Deputy Finance Minister Suahasil Nazara told a December edition of the APBN KiTa briefing in Jakarta on Thursday that October data showed two major tax groups still contracting, namely personal income tax and employee income tax (PPh OP and PPh 21), as well as value-added tax and luxury goods sales tax (VAT and PPnBM).

“In November, only one tax category still recorded negative growth,” Suahasil said. “VAT and luxury tax had returned to positive growth by the end of November, although the increase was modest. We expect stronger growth in December.”

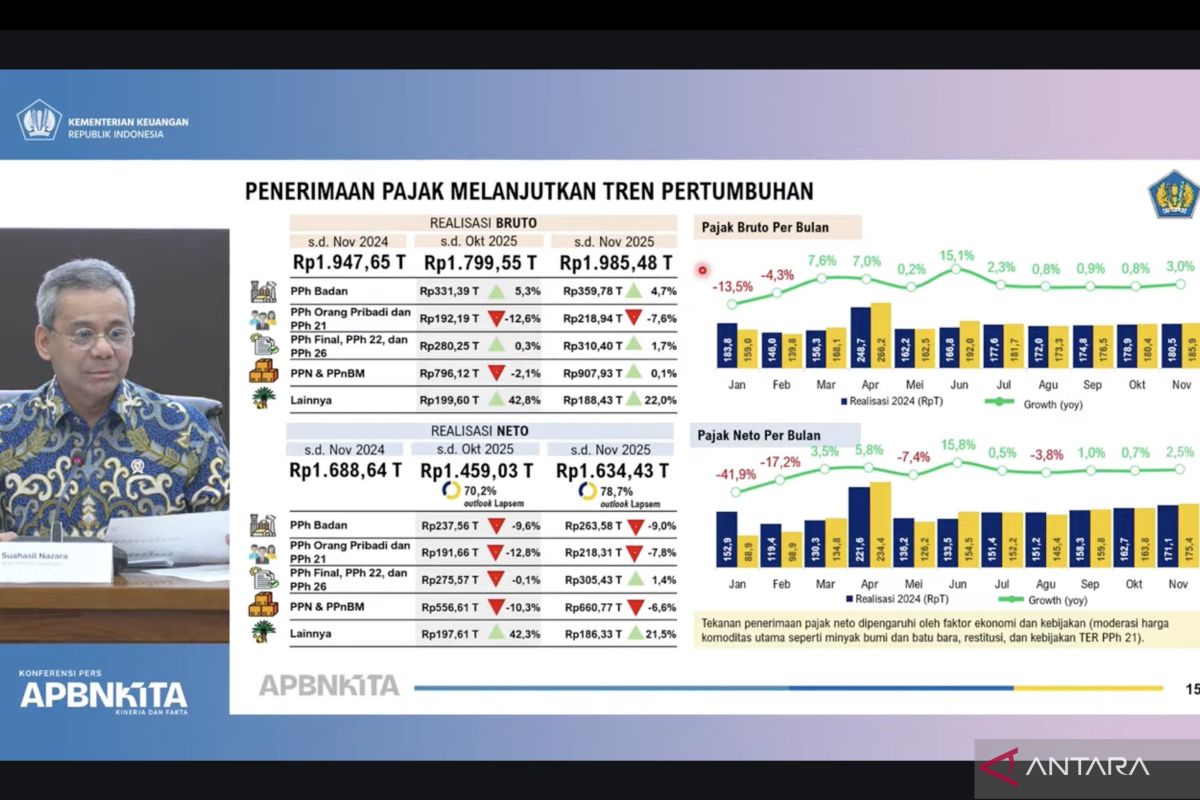

Gross tax revenue — collections before refunds — reached Rp1,985.48 trillion as of November 2025. Several components posted positive growth, including corporate income tax, which rose 4.7 percent to Rp359.78 trillion. Final income tax, along with PPh 22 and PPh 26, increased 1.7 percent to Rp310.40 trillion.

Related news: Indonesia to delay new taxes until economy hits 6 percent growth

VAT and luxury tax edged up 0.1 percent to Rp907.93 trillion, while other taxes recorded the strongest growth, jumping 22 percent to Rp188.43 trillion. In contrast, personal income tax and PPh 21 continued to contract, falling 7.6 percent to Rp218.94 trillion.

Net tax revenue — collections after refunds — stood at Rp1,634.43 trillion. On a net basis, only final income tax, PPh 22 and PPh 26, as well as other taxes, posted growth. Other major components remained under pressure.

Corporate income tax contracted nine percent to Rp263.58 trillion on a net basis. Personal income tax and PPh 21 declined 7.8 percent to Rp218.31 trillion, while VAT and luxury tax fell 6.6 percent to Rp660.77 trillion.

Meanwhile, net revenue from final income tax, PPh 22 and PPh 26 rose 1.4 percent to Rp305.43 trillion, and other taxes grew 21.5 percent to Rp186.33 trillion.

The ministry said it remains cautiously optimistic that stronger economic activity toward year-end will help lift tax receipts further in December, particularly from consumption-related taxes such as VAT and luxury goods levies.

Related news: KPK, Finance Ministry to pursue tax debtors owing up to Rp60 trillion

Translator: Imamatul Silfia, Primayanti

Editor: Rahmad Nasution

Copyright © ANTARA 2025