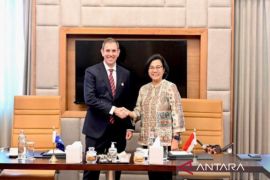

To avoid the middle-income trap, we must conduct fiscal consolidation, particularly as a result of the pandemic to create a sound state budget and (for) that we need tax reform.Jakarta (ANTARA) - Finance Minister Sri Mulyani Indrawati has said that tax reform is part of efforts to help Indonesia escape the middle-income trap.

“To avoid the middle-income trap, we must conduct fiscal consolidation, particularly as a result of the pandemic, to create a sound state budget and (for) that we need tax reform,” the minister explained during a working meeting with Commission XI of the House of Representatives (DPR) in Jakarta on Monday.

Tax reform will be able to revive the state budget, which has currently come under pressure due to the COVID-19 pandemic, Indrawati said. Through the tax reform, the tax foundation will become fairer, healthier, more effective, and accountable, she added.

Tax receipts, which rose 47.4 percent in 1992 compared to 22.81 percent in 1983 and further climbed to 65.1 percent in 2020, are the main source of state revenue, she noted.

A fair taxation system is one where all business sectors share a balanced burden, she said adding, till now tax receipts have hinged on only one or two sectors.

Related news: Five keys to save Indonesia from middle income trap: finance minister

Other sectors, such as the service sector, which have continued to grow have not contributed a lot to tax receipts, though they have also received state facilities, she noted.

This justice also applies to all income groups, with low income groups receiving assistance and remaining exempt from tax obligation and high income groups paying higher taxes, she said.

“This is what we need to say that the public will eventually receive financial benefit from the state in accordance with their situation,” Indrawati said.

Under a sound taxation system, taxes may serve as an optimum source of state revenue, she added. Such a system can adapt to any change and is designed in accordance with international best practices, she further said.

Meanwhile, an effective tax system provides optimum services, while at the same time, curbs taxpayer expenses, the minister explained.

According to Indrawati, the number of registered taxpayers in Indonesia have swelled 20-fold in the past 20 years to reach 50 million in 2021 from 2.59 million in 2002.

The ratio of individual taxpayers to employed people has also climbed to 34.66 percent in 2021 from 1.8 percent in 2002, she noted. This means that individual taxpayers have contributed significantly to tax receipts and are equal to those in OECD countries, she added.

Related news: Ministry reveals four keys to escape middle-income trap

Translator: Astrid Faidlatul H, Suharto

Editor: Rahmad Nasution

Copyright © ANTARA 2021