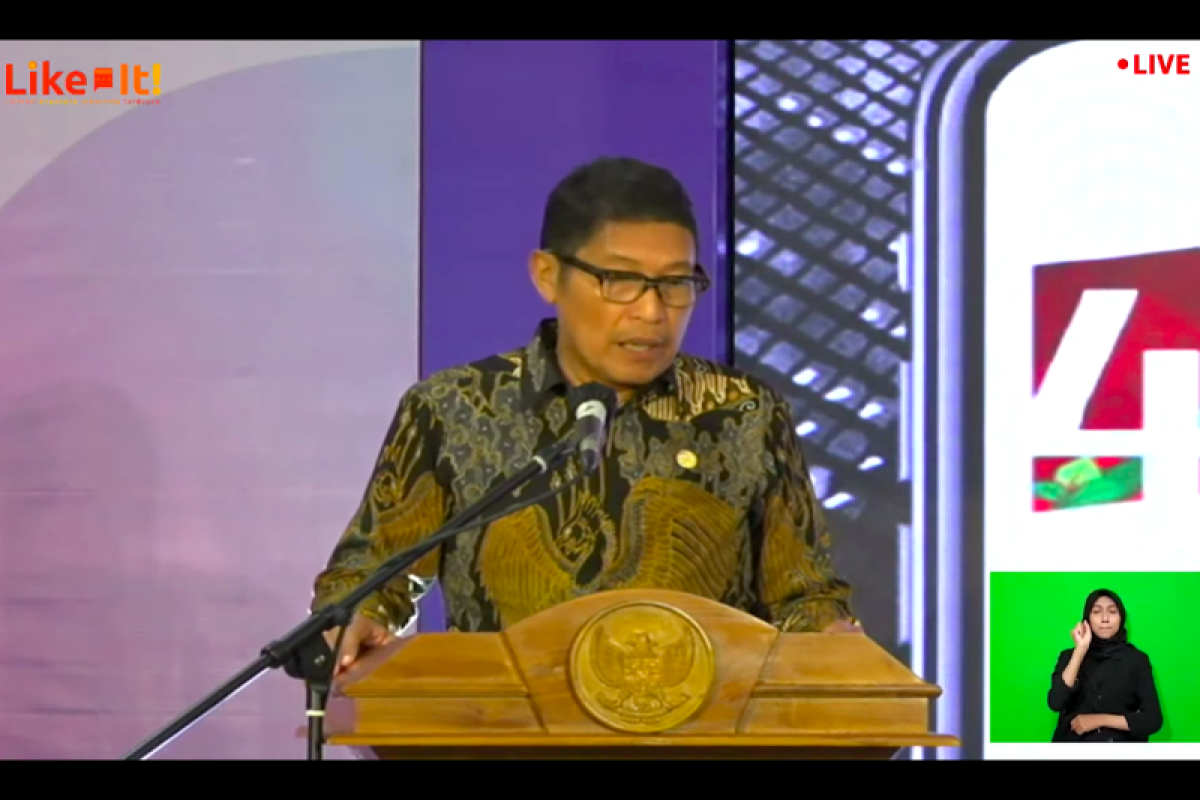

This was conveyed by OJK's capital markets, derivative finance, and carbon exchange chief executive supervisor, Inarno Djajadi, at the "LIKE IT (Indonesia Leading Financial Literacy)" event, which was followed online from Jakarta on Tuesday.

"It is a shame that we lost Rp139 trillion due to illegal investment. That amount of money can be used to build 12,600 schools or 504 new hospitals or build a toll road from Medan (North Sumatra) to Palembang (South Sumatra) with a length of 1.260 kilometers," he said.

Therefore, people must remain alert against illegal investments, he added.

OJK is consistently maintaining synergy, collaboration, and cooperation with the government, industry players, social organizations, associations, and other stakeholders to provide financial education to the public.

The protection measures devised by the OJK for investors have included educating people about avoiding illegal investments and encouraging the Indonesia Stock Exchange (IDX) to develop special notations and special monitoring boards.

"Those who are familiar with stocks will be given a special notation. If there is a late financial report or negative equity, the special notation will inform it. It aims to notify investors that their stocks are quite dangerous or should receive more attention," he informed.

The special monitoring board is meant to monitor stocks with a minimum price of Rp50 per share, he added.

"Those who are going to buy these stocks must be aware that the stocks are under special monitoring. We cannot prohibit you from buying certain stocks, but we are obligated to provide transparent information," Djajadi remarked.

Moreover, another protection measure by OJK has been the implementation of disgorgement authority under which money from fraud is given to investors who have suffered losses.

"We will take money from fraud in the capital market and hand it over to investors who lose. So we take money from fraud to distribute it to investors who have lost money, and also facilitate efforts to resolve customer complaints," he explained.

Related news: TPAKD increases financial inclusion index in rural areas: OJK

Related news: Target to publish regulation on carbon exchange next week: OJK

Related news: Wide spectrum of disabilities challenge to equal banking services: OJK

Translator: M Baqir Idrus A, Resinta S

Editor: Sri Haryati

Copyright © ANTARA 2023