Our purpose is to facilitate (residents) because even when we sometimes forget our taxpayer number, we will not forget our personal identification number.Jakarta (ANTARA) - Thanks to data integration, at least 19 million personal identity numbers can now be used as taxpayer numbers for filing taxes, the Directorate General of Taxes (DJP) has informed.

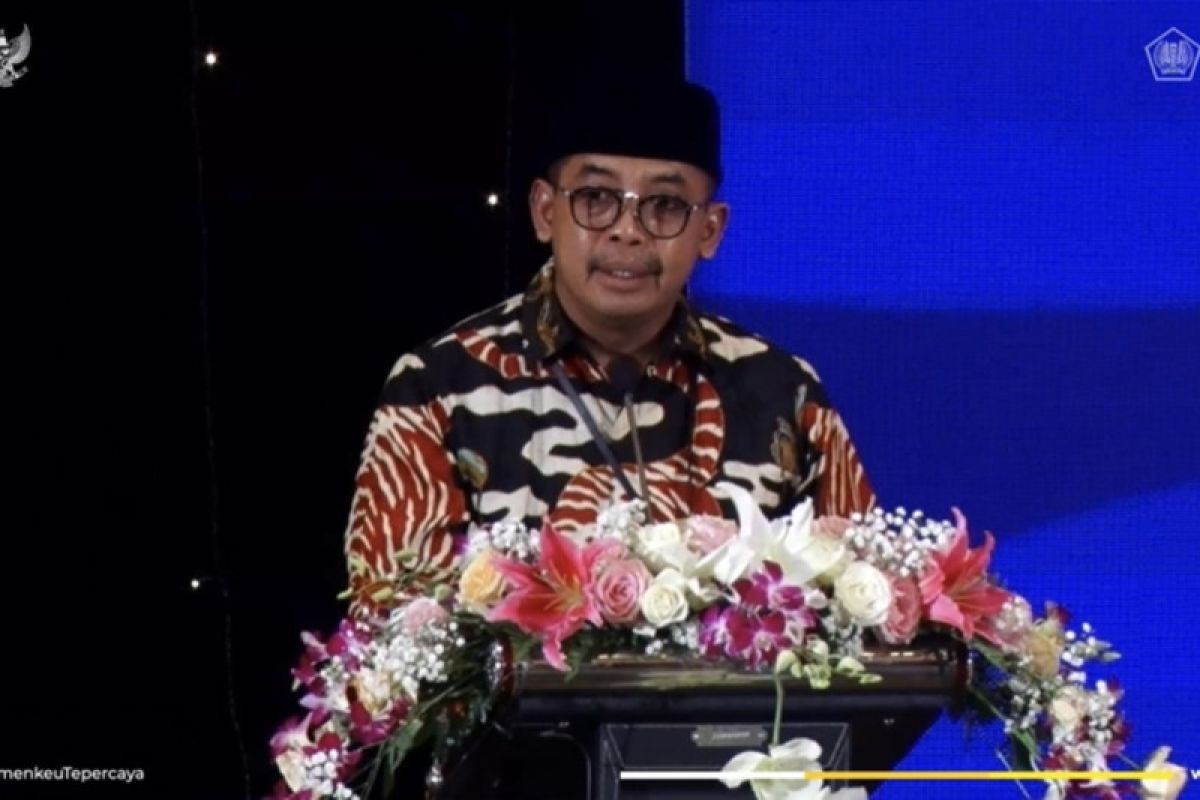

"This is a new start because we have successfully integrated some 19 million personal identity numbers with the (Home Affairs Ministry's) Directorate General of Population and Civil Records," Director General of Taxes, Suryo Utomo, stated at an event commemorating Tax Day here on Tuesday.

The owners of the 19 million personal identity numbers can now access taxation services on the DJP's website and file their taxes using their ID numbers, he informed.

Utomo said that the directorate general is committed to integrating more ID numbers with taxpayer numbers, but the process will take time as it has to be divided into several stages considering the hundreds of millions of personal identity numbers that the DJP needs to process for the purpose.

The process of updating and integrating personal identity numbers with taxpayer numbers began on July 14, 2022, he revealed.

The director general said that the purpose of the integration was to help residents file taxes.

"Our purpose is to facilitate (residents) because even when we sometimes forget our taxpayer number, we will not forget our personal identification number," Utomo explained.

He then expressed the hope that the integration will pave the way for other ministries and government institutions to synergize and integrate data and information to facilitate the provision of services to residents.

"There still many tasks that we must do for the integration and, God Willing, through our togetherness, we can make it," he remarked.

Last May, the Directorate General of Taxes and the Directorate General of Population and Civil Records inked a cooperation agreement on the use of personal identification numbers and data for tax purposes.

DJP's director of assistance, services, and public relations, Neilmaldrin Noor, stated that the cooperation agreement sought to integrate population data and the taxation database to improve services for taxpayers, in terms of access to and receiving taxation services, as well as to realize the Indonesia One Data Policy.

Related news: 18 mln emails sent to taxpayers to encourage voluntary disclosure

Related news: Agencies' agreement to integrate personal ID number as taxpayer number

Related news: Ministry projects 2022 tax revenue to grow to 15.3 percent

Translator: Astrid FH, Nabil Ihsan

Editor: Sri Haryati

Copyright © ANTARA 2022