http://www.acnnewswire.com/topimg/Low_ypo1508041.jpg

"The problem in Asia stemmed from the near collapse of China's Shanghai Composite Index during the month of June before the government stepped in," said Terry O'Connor, regional chief executive officer of Courts Asia and the chair of YPO's Southeast Asia region. "The crash made investors nervous, but as things settled down in July, the drop came to be seen as largely a stock market phenomenon, rather than an indicator of a dramatic slowdown in economic activity."

The most significant declines in confidence among Asian CEOs recorded by the survey occurred in Indonesia, Malaysia, Singapore and Hong Kong. In contrast, South Korea, Taiwan and Vietnam all reported markedly higher confidence. The degree of change was less dramatic in the three largest Asian economies: Japan was down 2.5 points to 56.6 compared with the April survey, while China was down 1.1 points to 60.7, and India was essentially unchanged at 66.1.

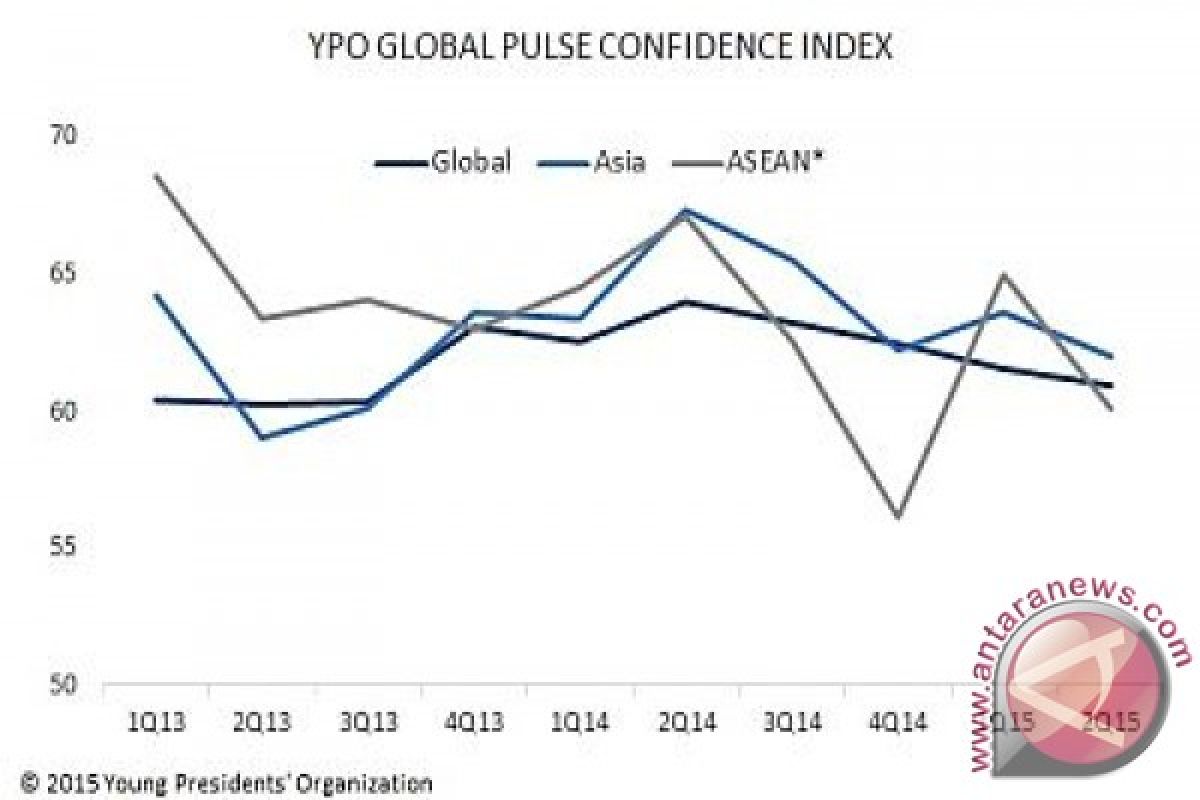

The YPO Global Pulse Confidence Index declined 0.6 point from 61.5 to 60.9 in the second quarter of2015. This was the fourth consecutive drop in global confidence from a near-record high of 64.0 one year ago, but each of the quarterly declines has been modest. Across the globe, confidence declined 0.5 point in the United States to 62.8, and 0.9 point in the European Union to 61.6. Confidence rose 1.0 point in Australasia to 61.4, and 2.1 points in Canada to 60.0. Latin America recorded its third consecutive drop in confidence, falling 2.3 points to 50.1, by far the lowest level among all nine regions.

Key findings in Asia

Expectations for investment, turnover remain strong; construction sector lags.

CEOs in Asia remained upbeat when it came to expectations around sales and fixed investment over the next 12 months. The YPO Fixed Investment Confidence Index for Asia increased 2.2 points to 64.5, with 52% of CEOs anticipating an increase in fixed investment of 10% or more over the coming 12 months. The YPO Sales Confidence Index for Asia slipped 1.8 points to 69.1 but remained in extremely positive territory. Seventy percent of CEOs expected an increase in sales of 10% or more over the next year.

The YPO Employment Confidence Index for Asia increased 0.2 point to 58.5; however, a clear majority of CEOs (58%) expected their employment levels to remain about the same over the coming 12 months.

Almost across the board, CEOs within the construction sector were less confident than their counterparts in the production and services sectors. For example, only 55% of business leaders in construction expected an increase in turnover during the coming 12 months, compared with 73% of those in production and 71% in the services sector.

YPO Global Pulse Confidence Index

The quarterly electronic survey, conducted in the first two weeks of July 2015, gathered answers from 2,127 chief executive officers across the globe, including 276 in Asia. Visit www.ypo.org/globalpulse for more information about the survey methodology and results from around the world.

About YPO

YPO (Young Presidents' Organization) is a not-for-profit, global network of young chief executives connected through the shared mission of becoming Better Leaders Through Education and Idea Exchange(TM). Founded in 1950, YPO today provides 23,000 peers and their families in 130 countries with access to unique experiences, extraordinary educational resources, access to alliances with leading institutions, and participation in specialised networks to support their business, community and personal leadership. Altogether, YPO member-run companies employ more than 15 million people around the world and generate US$6 trillion in annual revenues. For more information, visit www.ypo.org.

Contact:

YPO (Young Presidents' Organization)

Linda Fisk

Office: +1-972-629-7305 (United States)

Mobile: +1-972-207-4298

press@ypo.org

Reporter: PR Wire

Editor: PR Wire

Copyright © ANTARA 2015