During a press conference on the economic policy package in Jakarta on Monday, Industry Minister Agus Gumiwang Kartasasmita named Citroen, BYD, and AION as the companies.

"These three companies will benefit from zero import duties and a 15 percent PPnBM DTP," he said, referring to the luxury goods sales tax borne by the government.

He explained that providing incentives for the French automobile manufacturer and the two Chinese automotive producers is part of the government's efforts to demonstrate Indonesia's competitive regulations.

"Those regulations include incentives and stimulus," Kartasasmita remarked.

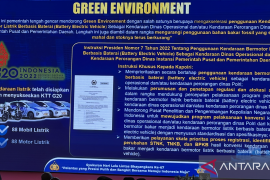

He emphasized that the incentives align with the government’s goal of making Indonesia a hub for battery electric vehicle (BEV) production in Southeast Asia.

Starting January 1, 2025, the government will also offer an incentive to cover 3 percent of the luxury tax burden for hybrid vehicles.

Currently, hybrid cars are subject to a luxury goods sales tax (PPnBM) of 6–12 percent. In contrast, BEVs benefit from various incentives, including zero PPnBM.

The government is also offering a government-borne 10-percent value-added tax (VAT) for electric cars that meet a minimum domestic component level (TKDN) of 40 percent.

"Here, we can see that the government is paying great attention to the manufacturing sector by providing incentives or stimulus for the automotive sector," Kartasasmita emphasized.

Related news: Indonesia seeks US market access for Korean-made EVs

Related news: Electric car incentives and goal of reducing air pollution

Translator: Putu Indah Savitri, Yashinta Difa

Editor: Anton Santoso

Copyright © ANTARA 2024