The government is currently intensively discussing various additional incentives required to revive the industrial sectorJakarta (ANTARA) - The government is readying additional incentives for the industrial sector grappling with the COVID-19 pandemic to inject new momentum into businesses.

Consequently, it can help drive the wheels of the national economy though adhering to health protocols.

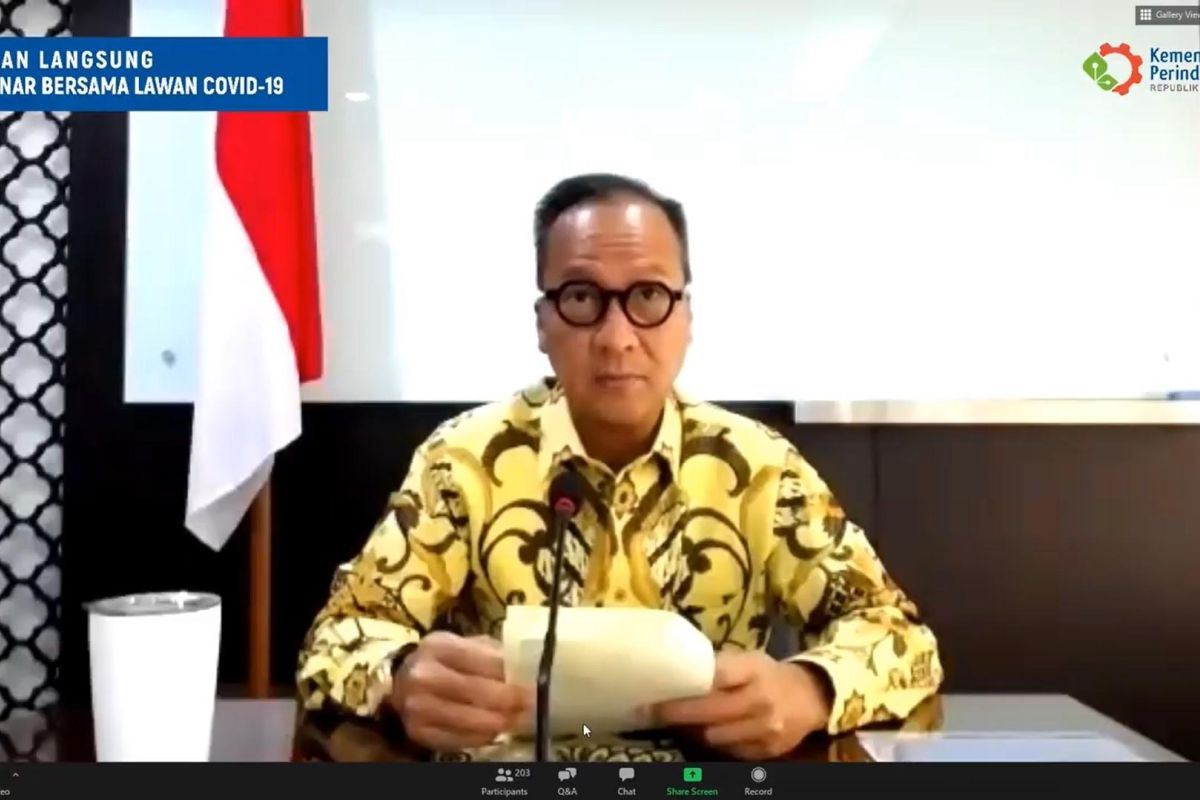

"The government is currently intensively discussing various additional incentives required to revive the industrial sector," Minister of Industry Agus Gumiwang Kartasasmita noted in a statement in Jakarta on Thursday.

Kartasasmita remarked that the additional incentives comprised waiving off payments or electricity subsidies for industries impacted by the COVID-19 pandemic.

To this end, the minister has sent out a circular to state-owned electricity company PLN.

The proposal is in the form of abolishing the minimum cost for 40 hours of electricity consumption, including for premium industrial customers consuming 233 hours of electricity. This policy is proposed for the subscription period from April 1 to December 31, 2020.

"The industry is expected to pay according to the amount of electricity consumed. The amount of stimulus required is Rp1.85 trillion for a period of nine months," he revealed.

Another incentive is in the form of postponing payment of 50 percent of PLN's bills for six months, starting April-September 2020, with guaranteed installments in the form of backward demand deposits for 12 months. The other proposed incentive was removal of late payment penalties.

Furthermore, Kartasasmita stated that the government was reviewing incentives in the form of eliminating value-added taxes (VAT) for local raw materials for export, postponing VAT payments for 90 days without fines, as well as the temporary release of Article 25 income tax installments.

"The government continues to maintain performance and support the productivity of industry players, including through the provision of tax incentives," he expounded.

Kartasasmita opined that industrial productivity also aimed at ensuring that the domestic community’s requirements were met.

"Providing additional tax breaks for the industrial sector will complement other incentives released earlier by the government," he stated.

Incentives launched for industry players encompass the exemption of import tax article 22, 30 percent of article 25 income tax installments, accelerated VAT refunds, and additional incentives for companies receiving bonded zone facilities and/or ease of import-export activities for handling the Covid-19 pandemic.

The minister has also suggested credit restructuring and working capital stimulus. This incentive will be offered with several criteria, including a track record of taxes and credit installments, good business prospects, employment absorption, heavy impact of Covid-19, and use of domestic raw materials.

As per Decree of the Minister of Energy and Mineral Resources No. 8 of 2020 on Determination of Users and Certain Natural Gas Prices in the Industrial Sector, the proposed point is the abolition of the minimum payment per contract and payment in accordance with the amount of usage.

"Such efforts are certainly expected to help the industry to continue to grow and help the national economy to continue to maintain a positive trend," the minister added.

Related news: Ministry prepares criteria for businesses to receive recovery stimulus

Related news: COVID-19 economic stimulus must support low-carbon development

Close

EDITED BY INE

Translator: Sella P, Azis Kurmala

Editor: Fardah Assegaf

Copyright © ANTARA 2020