Bank Indonesia believes that the initiative marks an important milestone in strengthening bilateral financial cooperation between Singapore and Indonesia.Jakarta (ANTARA) - Bank Indonesia (BI) and the Monetary Authority of Singapore (MAS) have agreed to initiate cooperation on cross-border Quick Response (QR) code-based payment linkage between Indonesia and Singapore to encourage payment connectivity in ASEAN.

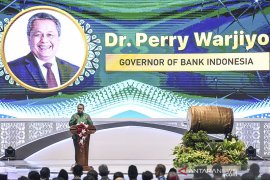

"Bank Indonesia believes that the initiative marks an important milestone in strengthening bilateral financial cooperation between Singapore and Indonesia," Governor of Bank Indonesia Perry Warjiyo remarked here on Monday.

He said that the initiative to encourage the digitalization of cross-border payments was also a priority of Indonesia’s 2022 G20 Presidency and the ASEAN Central Bank Governors' Meeting in April 2022.

The initiative is in line with the G20's attempts to overcome potential obstacles in global cross-border payment activities and support post-pandemic economic growth.

In addition, for Indonesia, the initiative is also a milestone in terms of the Indonesia Payment System Blueprint 2025.

The collaboration between the two countries will be launched in the second half of 2023 and enable users to make retail payments instantly, safely, and efficiently by scanning the Quick Response Code Indonesian Standard (QRIS) or Singapore’s NETS QR.

Furthermore, the payment connectivity is expected to encourage individuals and business actors, especially micro, small, and medium enterprises (MSMEs), to efficiently conduct cross-border trade, e-commerce, and other financial transactions.

The attempt is also expected to encourage the growth of the tourism sectors of the two countries.

BI and MAS also signed a memorandum of understanding (MoU) to encourage the use of local currencies in bilateral transactions, such as trade and direct investment.

Business actors can take advantage of the initiative to reduce the exchange rate risk and cost of conducting bilateral trade.

In addition, the initiative is also expected to promote the digital economy, financial inclusion, as well as strengthen macroeconomic stability through the increasing use of local currencies.

Managing Director of MAS Ravi Menon said that the QRIS-NETS QR code payment connectivity is a milestone for ASEAN in building payment integration in the region by 2025 and supporting the dynamics of cross-border trade activities.

Related news: QRIS' interconnectedness must facilitate MSMEs, tourism sector: Jokowi

Related news: QRIS full integration in Thailand begins today: Bank Indonesia

Translator: Astrid Habibah, Uyu Liman

Editor: Rahmad Nasution

Copyright © ANTARA 2022