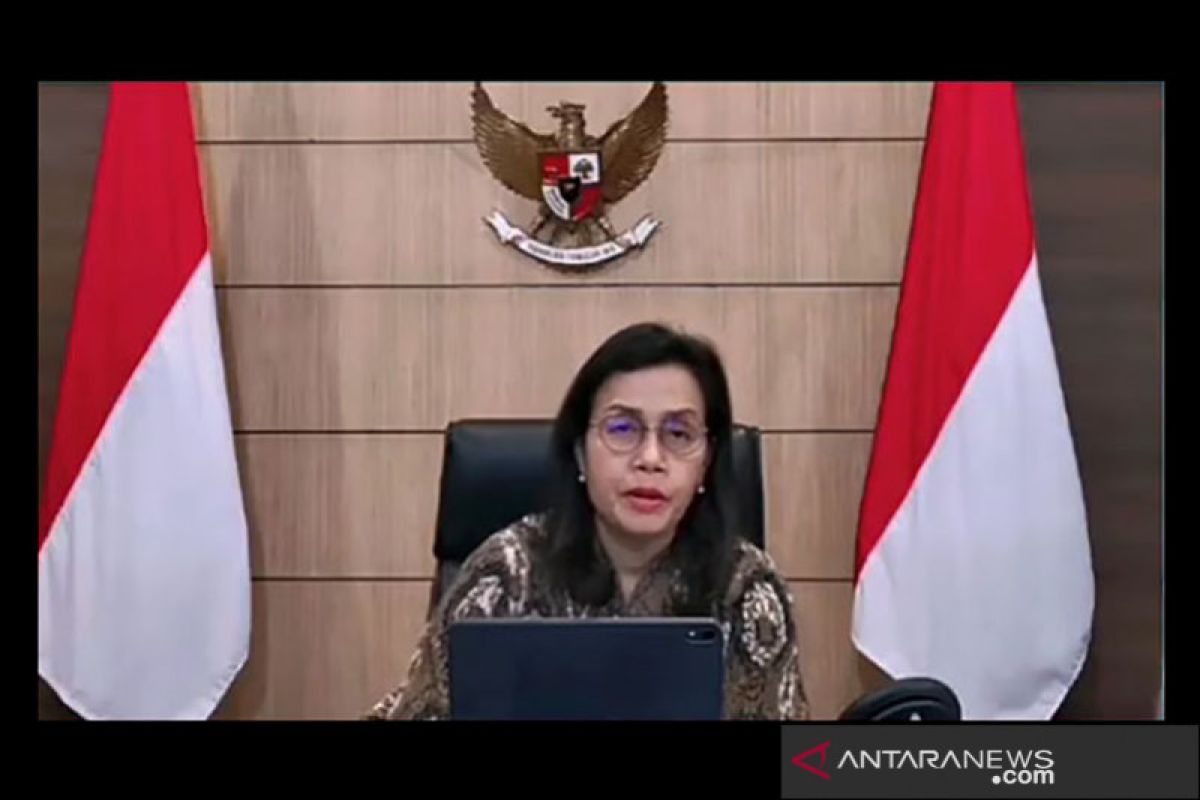

"We hope for Indonesian pharmaceutical companies to use this momentum amidst COVID-19 and the various incentives given by the government, including the super deduction," she said at a press conference on the October State Budget in Jakarta on Monday.

Pharmaceutical companies that are conducting research to discover a vaccine against COVID-19 are eligible for the tax incentive, she informed.

With the tax stimulus, she continued, domestic pharmaceutical companies can increase the pharmaceutical industry's capacity and industry capabilities.

“Countries with a strong pharmaceutical industry are able to or can continue to be able to discover solutions for the pandemic, (and) at the same time, develop leadership on the international stage," the minister remarked.

The former World Bank managing director is optimistic about the potential of the domestic pharmaceutical industry to become a global player, as Indonesia is one of the countries with a large population and economy.

Indrawati had earlier issued Finance Minister Regulation number 153 of 2020 on Granting A Reduction in Gross Income on October 9, 2020 for certain research and development in Indonesia.

According to the regulation, tax-payers who carry out certain research and development activities in Indonesia may be granted a gross income reduction of up to 300 percent. (INE)

Related news: Bio Farma can produce 16-17 million doses of COVID-19 vaccine a month

Related news: Govt to offer citizens COVID-19 vaccine derived from three sources

EDITED BY INE

Translator: Dewa Ketut Sudiarta Wiguna/Ari

Editor: Suharto

Copyright © ANTARA 2020