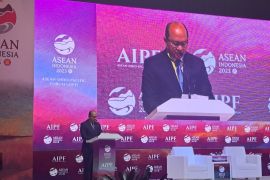

"Digital finance system will be essential, and I expect all of its obstacles can be resolved," Hartarto stated during the Mastercard Strive Indonesia launch event, as quoted from the statement on Tuesday (April 4).

The minister noted that only 20 million out of the 64 million MSMEs have digitized their businesses, and he expects the figure to increase.

The 64 million MSMEs nationwide are supporting economic resilience, with their contribution to the national gross domestic product (GDP) reaching 61 percent and providing jobs for 97 percent of the national workforces, he emphasized.

He also pointed out that currently, only some 13.7 million, or 21 percent of the MSMEs, have connected to the digital finance system, which recorded transaction value totaling Rp405 trillion (US$27.1 billion) in 2022.

Meanwhile, the coordinating minister also praised the launch of Mastercard Strive Indonesia and Mastercard's cooperation and contribution towards the implementation of the National Strategy for Inclusive Finance (SNKI) Program through workshops for over 300 thousand MSMEs actors until 2024.

"I hope the program can encourage more unbanked MSMEs to (be) bankable (MSMEs), as there will be more training classes provided by Mastercard," Hartarto remarked.

Through support and cooperation from stakeholders, Indonesia has recorded an increase in its financial inclusion level, from 83.6 percent in 2021 to 85.1 percent by 2022, surpassing the 85-percent target for 2022, he noted.

He remarked that the targets for financial inclusion in 2023 and 2024 were set for 88 percent and 90 percent, respectively.

Related news: Better funding access for SMEs to support financial inclusion

Related news: Financial Inclusion Month to create extensive public financial access

Related news: Minister presses for improving women's access to financial services

Translator: Sanya Dinda S, Nabil Ihsan

Editor: Azis Kurmala

Copyright © ANTARA 2023