“Digital taxation continues to play a key role in driving state revenue in this digital era,” said Director of Dissemination, Services, and Public Relations of the Directorate General of Taxes (DJP) at the Ministry of Finance, Rosmauli, in a written statement on Friday.

A breakdown of the tax receipts shows that value-added tax (VAT) from electronic-based trade (PMSE) contributed 6.51 trillion rupiahs.

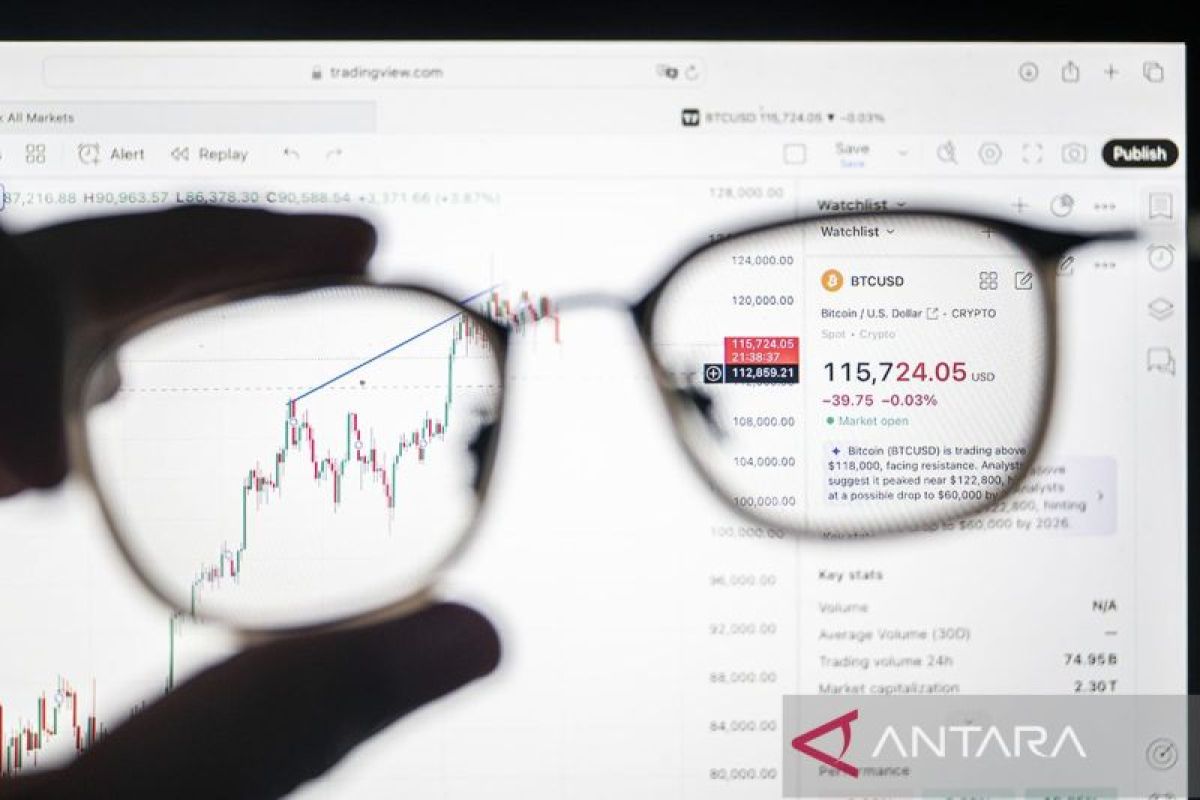

Meanwhile, taxes from cryptocurrency transactions totaled 522.82 billion rupiahs, fintech (peer-to-peer lending) contributed 952.55 billion rupiahs, and the Government Procurement Information System (SIPP) generated 786.3 billion rupiahs.

Since the implementation of PMSE VAT in 2020, total collections have reached 31.85 trillion rupiahs, submitted by 201 digital businesses out of 236 appointed collectors.

In August 2025, four new PMSE VAT collectors were appointed: Blackmagic Design Asia Pte Ltd, Samsung Electronics Co Ltd, PIA Private Internet Access Inc, and Neon Commerce Inc. During the same period, one collector—TP Global Operations Limited—was delisted.

Cryptocurrency-related taxes have generated 1.61 trillion rupiahs from 2022 to 2025. This includes 770.42 billion rupiahs from income tax (Article 22) on crypto sales transactions and 840.08 billion rupiahs from domestic VAT.

The fintech (P2P lending) sector contributed a total of 3.99 trillion rupiahs over the same period. This includes 1.11 trillion rupiahs in income tax (Article 23) on interest earned by domestic taxpayers and permanent establishments, 724.32 billion rupiahs in income tax (Article 26) on interest earned by foreign taxpayers, and 2.15 trillion rupiahs in domestic VAT.

Meanwhile, SIPP-related tax revenue reached 3.63 trillion rupiahs between 2022 and 2025, consisting of 242.31 billion rupiahs in income tax and 3.39 trillion rupiahs in VAT.

The Directorate General of Taxes expressed optimism that tax revenue from the digital economy will continue to grow, supported by an expanding PMSE VAT base, the ongoing development of the fintech and crypto sectors, and further digitalization of government procurement systems.

Related news: KPK, Finance Ministry to pursue tax debtors owing up to Rp60 trillion

Related news: RI seeks to boost GDP share of digital economy via Prospera

Translator: Imamatul, Azis Kurmala

Editor: Aditya Eko Sigit Wicaksono

Copyright © ANTARA 2025