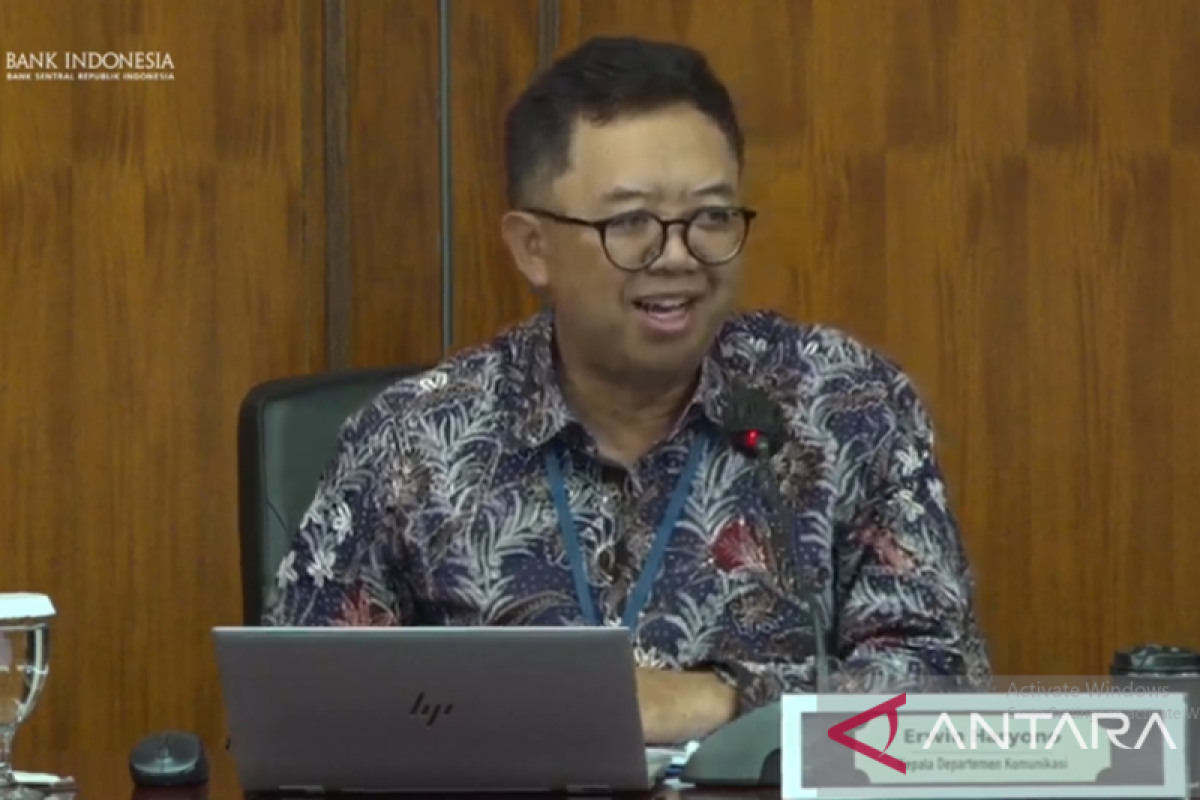

"Indonesia's balance of payments performance in the fourth quarter of 2022 remains solid and able to support Indonesia's external resilience," said Erwin Haryono, the central bank's Communications Department Executive Director, in a statement issued here, Monday.

He remarked that Indonesia's BOP performance in the fourth quarter of 2022 was supported by a high current account surplus and an improvement in the capital and financial account deficit.

Meanwhile, the current account again recorded a surplus of US$4.3 billion, or 1.3 percent of the gross domestic product (GDP), continuing the surplus achieved in the previous quarter of US$4.5 billion.

The current account performance stems from a maintained surplus in the non-oil and gas trade balance, supported by export commodity prices that remain high.

In addition, the deficit in the oil and gas trade balance decreased in line with the downward trend in world oil prices amid the tendency to increase fuel demand during the Christmas and New Year holidays.

The deficit in the services account improved, supported by an increase in the number of foreign tourist arrivals as a positive impact on the holding of various international events during the reporting period and year-end seasonal patterns.

The current account surplus was also supported by an increase in the surplus in the secondary income account stemming from increased receipts from government grants.

Meanwhile, the deficit in the primary income account rose due to the payment of investment returns to foreign investors that increased in line with the business cycle and the trend of rising interest rates.

The capital and financial account recorded an improvement, from a deficit of US$5.5 billion, or 1.6 percent of the GDP, in the third quarter of 2022 to a deficit of US$0.4 billion, or 0.1 percent of the GDP, in the fourth quarter of 2022.

"This positive performance was mainly supported by direct investment that recorded an increase in surplus in line with investor optimism about the prospects for economic improvement and a maintained domestic investment climate," Haryono remarked.

The pressure on the net outflow of portfolio investment has also begun to ease in line with the inflows into the domestic government securities (SBN) market that have started since the middle of Q4 of 2022.

Moreover, other investment transactions experienced a decrease in the deficit partly due to the withdrawal of private placements amid increasing obligations to pay off foreign debt.

Related news: Confident of W Java's positive economic growth in 2023: BI

Related news: BI awarded as Southeast Asia's best forex management institution

Translator: Martha Herlinawati, Cindy Frishanti Octavia

Editor: Anton Santoso

Copyright © ANTARA 2023