“After the COVID-19 pandemic, public consumption, investments and net exports are expected to increase again. The national budget, which used to cushion the economy, could then be focused on gradually reducing deficits,” he added.

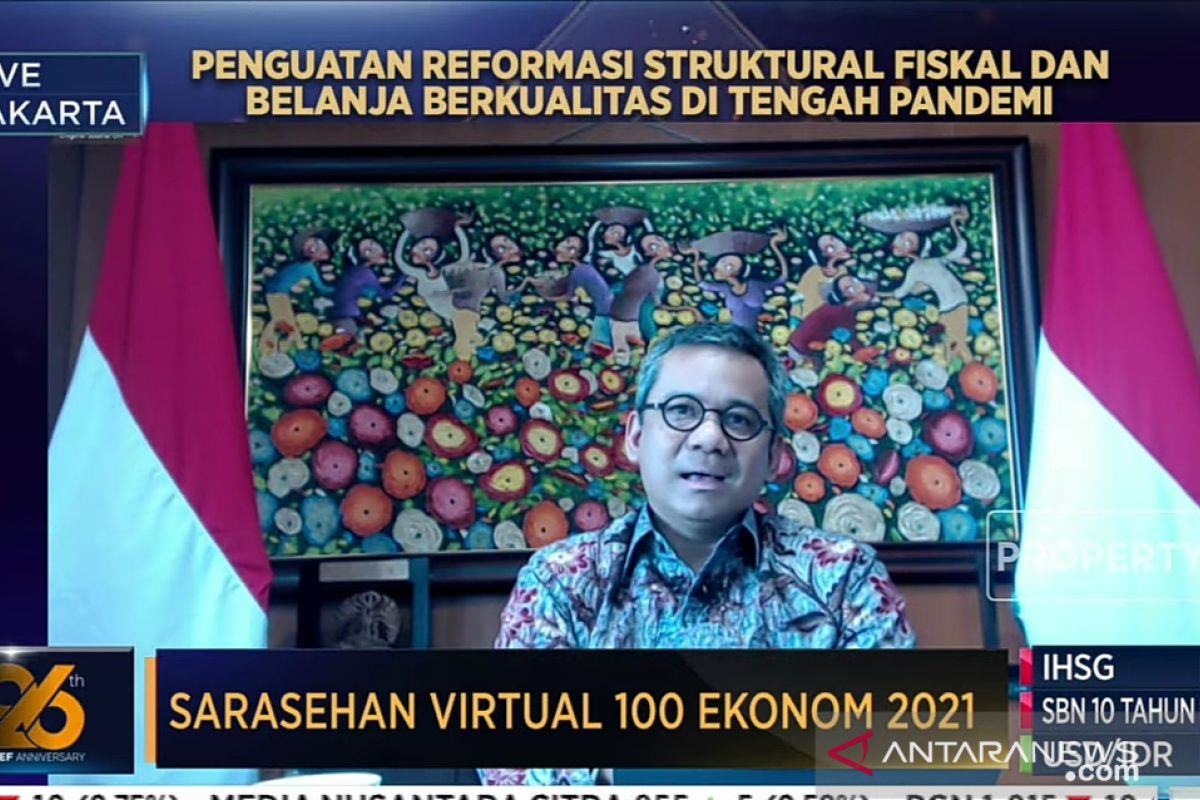

"Simply put, we are decreasing the deficit. Last year, our deficit was 6.1 per cent of Gross Domestic Product (GDP). This year, it is 5.7 percent, and we are still talking about next year’s figure with the House of Representatives. Hopefully it can be only 4.8 per cent," Nazara said in Jakarta on Thursday.

The national health budget deficit is expected to be below 3 per cent of GDP. Currently, the government is trying to find ways of increasing tax income while not burdening the public.

Currently, taxes are not only used as a source of state income, but also to support the public economy, through the distribution of various tax incentives.

Related news: Indonesian President pushes for developing more export commodities

“Our current thought is that taxes are key to managing the economy. The DGT (Directorate-General of Taxes) is no longer afraid to ask which business sectors still need tax incentives,” Nazara stressed.

By achieving its deficit target of below 3 per cent by 2023, the government can also efficiently allocate national spending without reducing its contributions to economic growth.

"Arranging this within our medium-term fiscal management is very important," he further added.

The national economy have suffered considerably since the pandemic began last year, forcing the government to adopt various restrictive policies that limited socio-economic growth, as well as allocate most of the national budget to assist those affected by COVID-19.

Related news: Ministry pushes higher fishery exports to Middle East

Translator: Sanya D S, Mecca Yumna

Editor: Rahmad Nasution

Copyright © ANTARA 2021