"They have an impact on reducing the financial inclusion gap in rural and urban areas," OJK's Chief Executive of Market Conduct Supervision, Education, and Consumer Protection, Friderica Widyasari, stated here on Thursday.

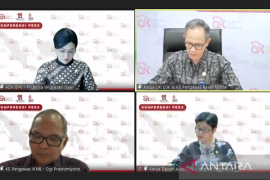

At the "ASEAN Fest 2023: OJK Seminar on Financial Inclusion" on Thursday, Widyasari remarked that based on the 2022 National Financial Literacy and Inclusion Survey (SNLIK), the financial inclusion index in rural areas increased, from 68.49 percent in 2019 to 82.7 percent in 2022.

Meanwhile, the financial inclusion index in urban areas also increased, from 83.6 percent in 2019 to 86.7 percent in 2022.

"This significantly narrows the financial inclusion index gap between rural and urban areas, from 15 percent in 2019 to only four percent in 2022," Widyasari remarked.

On the occasion, she highlighted that financial inclusion remains one of ASEAN's priority issues in economic development, as reflected in the declaration of ASEAN leaders that underlines ASEAN's commitment to support financial inclusion.

Hence, Widyasari affirmed that the OJK continues to innovate and encourage the acceleration of financial inclusion in all regions, with a main focus on villages.

One of the initiatives that have been carried out by OJK is the formation of TPAKDs. So far, as many as 495 TPAKDs have been formed in 34 provinces.

"I would like to thank all governors and the representatives of governors of all provinces. They have supported and made this program very impactful for the region, as well as the implementation of the inclusive financial ecosystem that has been established in 35 villages in Indonesia," she remarked.

Related news: OJK strives for inclusive digital finance with consumer protection

Related news: BI outlines focus areas of digital public infrastructure

Related news: Reaching unbanked Indonesians challenge for financial inclusion: Indef

Translator: M Alatas, Kenzu

Editor: Azis Kurmala

Copyright © ANTARA 2023