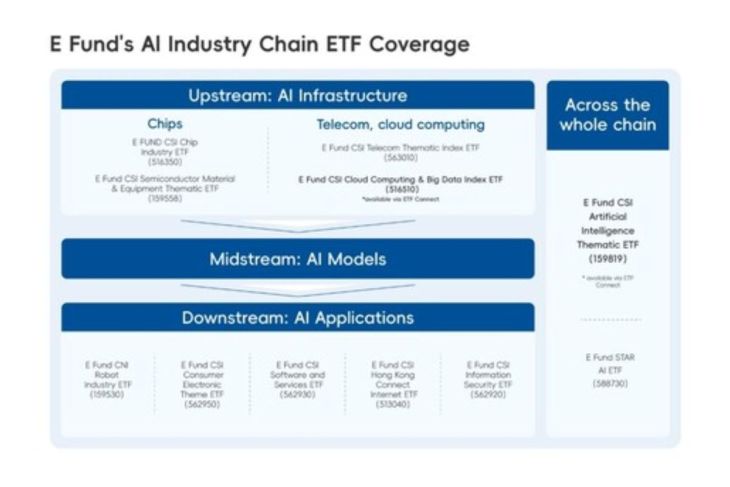

Growing Interest on ETFs as a Key AI Investment Channel

With the rapid advancement of AI, an increasing number of investors are leveraging ETFs to access AI-driven opportunities. E Fund Management ("E Fund"), the largest mutual fund manager in China, has been at the forefront of this trend, providing comprehensive exposure to the AI sector. Notably, E Fund CSI Artificial Intelligence Thematic ETF (Code: 159819), offering the lowest fee of its kind, recently surpassed RMB 15.6 billion (USD 2.16 billion) milestone, up by 83% since the beginning of this year. The rapid rise in AI-related ETFs demonstrates their role as an efficient vehicle for capitalizing on industry trends.

Asset Management Industry in China Embracing AI

It has been observed that Chinese brokers and fund managers have already started to integrate DeepSeek models into their business. Its advanced reasoning capabilities and efficiency in resource utilization make it an ideal tool for financial institutions seeking to enhance their digital infrastructure. According to E Fund, the company has embedded DeepSeek's model into its daily operations, changing the way it conducted research, managed risks and interacted with clients. The company has also enhanced its proprietary AI model, EFundGPT, drawing from DeepSeek's expertise in synthetic data and knowledge distillation.

About E Fund

Established in 2001, E Fund Management Co., Ltd. ("E Fund") is a leading comprehensive mutual fund manager in China with over RMB 3.5 trillion (USD 490 billion) under management.* It offers investment solutions to onshore and offshore clients, helping clients achieve long-term sustainable investment performances. E Fund's clients include both individuals and institutions, ranging from central banks, sovereign wealth funds, social security funds, pension funds, insurance and reinsurance companies, to corporates and banks. Long-term oriented, it has been focusing on the investment management business since inception and believes in the power of in-depth research and time in investing. It is a pioneer and leading practitioner in responsible investments in China and is widely recognized as one of the most trusted and outstanding Chinese asset managers.

Source: E Fund. AuM includes subsidiaries. Data as of Dec 31, 2024. FX rate is sourced from PBoC.

Source: E Fund Management

Reporter: PR Wire

Editor: PR Wire

Copyright © ANTARA 2025