"University students should conduct financial planning, such as managing daily cash flow, prioritizing needs instead of wants, planning emergency funds and others," Yulianta noted through a press statement on Wednesday.

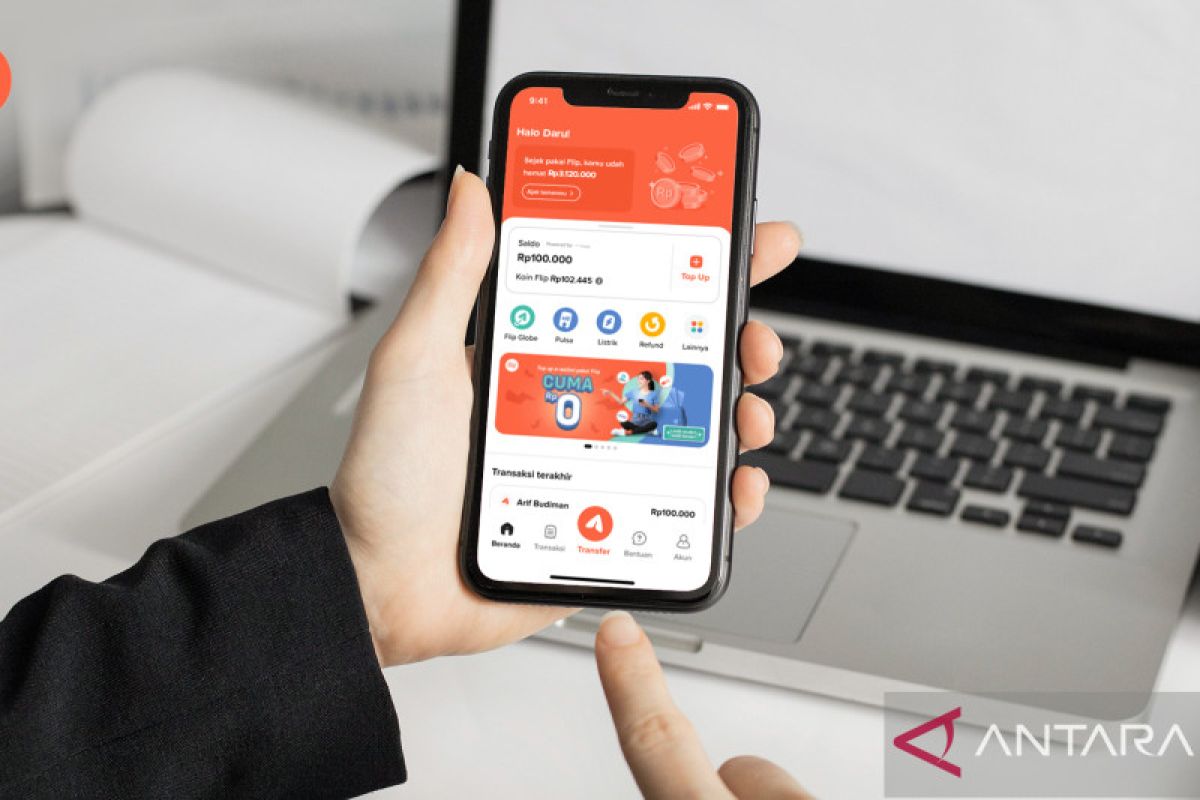

"In addition, university students should understand the use of financial technology, so they can avoid illegal loan or investment as well as fraud," the deputy director emphasized.

The OJK continues to improve financial literacy in Indonesia. The 2022 Financial Literacy and Inclusion National Survey Results (SNLIK) show that Indonesians' financial literacy index reached 49.68 percent, while their financial inclusion stood at 85.10 percent.

This figure is an improvement as compared to the results of the 2019 SNLIK that showed 38.03 percent for the financial literacy index and 76.19 percent for financial inclusion.

Nonetheless, the figure is still far from the government's target of the financial inclusion rate of 90 percent by the end of 2024.

Head of AFTECH's Financial Education and Literacy Department Rafi Putra Arriyan called for collaborative efforts from regulators, the industry, and associations to achieve this target through various initiatives.

Through this collaboration, understanding and practices on financial management and solution among members of the public will be more optimal, Arriyan, concurrently the co-founder and CEO of Flip, remarked.

Earlier, the company collaborated with OJK, the Jakarta Representative Office of Bank Indonesia (BI), AFTECH, and Bogor Agriculture Institute (IPB) to disseminate information on financial planning and education program.

The event, titled "Financial Hacks: Managing Scholarship University Students' Finance," had over two thousand participating students that received the College Smart Indonesia Card (KIP-K) scholarship in IPB, both offline and online.

Related news: OJK disseminates information on financial literacy to students

Related news: Government's role in safeguarding citizens from illegal online loans

Translator: Arnidhya Nur Z, Fadhli Ruhman

Editor: Rahmad Nasution

Copyright © ANTARA 2022