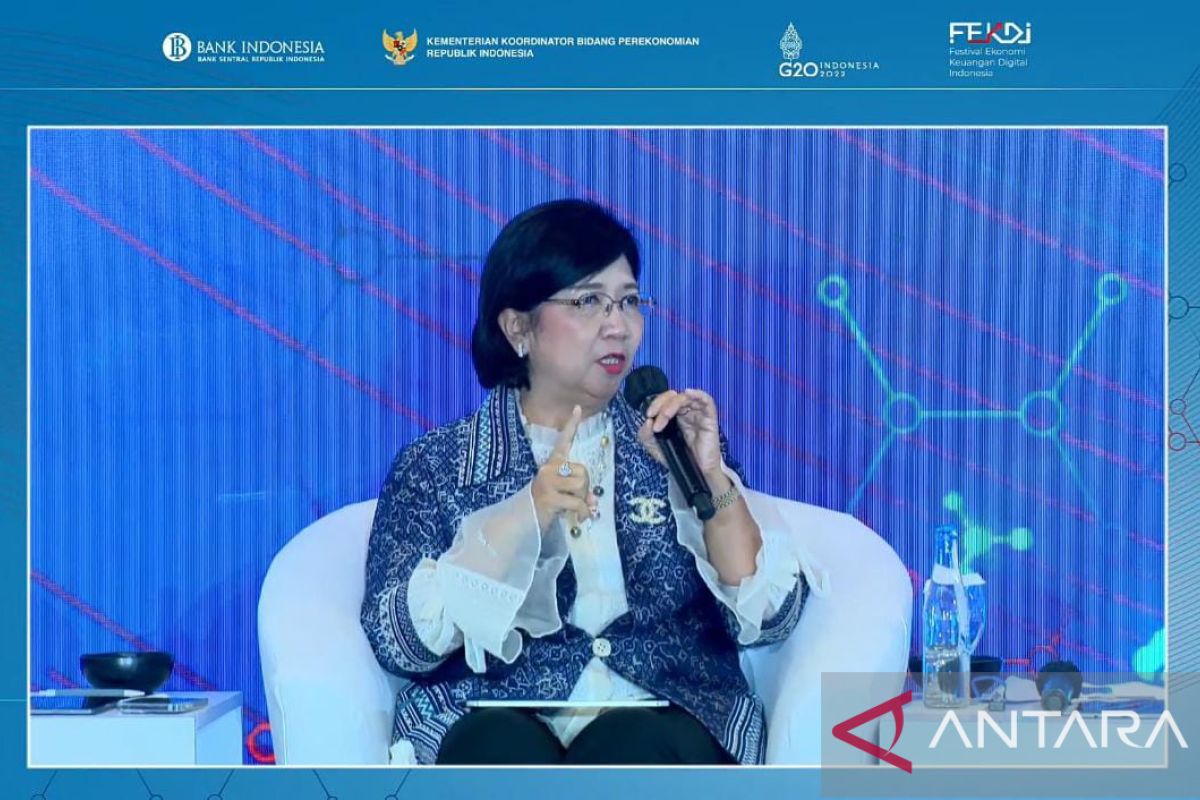

What's important is to reach the lower classJakarta (ANTARA) - The payments system will be the backbone of economic development and digital finance in Indonesia, senior deputy governor of Bank Indonesia (BI), Destry Damayanti, has said.

Speaking at the Indonesian Digital Finance Economic Festival held by BI in a hybrid format here on Friday, she stated that the economic ecosystem and digital finance must be supported with a strong and healthy payments system.

That would allow them to develop further and provide services to the people.

To this end, BI, which has control over the payments system, will continue to develop opportunities, minimize access barriers, and impose a small fee on users, she informed.

Strong cooperation between institutions, associations, and the industry will be necessary to educate digital payments system users in the future, she remarked.

The system must advance economic inclusivity that not only reaches users from the upper economic class, but also people from the lower economic class, she added.

Related news: Some 18.7 million merchants, users registered to use QRIS: BI

"What's important is to reach the lower class," she said.

Ninety percent of the 90 million merchants utilizing the QRIS (Quick Response Code Indonesian Standard) payments system are micro, small, and medium enterprises (MSMEs), Damayanti pointed out.

Thus, BI has also started targeting the upper-middle segment for utilizing QRIS.

She said that user security remains an important aspect and the interconnection between payments system operators must have high security in the future.

Proper and strong security is very important for organizers. Users must also be made aware of the urgency of this technology because it will provide them with security, she added.

Related news: BI records 133 thousand merchants in Riau Islands utilizing QRIS

"And we, as the regulator, should be able to balance and support this. Operators, providers, and also users, that may be our policies," Damayanti remarked.

BI first unveiled the QRIS payments system in 2019 with a transaction limit of Rp2 million. This limit was raised to Rp5 million and increased further to Rp10 million in March 2022.

Related news: Some 19 million merchants utilizing QRIS: Bank Indonesia

Related news: Need digital-ready society to realize Advanced Indonesia vision

Translator: M Heriyanto, Fadhli Ruhman

Editor: Fardah Assegaf

Copyright © ANTARA 2022