"We will continue to evaluate our financial system and LPS still has some room to lower the guaranteed interest rate even further," he said at a press conference organized by the Financial System Stability Committee (KSSK) here on Friday.

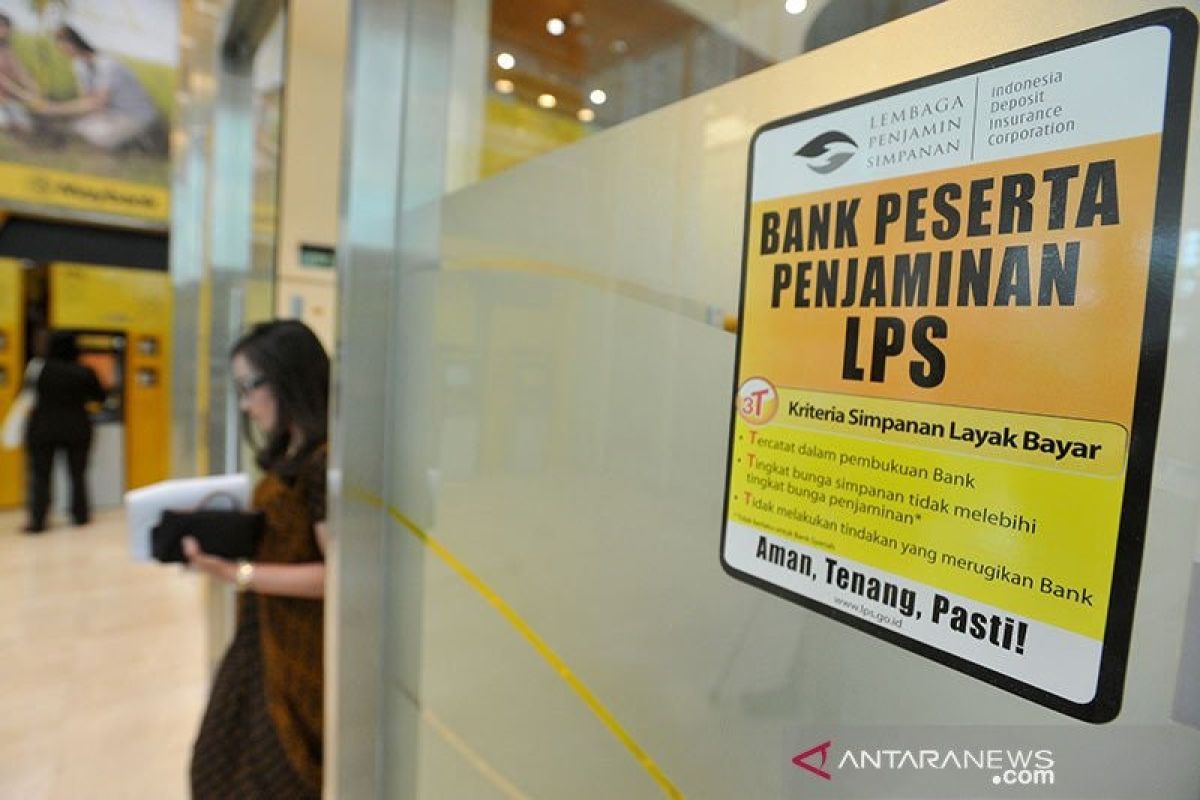

The guaranteed interest rate for rupiah savings is currently 4 percent in commercial banks and 6.5 percent in rural banks (BPR), and 0.5 percent for foreign exchange savings in commercial banks, Sadewa noted.

Lowering the guaranteed interest rate below 4 percent will support economic growth because it would lower banks' deposit interest, he explained.

According to Sadewa, lowering the interest rates will prompt customers with large funds who have been benefiting from high interest rates and have been hesitant to start spending.

Related news: Increasing financial literacy for greater financial stability: LPS

Such spending would support the economy and lower class citizens will also enjoy its positive impact, he added.

"The economy will roll even faster. It is going to support economic growth," Sadewa asserted.

In the first half of 2021, the LPS lowered the guarantee interest rate by about 50 basis points for rupiah savings in commercial banks as well as rural banks and 50 basis points for foreign exchange savings in commercial banks, he noted.

In addition to lowering the guarantee interest rate, LPS also supports the nation's economic growth by helping increase financial literacy and inclusion, which can foster the development of deep financial markets, he said.

To this end, the LPS is collaborating with various stakeholders, including mass media, to disseminate information and boost financial literacy, he added.

Related news: LPS urges banks to lower lending rate

Translator: Astrid Habibah, Fadhli R

Editor: Rahmad Nasution

Copyright © ANTARA 2021