"It is estimated to grow 4.8 percent. We provided a modest growth estimation because due to tax revenues in 2021-2022, there was a windfall from commodities. If it would not happen next year, the commodities might become softer," she noted during a press conference on the 2023 Draft State Budget and Financial Note in Jakarta, Tuesday.

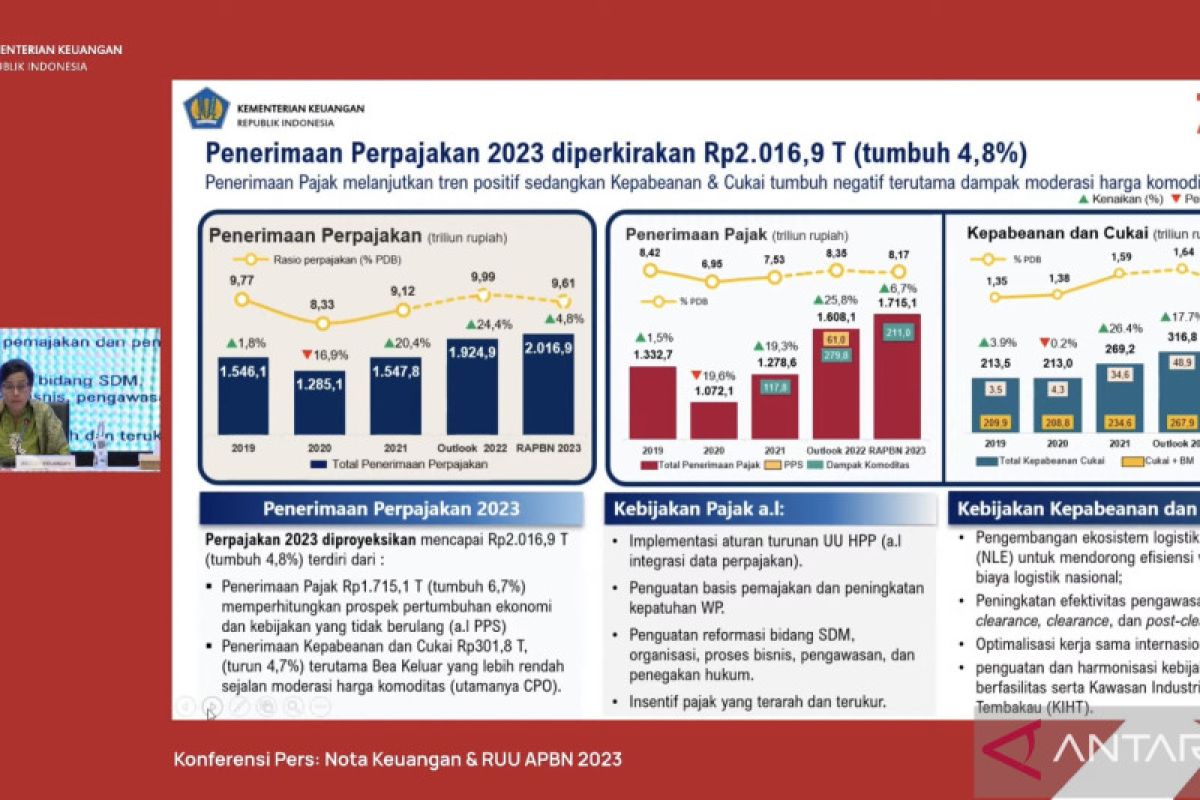

Indrawati estimated that tax revenues in 2023 only reached 4.8 percent, or lower than the growth in the previous years, such as this year, during which it was projected to grow 24.4 percent, from Rp1,547.8 trillion in 2021 to Rp1,924.9 trillion.

Tax revenues in 2021, which amounted to Rp1,547.8 trillion, also grew to reach 20.4 percent as compared to Rp1,285.1 trillion in 2019.

The growth in tax revenues in the last two years was caused by a windfall from rising commodity prices, as in 2021, there was a windfall contribution from commodity prices of Rp117 trillion and this year, with Rp279 trillion.

“This year, we have a voluntary disclosure program (PPS) that generates revenue of Rp61 trillion. In 2022, we receive extra tax revenue from windfalls and PPS," the minister remarked.

Related news: Indonesia's tax revenues surpassed target until Dec 26: Mulyani

On the other hand, Indrawati said that the opportunity to receive a windfall from rising commodity prices would not occur next year, resulting in tax revenues at only Rp1,715.1 trillion, or growing 6.7 percent from this year, with Rp1,608.1 trillion.

The minister noted that next year’s tax policy will focus on implementing the derivative rules of the Harmonization of Tax Regulations Law (UU HPP) as well as strengthening the taxation base and increasing taxpayer compliance (WP).

This would be followed by strengthening reforms in the field of human resources (HR), organization, business processes, supervision and law enforcement, as well as providing targeted and measurable tax incentives.

Meanwhile, customs and excise revenues next year are estimated at Rp301.8 trillion, decreasing 4.7 percent from this year's Rp316.8 trillion due to the commodity aspect.

For this year, commodities had contributed Rp48.9 trillion, while next year, they were projected to contribute to customs and excise, at Rp9 trillion.

"That is why the level of customs and excise is lower than this year," she explained.

Next year's customs and excise policies will focus on developing the national logistics ecosystem (NLE) to encourage time and cost efficiency of national logistics, she affirmed.

In addition, customs focus on increasing the effectiveness of pre-clearance, clearance, and post-clearance or audit supervision.

Customs and excise will also strengthen the harmonization of policies on facilities and industrial zones for tobacco products (KIHT).

Related news: Tax revenues utilized to support education, health workers: Indrawati

Related news: Increase state revenue to meet needs of middle class: ministry

Translator: Astrid Faidlatul H, Resinta S

Editor: Suharto

Copyright © ANTARA 2022