This is our common goal. We will have a large bank that can be classified as a BUKU IV BankJakarta (ANTARA) - The envisioned merger of three sharia banks would drive development of the banking industry and sharia economy, with Indonesia ranked as the world largest market for the industry, the Financial Services Authority (OJK) stated.

"This is our common goal. We will have a large bank that can be classified as a BUKU IV Bank," OJK's Director of Research and Development of Sharia Bank, Deden Firmansyah, noted during a webinar on the post-pandemic economic potential of sharia banks here on Tuesday.

General Bank based on Business Activities (BUKU) category IV are banks, with a core capital of at least Rp30 trillion, according to OJK Regulation No. 6 of 2016.

BUKU I are banks with core capital of less than Rp1 trillion, while BUKU II are banks with core capital of between Rp1 trillion and Rp5 trillion, and BUKU III are banks with core capital of Rp5 trillion to less than Rp30 trillion.

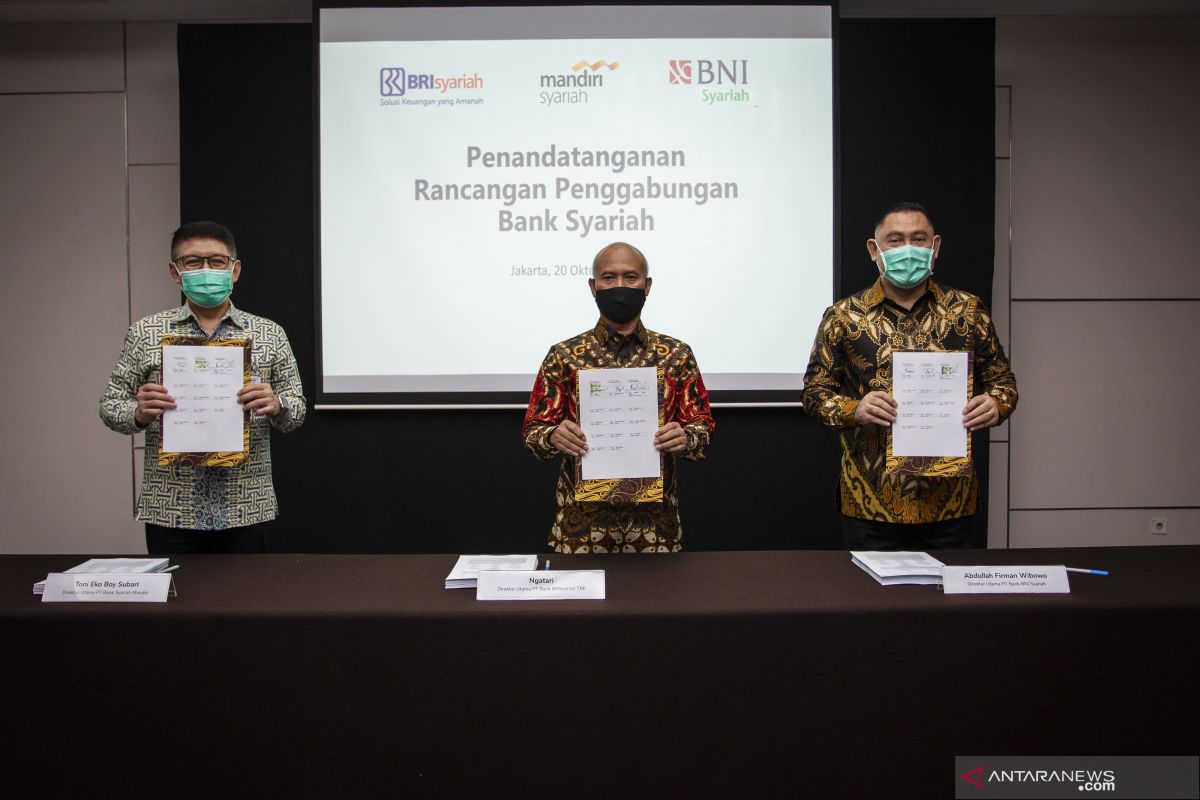

The three sharia banks are subsidiaries of three state-owned banks: PT Bank BRI Syariah Tbk, PT Bank BNI Syariah, and PT Bank Syariah Mandiri.

Firmansyah explained that the plan will support the government's efforts to make Indonesia the world's sharia economic and financial hub for which a strong banking industry was necessary.

"We need to have an anchor bank that can operate in the global arena without ignoring the domestic market in Indonesia," he remarked.

On the other hand, the OJK has encouraged sharia banks to adopt the latest technology if the growth is swift, as digitalization is a must in the sharia financial industry.

As of August 2020, total assets in sharia banking had reached Rp550.63 trillion of the total Rp1,678.94 trillion of assets in the sharia financial industry in the country.

The asset value had grown by 2.29 percent as compared to December 2019 year-to-date (ytd), while third-party funds collected as of August 2020 has reached Rp436.77 trillion or increased by 2.7 percent ytd.

During the period, sharia banks had disbursed Rp378.98 trillion of funding in total, or grew by 3.80 percent as compared to December 2019 ytd.

"The sharia bank market share has reached six percent," he noted.

Despite its large market in the financial industry, the number of sharia bank accounts only reached 35 million. Hence, sharia banking can potentially still be developed further.

"The number of sharia bank customers is still low. Hence, there is potential to increase the number of customers and assets," he added.

Related news: BI pushes for expediting digitalization of sharia economy

Related news: Sharia economy is 80 percent contributor of GDP: Bank Indonesia

EDITED BY INE

Translator: Dewa Ketut SW, Sri Haryati

Editor: Fardah Assegaf

Copyright © ANTARA 2020