Expedite corporatization and economic and finance digitalization for supporting economic recovery, especially for MSMEs, the pillars of the country's economy.Jakarta (ANTARA) - Senior Deputy Governor of Bank Indonesia (BI) Destry Damayanti drew attention to at least four strategies that can drive banking credit growth in 2021.

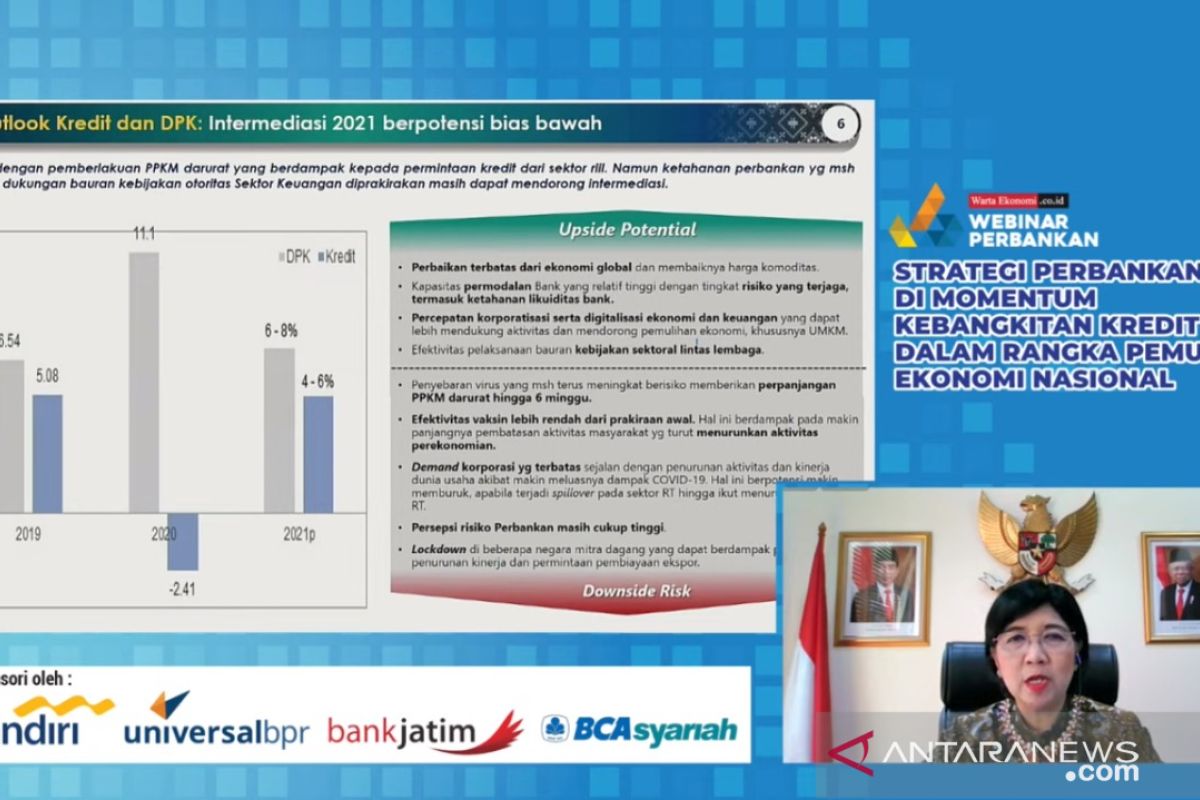

"We earlier estimated credit growth to lie between six to eight percent this year, but we lowered it down to four to six percent. However, the application of four strategies can accelerate growth," Damayanti stated during an online discussion here, Thursday.

The senior deputy governor of BI noted that the first strategy entailed sustained improvement in the global economy that can lift global commodity prices, so that Indonesia, as a commodity-based country, will also be able to enjoy the rising prices and be able to boost credit.

Under the second strategy, the bank's relatively high capital capacity, with a secured level of risk, including the resilience of bank liquidity, can encourage banks to continue to channel their credit, according to Damayanti.

Related news: Sharia growth better than national economic growth: Bank Indonesia

Damayanti noted that the third strategy involved expediting corporatization and economic and finance digitalization for supporting economic recovery, especially for MSMEs, the pillars of the country's economy.

"More than 99 percent of the businesses fall in the MSME segment, and if we look at the credit segment recovery, this MSME credit has been recovering faster than that of the corporate segment," she pointed out.

Damayanti noted that the fourth strategy entailed effectiveness of a cross-sectoral policy mix. With that, the BI, Financial Services Authority (OJK), Finance Ministry, and Deposit Insurance Agency (LPS) can continue to increase synergy and coordination in the national economic recovery agenda as well as boost banking intermediation.

Nonetheless, she did point to some existing barriers that potentially suppressed credit growth, such as the COVID-19 Delta variant transmission and the perception of banking risk that makes banks wary of channeling their credit.

Related news: PPKM posts must apply end-to-end integrated approach against COVID-19

Related news: Economic transformation basis for healthy growth: BI

Translator: Agatha, Satyagraha, Kenzu

Editor: Fardah Assegaf

Copyright © ANTARA 2021