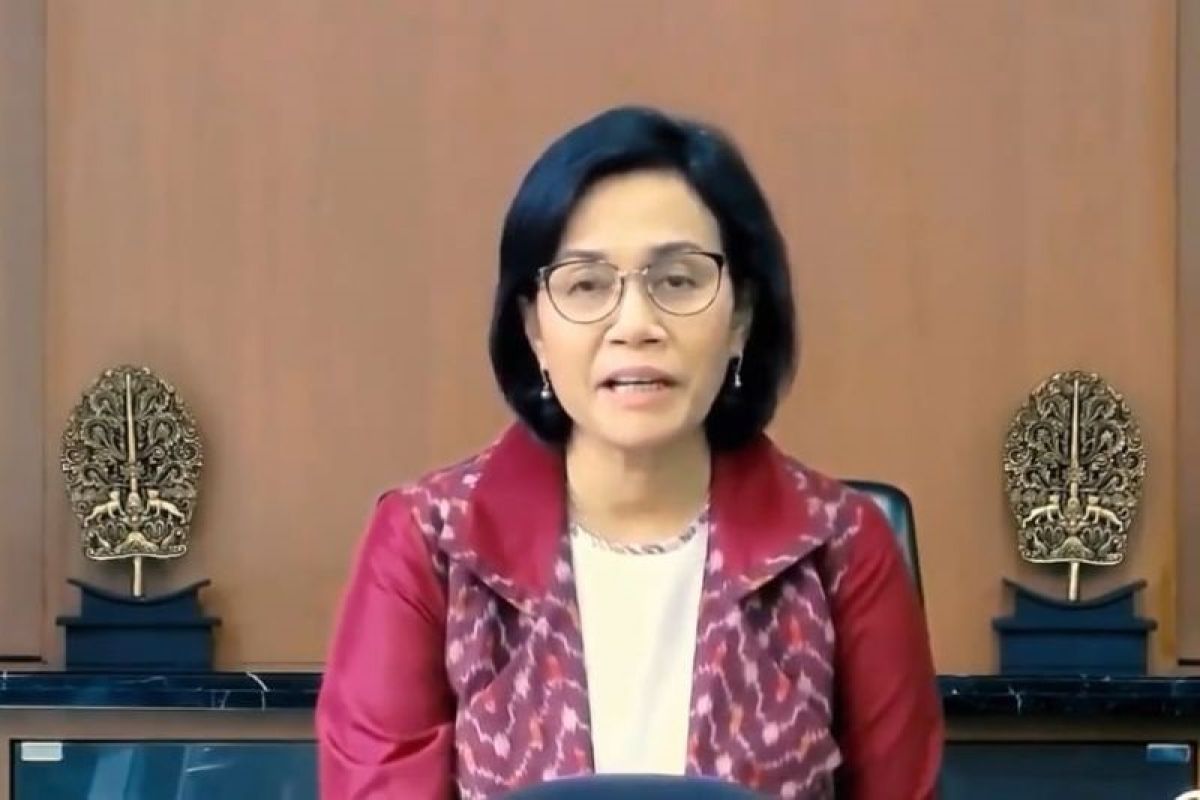

Those are vulnerable groups who are usually ensnared by illegal financial activities.Jakarta (ANTARA) - Strengthening customer protection is very important nowadays as the financial services industry has become more complex, dynamic, and vulnerable to many new risks, Finance Minister Sri Mulyani Indrawati has said.

"Hence, customer protection and financial literacy have become our concern in discussing financial inclusion," she remarked at the Indonesian Financial Services Authority (OJK)-Organisation for Economic Cooperation and Development (OECD) Conference here on Thursday.

Strengthening the customer protection system is crucial to improve customer empowerment, increase financial institutions’ awareness of the importance of customer protection, and boost public trust in the financial services sector, she explained.

Related news: Palm oil downstreaming to increase added value of exports: minister

Between 2018 and 2021, the OJK closed more than 3,500 illegal online lenders, the minister informed.

According to OJK, the high number of illegal financial activities in Indonesia was due to low financial literacy, which was only 38.03 percent in 2019, much lower than the financial inclusion index of 76.19 percent in 2019, she said.

"The figure shows that a lot of Indonesians use financial services without having adequate financial literacy," Indrawati noted.

Hence, she urged all stakeholders to improve public financial literacy so that customers can use financial products safely and effectively, as well as protect themselves from potential fraud and unfavorable mistakes.

Related news: Indonesia has crucial climate role: finance minister

G20 countries should develop financial literacy standards by evaluating the existing tools and developing strategies and programs to promote financial education targeting poor families, the elderly, people with low education levels, small- and medium-sized business owners, and women.

"Those are vulnerable groups who are usually ensnared by illegal financial activities," the minister remarked.

Hence, she suggested that all parties establish more effective approaches to increase financial inclusion, especially in the midst of a pandemic that has forced people to change and use digital technology, often without any customer protection or financial literacy.

Related news: CPO production projected to rise 1.9 million tons in 2022

Related news: OJK, MUI should issue digital sharia economic development guidelines

Translator: Agatha Victoria, Uyu Liman

Editor: Fardah Assegaf

Copyright © ANTARA 2021