Amid the quite challenging condition until the fourth quarter last year, BSI still showed solid performance.Jakarta (ANTARA) - Bank Syariah Indonesia (BSI) posted a net profit of Rp3.03 trillion for 2021, up 38.42 percent compared to Rp2.19 trillion the previous year.

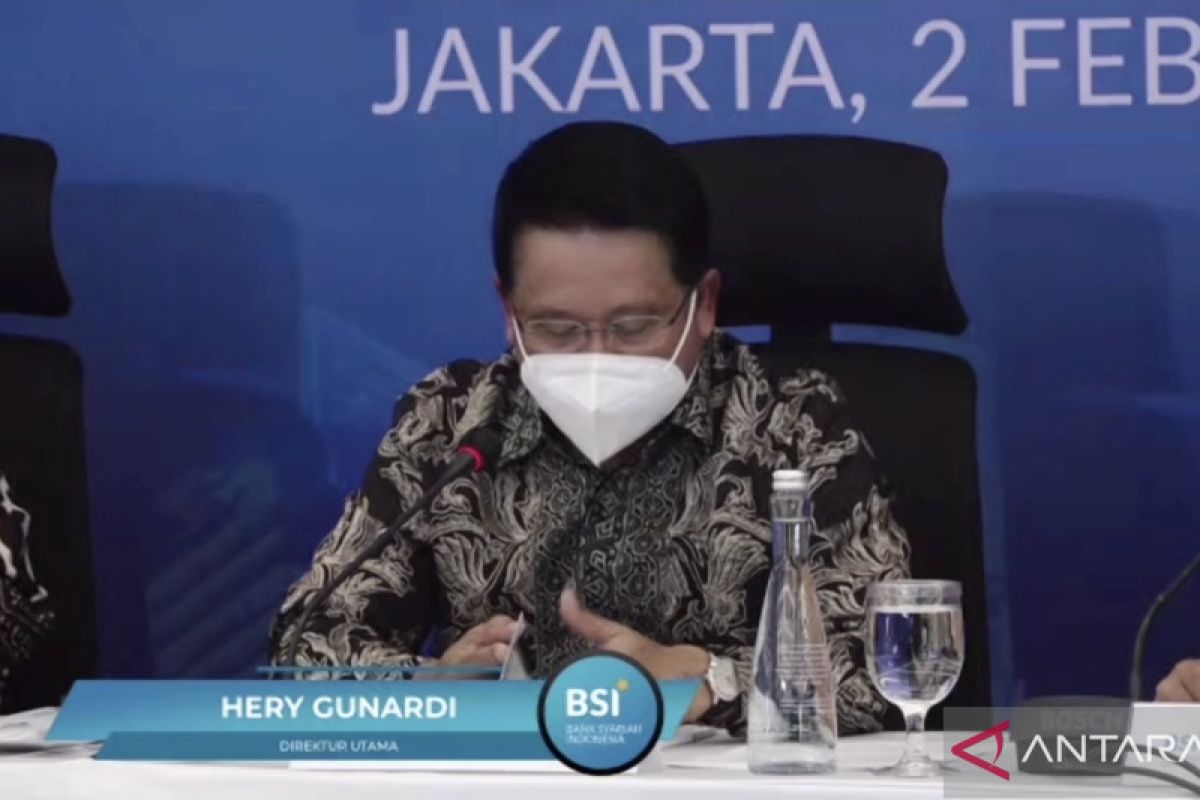

"Amid the quite challenging condition until the fourth quarter last year, BSI still showed solid performance," BSI president director Hery Gunardi said in an online press conference in Jakarta on Wednesday.

The bank saw its assets rise 10.73 percent to Rp265.29 trillion year on year (yoy) from Rp239.58 trillion earlier, while financing grew 9.32 percent yoy from Rp156.7 trillion to Rp171.29 trillion, and third-party fund placement expanded 11.12 percent yoy to Rp233.25 trillion, he informed.

"Regarding CSR (corporate social responsibility), the amount of alms paid by BSI at the end of 2021 could reach Rp102 billion, up (37.84 percent) which was in line with the profit growth," he said.

The bank's non-performing financing (NPF) net improved to 0.87 percent by December 2021, he said. The probability ratio also increased, with return on equity rising from 11.18 percent to 13.71 percent and return on assets climbing from 1.38 percent to 1.61 percent, he added.

Related news: BSI's presence in Dubai can intensify RI-Middle East relations: govt

"While the merger of operations (of sharia units of state-owned banks) is ongoing, BSI also made improvement in terms of efficiency, with BOPO declining from 84.62 percent to 80.46 percent," BSI's finance and strategy director, Ade Cahyo Nugroho, informed.

BSI also managed to lower the cost of funds significantly from 2.68 percent to 2.03 percent and increase the capital adequacy ratio (CAR) from 18.24 percent to 22.09 percent, he said.

BSI is thankful to the Indonesian community for their trust in the relatively young corporation, he added. The public enthusiasm was reflected by people's savings at BSI, which swelled 12.84 percent to Rp99.75 trillion from Rp88 trillion, he said.

The growth was particularly fueled by Wadiah savings, which grew 15.3 percent or Rp34.1 trillion, he added.

"The other thing that we thank God for is that BSI has become one of the strongest banks in terms of saving business, which is very positive for the future development of BSI," he remarked.

Related news: BSI, Western Union collaborate to facilitate international remittances

Translator: Kuntum Khaira R, Suharto

Editor: Rahmad Nasution

Copyright © ANTARA 2022