Most people often receive messages from unknown phone numbers that give attractive offers.

"We offer Rp5 million-Rp500 million with easy requirements. Contact us through WA 081XXXXXXXXX," according to an offer through SMS received on Antara's cell phone.

Some lending offers give attractive facilities, such as simple and fast processing, even without collateral.

However, with the high incoming SMS volume having similar content, cell phone users sometimes become "lazy" to open the short messages.

People unfamiliar with communication technology and unaware of the legal aspect can be easily tricked by such offers.

It should be noted that online loan companies are not entirely illegal. The lending businesses must be registered with the Financial Services Authority (OJK) as an official legal entity.

Related news: Financial literacy necessary to reduce illegal online loan cases

According to the OJK, as of August 31, 2021, there were 68.41 million borrowers of official online loans, with a total national value of Rp249.938 trillion.

In addition, as many as 106 peer-to-peer lending financial technology companies are registered and licensed with the authority until October 6, 2021.

The public must remain vigilant and careful while using the loan services. The consumer should pay attention to the legality of the companies.

Indonesian President Joko Widodo (Jokowi) also highlighted the dangers of opting for illegal online loans.

"I heard the lower class people, who took illegal online loans, were deceived and faced high-interest rates," Jokowi noted in his remarks on the occasion of Virtual Innovation Day 2021 held here, Monday (Oct 11).

The head of state noted that the development of financial technology should be escorted to develop a better economy for Indonesia.

Jokowi called on the OJK and financial technology companies to ensure balanced dissemination of financial and digital literacy among the people to encourage inclusive economic growth.

"Financial inclusion should provide wider access to the people, especially the lower middle class, as a solution to reduce social inequality and reach the society that has not availed the services of the conventional financial system," Jokowi stated.

Illegal loan trap

The OJK noted that the people's need for an easy loan is a factor behind the spread of illegal online loans.

Apart from the urgent need owing to financial difficulties, other factors that drive people to use illegal online loans comprise the scarce financial literacy among members of the community.

The ease of uploading applications and sites on the internet or cell phone operating system is also misused by the illegal loan party.

The OJK spoke of having stopped thousands of lending operations since 2018.

At least 404 illegal loans were discontinued in 2018. Meanwhile, 1,493 illegal loans were also closed in 2019.

During 2020 and until October 2021, some 1,026 and 593 unregistered loans were discontinued.

The authority suspended 3,516 parties involved in illegal loans in four years.

The authority also received a total of 19,711 complaints from people regarding illegal loans. Some 47.03 percent were serious violations, while 52.97 percent were moderate to minor violations.

