"In that context, since 2017 until last month, the Investment Alert Task Force (SWI) working under OJK's coordination had closed more than 5,500 illegal investments and online lending services," Siregar stated here on Tuesday.

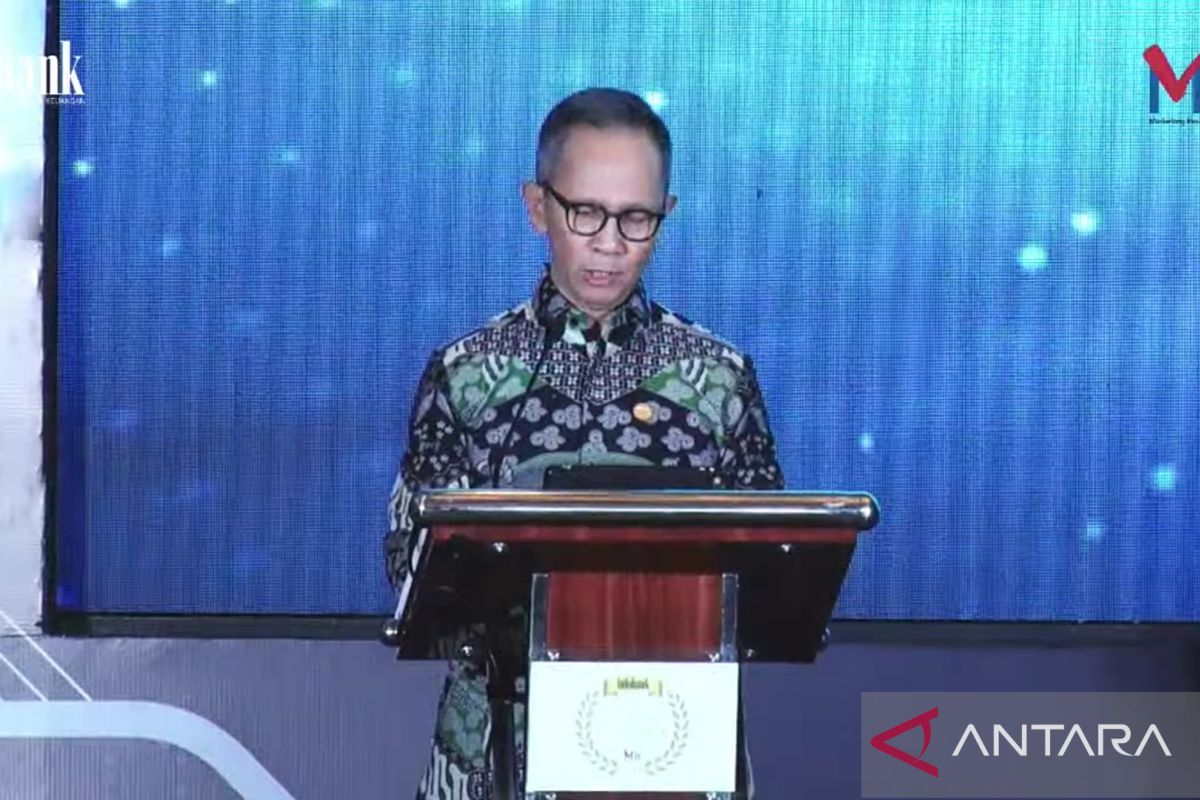

During the "Crime and Risk Prevention in Financial Sector" webinar, the OJK chief said the agency would continue to empower SWI by boosting its mandate to conduct cyber patrols and suspend illegal financial activities.

At the same time, the OJK is committed to preventing money laundering, terrorism funding, and weapons of mass destruction proliferation funding by issuing OJK Regulation No. 8 of 2023.

In accordance with Law on Financial Sector Development and Strengthening (UU P2SK), the OJK will prepare for the expansion of its monitoring and regulatory duties to savings and loan co-operatives and digital asset transactions, which earlier were beyond its authority.

The OJK will also continue to anticipate cyberattacks in the financial services sector that continue to increase amid the ongoing digitalization.

According to the National Cyber and Crypto Agency (BSSN), over 700 million cyberattacks in all sectors in Indonesia occurred in 2022 alone.

Meanwhile, the Global Risk Institute stated that cybercrimes had caused up to US$100 billion in losses in the global financial sector in merely a year.

"In the context of regulating (function), last year, the OJK issued a regulation on technology and information implementation of commercial banks and a circular on cybersecurity and defense for commercial banks," Siregar noted.

"Hence, for today, our focus is to ensure how to implement those regulations consistently," he affirmed.

Related news: Public participation needed to stamp put illegal investments: OJK

Related news: Bareskrim seizes Rp1.5 trillion from illegal investment providers

Related news: Influencers must be selective in endorsing financial products: OJK

Translator: Sanya Dinda S, Nabil Ihsan

Editor: Sri Haryati

Copyright © ANTARA 2023