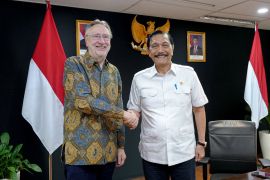

Speaking in Jakarta on Friday, Luhut said digital tools could broaden the tax base while improving system efficiency, reducing manual interventions that often create opportunities for revenue leakage.

Through digital reforms, practices of underreporting revenue to stay below Rp5 billion—the threshold for small and medium enterprise (SME) tax eligibility—can be minimized, he said, noting such practices are common.

A broader tax base, he added, would increase state revenue potential and allow for phased adjustments in tax rates over time.

“With technology, reform happens. More taxpayers will be included, but taxes can be reduced gradually,” Luhut said.

The approach aims to balance compliance and administrative ease, replacing face-to-face interactions with automated systems to enhance transparency and reduce bureaucracy.

“This forces people to deal with machines instead of officials, increasing efficiency, curbing corruption, and making Indonesia more effective,” he said.

Luhut said he plans to submit the proposed reforms to President Prabowo Subianto for consideration.

According to the Finance Ministry, government revenue reached Rp172.7 trillion as of Jan. 31, 2026, up 9.8 percent year-on-year from Rp157.3 trillion in January 2025.

January’s revenue represents 5.5 percent of the 2026 state budget target of Rp3,153.6 trillion.

The strong performance was driven by tax receipts, which surged 30.8 percent to Rp116.2 trillion, achieving 4.9 percent of the 2026 budget target of Rp2,357.7 trillion.

Related news: Finance Ministry targets 40 steel firms over Rp5 trillion VAT losses

Related news: Indonesia eyes Rp134 trillion from minerals and coal in 2026

Translator: Imamatul S, Rahmad Nasution

Editor: M Razi Rahman

Copyright © ANTARA 2026