The stock market still provides attractive investment opportunities because of its valuation. There is also the potential growth of the corporation’s profit which is estimated to be around nine percent this yearJakarta (ANTARA) - The Indonesian stock and bond market remains an attractive option amid the global economic turmoil, an investment strategist at an asset management corporation in Indonesia believes.

"The stock market still provides attractive investment opportunities because of its valuation. There is also the potential growth of the corporation’s profit which is estimated to be around nine percent this year," the Chief Economist and Investment Strategist Manulife Asset Management Indonesia, Katarina Setiawan, said in a statement received here, Monday.

Going forward, there are several catalysts for the stock market, including further interest rate cuts by Bank Indonesia, accelerated policy reforms by the government, improved data on economic activity, and corporate tax cuts, she stated.

Amidst the current low interest rates, Indonesian bonds are very attractive because they still provide high yields.

"The central bank's commitment to safeguarding the Rupiah exchange rate and the bond market provides a positive sentiment for Indonesian bonds," she said.

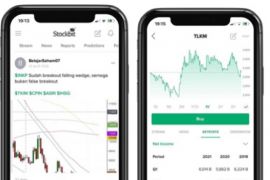

Turmoil and volatility in the financial markets are not uncommon, she said advising investors to always keep an eye on every development.

"Keep in mind that there are always opportunities in every condition, even amidst high global volatility. Do not be afraid to invest and adjust your investment portfolio, with targeted investment objectives and time frames," she said. (INE)

Related news: IDX index plunges over trade war sentiment

Related news: Indonesian stock market still attractive amid global dynamics

EDITED BY INE

Translator: Citro Atmoko / Aria Cindyara

Editor: Fardah Assegaf

Copyright © ANTARA 2019