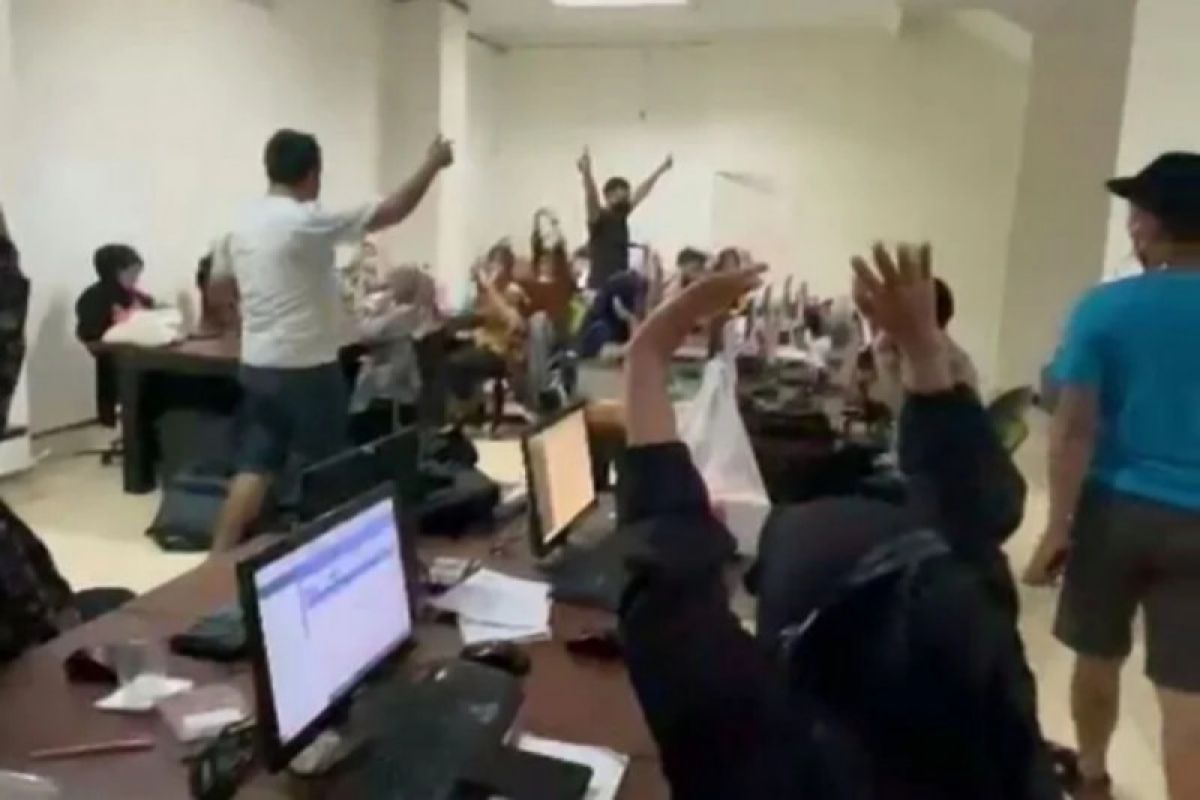

Critical violations include disbursement without consent, threat of personal data dissemination, and intimidation of all contacts on the borrowers' cellular phones.

Even worse, debt collection was conducted with harsh words and even to the point of sexual harassment.

Related news: West Jakarta Police probe two reports of illegal online loans

Avoid illegal loan

People can recognize the characteristics of illegal loan parties, such as often setting high-interest rates, large fees, unlimited fines, and intimidating the borrowers.

People seeking loans must understand the legality to borrow cash only from registered and licensed lenders.

To check the legality of online lenders, people can contact 157 or send a message through the WhatsApp application at 081157157157.

People can also check it via email to consumer@ojk.go.id.

The OJK also presents a list of official loan companies that have received permits on the website www.ojk.go.id.

In addition, people should install an official loan application on their cellular phone through an official provider.

Law enforcement officials and the government have acted quickly to handle illegal online loan cases that ensnared several people.

Director of Special Economic Crimes of the Indonesian Police, Brigadier General Helmy Santika, stated that investigations into illegal loans have different characteristics, as the cases involve various acts of crimes.

The police have received 371 reports related to illegal loans from 2020 to 2021.

Of that figure, as many as 91 cases have been revealed, eight cases are entering the trial stage, while the rest are under investigation.

"The police assess illegal loan cases derived from SMS blasting and intimidation to harsh collection cases and not only limited to the financial loan," Helmy added.

The police have urged people to be wary of lenders, who offer fast financial loan with easy requirements.

Several regulations that are likely to be violated in cases of illegal loans range from the Consumer Protection Act to the Trade Law, and the Pornography Law.

Coordinating Minister for Political, Legal, and Security Affairs, Mahfud MD, noted that criminal and civil law actions can be applied to illegal loan cases.

To protect the public, the government will also conduct a moratorium on permits for online loan providers.

The OJK also urged to conduct a moratorium on the financial technology licenses for online loan businesses.

Meanwhile, the Ministry of Communication and Information Technology will conduct a moratorium on the issuance of electronic system operators for new loan service applications.

"The government will take firm steps to free the digital space of illegal and unregistered lending practices because they caused serious impacts," Minister of Communications and Information, Johnny G. Plate, stated.

The swift response of law enforcement and the moratorium is expected to nip the problem of SMS of “fake” loan offers in the bud.

More importantly, others will not be deceived and ensnared by illegal online loans that are burdensome.

People must take preventive acts by improving literacy on digital applications and the legality of lender companies.

Maturity and prudence in using digital devices and managing finances are crucial to avoid the trap of illegal loans.

Related news: Beware of illegal online loan services

Related news: Ministry blocks 151 unlicensed fintech P2P lenders

Editor: Sri Haryati

Copyright © ANTARA 2021