The law actually strengthens the credibility of each authority.Jakarta (ANTARA) - The Law on Financial Sector Development and Strengthening (P2SK) will not curtail the independence of Bank Indonesia (BI), the Financial Services Authority (OJK), and the Indonesia Deposit Insurance Corporation (IDIC/LPS), the Finance Ministry has assured.

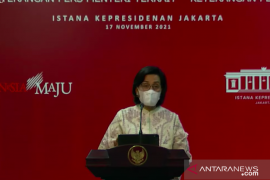

"Here (the Law on P2SK) emphasizes the independence and the role of the (three financial) authorities, namely BI, OJK, and LPS. The law actually strengthens the credibility of each authority," Finance Minister Sri Mulyani Indrawati explained here on Thursday.

She made the statement during a plenary session of the Indonesian House of Representatives (DPR RI) at the Parliamentary Complex.

She said that the law aims to strengthen institutional authority and governance in the financial sector, thus it will accentuate the objectives, duties, and authority of the three institutions to bolster financial system stability and economic growth while still prioritizing their independence.

Related news: Global economy undergoing rampant, troubling changes: minister

Article 36A of the Law on P2SK states that to maintain financial system stability during an economic crisis, BI has the authority to buy long-term government securities (SBNs) in the primary market.

"BI is indeed given an additional mandate (under Article 36A), but it does not disrupt the independence of BI," the minister said.

Under the law, the LPS will also have an additional mandate to guarantee insurance policies managed by insurance companies.

The law will strengthen the independence of the three financial institutions by prohibiting the candidates and members of the board of governors of BI, OJK, and LPS from serving as political party administrators and/or members.

The Law on P2SK will also carry out institutional strengthening by raising the number of members on the board of commissioners of OJK and LPS to help the institutions fulfill their mandates.

In addition, the law will mandate the establishment of supervisory bodies at OJK and LPS as a check-and-balance effort to improve the performance, accountability, independence, transparency, and credibility of the institutions.

Related news: Govt allocates US$200 bln for improving HR, social protection reform

Furthermore, the law will regulate the implementation of integrated supervision of banking, capital market, pension funds, insurance, cooperatives, as well as fintech and digital financial asset transactions—such as cryptocurrencies—under OJK.

The OJK will be mandated to carry out digital financial asset supervision to strengthen the regulation of the implementation of the sector as well as to bolster investor and consumer protection.

Meanwhile, the aim of tasking the OJK with licensing, regulating, and supervising cooperatives is to provide legal certainty and protection to the members of the cooperative.

Related news: Need to build integrity through anti-graft push to revive economy

Related news: Tobacco tax increase to help control cigarette consumption: minister

Translator: Astrid Habibah, Uyu Liman

Editor: Fardah Assegaf

Copyright © ANTARA 2022