Amin laid emphasis on four specific strategies for the sharia insurance industry to improve its performance in future.

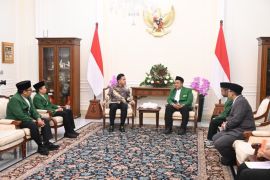

"First, strengthen product innovation and expand the market share. Sharia insurance products must be developed to become more competitive," Amin noted at the opening of the 2022 Indonesian Sharia Insurance Association's (AASI's) annual working meeting on Wednesday.

On account of the huge potential of the halal industry, the vice president reminded that literacy related to the benefits of sharia insurance can be further improved, especially for sharia Micro, Small, and Medium Enterprises (MSMEs) players.

"We must continue to explore the market niche for the halal industry, so that the sharia insurance industry grows and is also integrated into the halal industry ecosystem that is being built," he affirmed.

Secondly, the vice president accentuated the importance of strengthening industrial exposure through cross-sectoral collaboration, such as with sharia fintech and other sectors.

"In addition, we must accelerate the promotion and positioning of sharia insurance through various media channels," he remarked.

Thirdly, Amin deemed it important to improve corporate governance by adopting best practices in developed countries.

“One of the steps is by utilizing technology and implementing digitalization in all sectors. Breakthroughs are needed to increase efficiency as well as overcome capital challenges," Amin noted.

According to the last strategy, as a reflection of the company's image, the vice president urged AASI's human resources to improve their quality and quantity through certification.

"AASI needs to optimize the role of the Sharia Insurance Professional Certification Institute to create more qualified sharia insurance industry players and be actively committed to developing the industry and building public trust," Amin stated.

Attendees at the event comprised Deputy Commissioner for Supervision of the Non-Bank Financial Industry (IKNB) II from the Financial Services Authority (OJK) Mch. Ihsanudin, Chairman of AASI Tatang Nurhidayat, secretary of the AASI Advisory Board Mohamad Hidayat, ranks of the AASI Advisory Board, as well as ranks of the Daily Executive Board and members of AASI.

Meanwhile, the vice president was accompanied by Head of the Secretariat of the Vice President, Ahmad Erani Yustika, and Special Staff for Communication and Information, Masduki Baidlowi.

Related news: Sharia insurance should prioritize sound corporate governance: VP

Related news: Ratifying ASEAN protocol can help expand sharia insurance market

Translator: Rangga Pandu A J, Resinta S

Editor: Suharto

Copyright © ANTARA 2022