Since it is still in line with economic fundamentals, the Central Bank has yet to enter the market for exchange rate intervention.

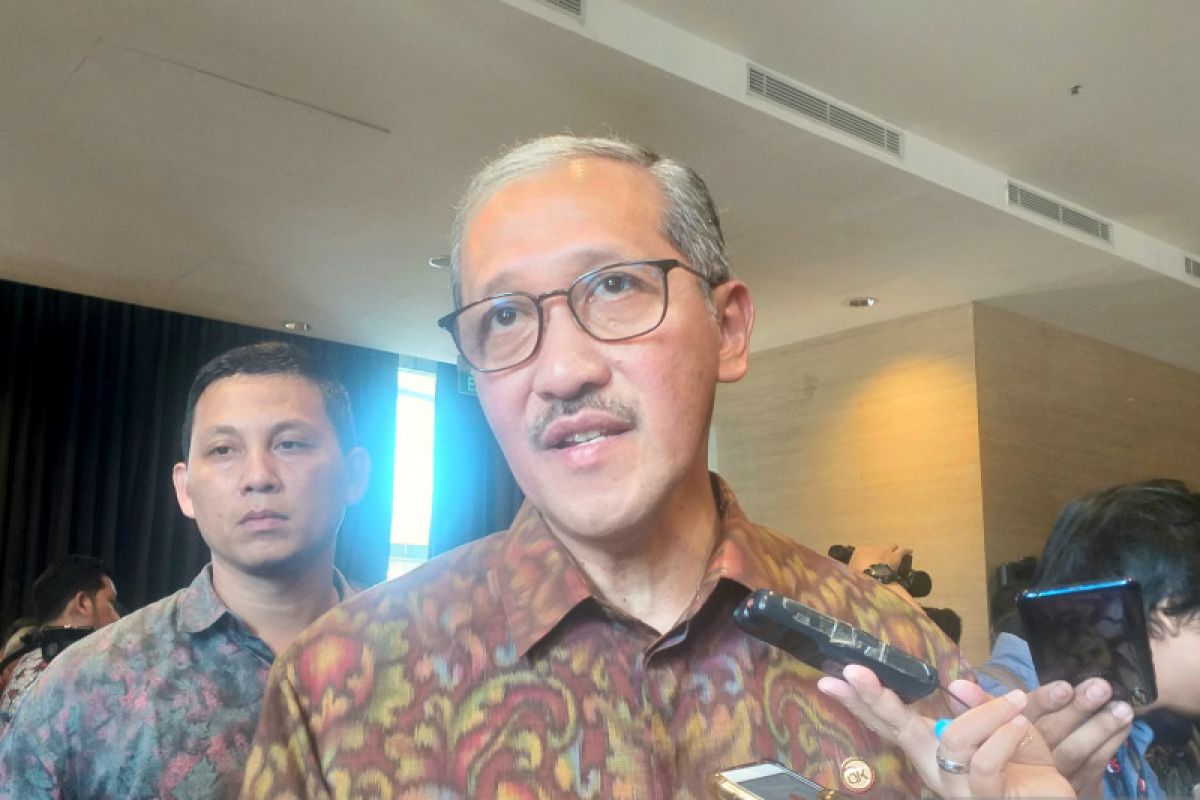

BI Deputy Governor Dody Budi Waluyo stated at the annual meeting of the financial services industry in Jakarta on Thursday that if the rupiah’s appreciation prolonged and lies in a range that did not align with economic fundamentals, the Central Bank will not hesitate to intervene.

"If the rupiah is outside its fundamentals, the BI will enter," he stated.

In the meantime, in the spot market, the rupiah exchange rate at 15.00 West Indonesia Time, or before closing, still showed a strengthening trend at Rp13,650 per US dollar, as compared to Thursday morning's opening of Rp13,678 per US dollar.

Waluyo remarked that the rupiah’s strengthening that had continued to occur since early 2020 is yet in line with fundamentals owing to improvements in several domestic economic indicators.

The big players responded to sentiment ahead of the announcement of the economic growth in the fourth quarter of 2019 that the BI believes to be better than the third quarter of 2019, at 5.02 percent.

Furthermore, Waluyo noted that the drastic reduction in the trade balance deficit to US$3.2 billion in 2019 as compared to US$8 billion in 2018 also served as a positive catalyst to strengthen the rupiah.

"Inflation in 2019 was also under control. Many of these factors made the rupiah stronger and yet in line with fundamentals," he pointed out.

Waluyo expounded that the rupiah’s strengthening had dual impacts on the economy. In the short term, the rupiah’s appreciation will boost investment and consumption activities, as the cost structure will be cheaper. In this case, the strengthening of the rupiah will reduce the cost of imports.

Furthermore, in the short term, the strengthening of the rupiah will also have a positive impact on financial flows within corporations that have foreign currency debt. Corporations will not suffer foreign exchange losses from foreign currency debt exposures.

However, in the medium to long term, the strengthening of the rupiah will undeniably lower the value of exports. This is since the price of export commodities, after converting to rupiah, will decline.

Waluyo stressed that the BI will continue to oversee the movement of the rupiah exchange rate according to its fundamentals.

"We will not hesitate to enter if it is not in accordance with its fundamentals," he added.

Related news: Rupiah appreciates 0.41 percent following US-China trade deal

Related news: Rupiah's strengthening has yet to impact state budget

Related news: Rupiah weakens amidst escalation of US-Iran conflict

Translator: Indra Arief, Azis Kurmala

Editor: Sri Haryati

Copyright © ANTARA 2020