Volatility in financial markets, both stocks, bonds and exchange rates, is on an increasing trendJakarta (ANTARA) - Indonesia's financial services sector was able to face global-level upheavals occurring currently, including the policy of high interest rates for protracted time periods or higher for longer, Financial Services Authority (OJK) Chairman Mahendra Siregar stated.

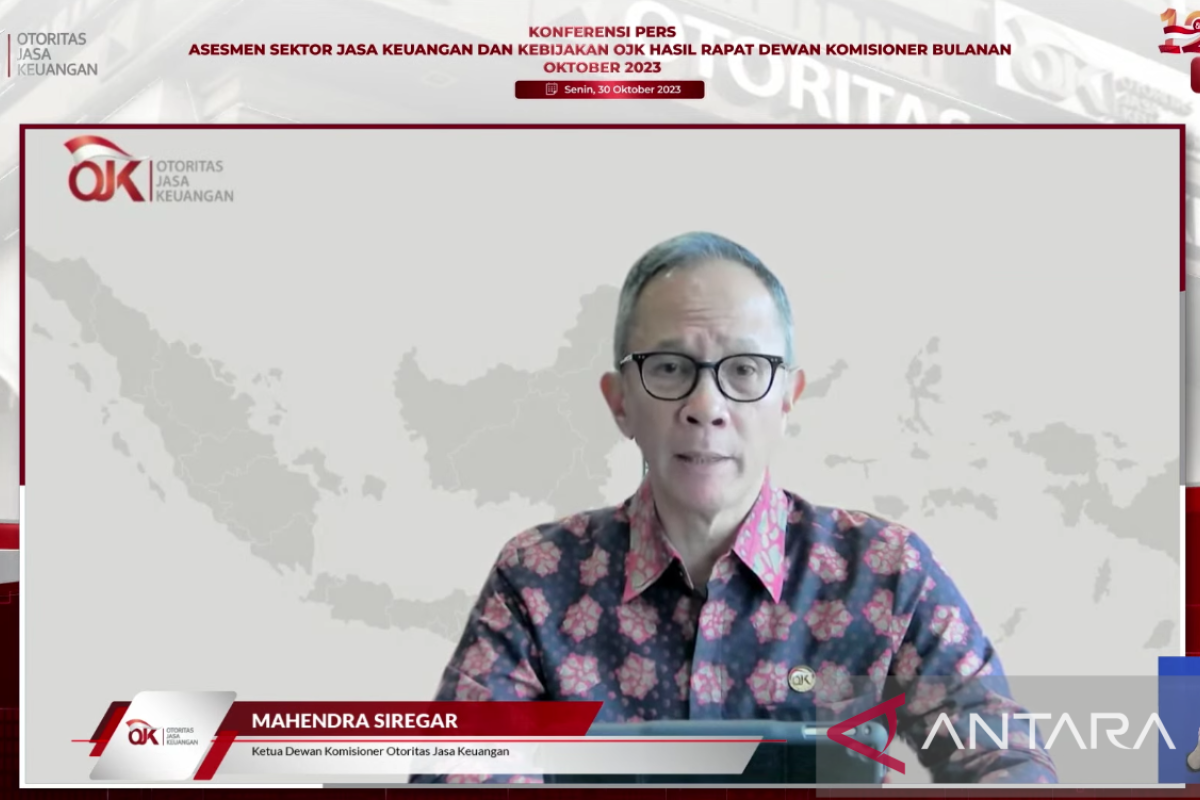

"The financial services sector has remained stable in the face of increasing global uncertainty, as demonstrated by the impact of a strong capital style, adequate liquidity conditions, and a maintained risk profile," Siregar remarked at a press conference on OJK Monthly Board of Commissioners Meeting (RDKB) in October 2023 in Jakarta, Monday.

Moreover, he affirmed that the national financial services sector was able to face increasing geopolitical tensions at the global level, one of which is the ongoing conflict in the Middle East between Israel and Hamas.

"Global geopolitical risks are increasing as the conflict in Gaza between Israel and Hamas has the potential to significantly disrupt the world economy, especially if there is an escalation in the wider Middle East," Siregar cautioned.

Siregar stated that the improving labor market and persistent high inflation in the United States (US) had encouraged an increase in bond-market sell-offs in one of the world's strongest economies.

Moreover, the increase in US bond yields (US Treasury yields) has increased capital outflow or outflow of capital from emerging markets, including Indonesia, as well as caused a significant weakening of the exchange rate and bond market.

"Volatility in financial markets, both stocks, bonds and exchange rates, is on an increasing trend," he stated.

However, Siregar reminded that the performance of the domestic corporate sector is still relatively good, as is reflected in the manufacturing Purchasing Managers' Index (PMI) that continues to be in the expansion zone and the trade balance that continues to record a surplus.

On the other hand, he affirmed that the people's purchasing power is still under pressure, as is reflected in the declining Consumer Confidence Index (IKK) and low retail sales performance.

Related news: Rupiah's drop still safe for real, financial sectors: Jokowi

Related news: BI aims to bolster cybersecurity to protect national financial system

Related news: Need collaboration to bolster governance of financial services: OJK

Translator: Muhammad Heriyanto, Cindy Frishanti Octavia

Editor: Sri Haryati

Copyright © ANTARA 2023