With the rapid development of technology and Internet penetration, Indonesia has the potential to benefit significantly from the digital economy.

However, there are challenges that will need to be overcome to develop and strengthen the digital financial ecosystem in the country, namely the infrastructure gap, low financial literacy and education, and cybersecurity threats. This will require stronger collaboration between stakeholders.

In this regard, the government is continuing to make efforts to develop the digital economy thoroughly, as stated in the 2030 National Strategy for Indonesia’s Digital Economy Development, especially building the six pillars of digital economy development.

The six pillars are strengthening infrastructure, human resources, business climate and cybersecurity, research on innovation and business development, and financing and investment, as well as pushing credible policies and regulations.

The government is continuing to carry out digital infrastructure development. In the period from 2019 to 2022, the budget for digital infrastructure reached Rp75 trillion (around US$4.6 billion).

According to head of the Center for Financial Sector Policy of the Fiscal Policy Agency of the Ministry of Finance, Adi Budiarso, Indonesia has committed to continuously investing in digital infrastructure going forward.

One of its main digital infrastructure programs is the development of the Palapa Ring fiber optic project for preparing and strengthening Internet connectivity across Indonesia.

In 2024–2025, the Indonesian government will continuously make efforts to connect the Palapa Ring network up to the last mile.

Digital talents

The digital economy will not be able to advance without qualified human resources. Therefore, digital talents will need to be continuously developed, including by improving the quality of basic and higher education, developing inclusive digital education and training programs, and increasing the level of financial and digital economic literacy.

The development of the digital economy is inseparable from the need for building a conducive business climate, in line with various efforts for structural reforms by the government.

To develop the digital economy, the government is continuing to encourage the digitalization of micro, small, and medium enterprises (MSMEs), promote the presence of new technology startups, and accelerate the use of digital technology in the main sectors of the economy.

Innovation can accelerate the development of the digital economy. To this end, the government is intensively encouraging research and development (R&D) efforts, especially in the public and private sectors, for example, by providing incentives such as a super tax deduction for R&D.

The digital economy is a sector that requires large capital. For that reason, investment — both domestic and foreign — in the sector needs to be pushed.

The government is making efforts to devise incentives to attract more investment in the digital sector.

It is also continuing to develop policies and regulations that encourage innovation while paying attention to consumer and community protection.

Reform in the financial sector and the development of digital finance are also needed to encourage policy strengthening in the sector.

To realize the Advanced Indonesia 2045 vision, the financial sector also needs to advance. Therefore, the intermediation function of the financial sector needs to be directed to allow it to become a source of deep, innovative, efficient, stable, and inclusive financing to support the achievement of the Golden Indonesia vision.

Fintech boost

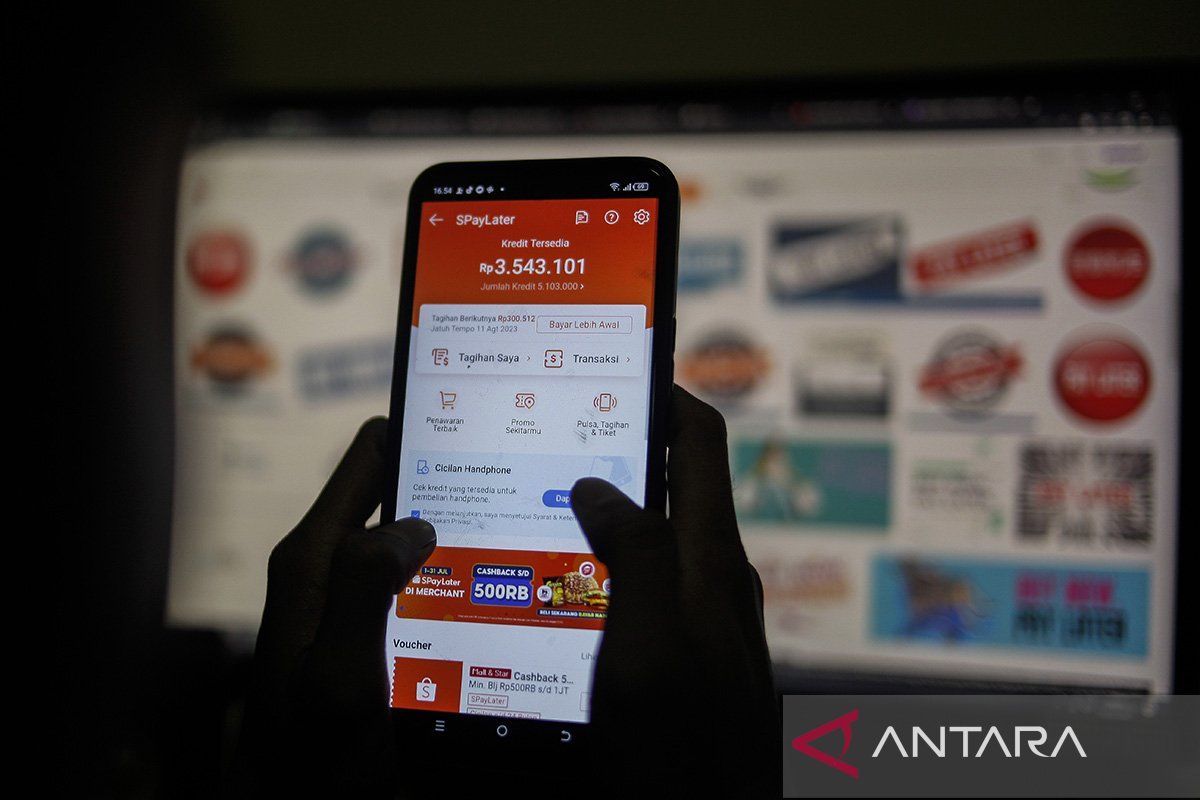

The Fourth Industrial Revolution has brought significant progress in terms of digital technology, including the emergence of digital financial technology (fintech).

According to the chief executive for capital market supervision at the Financial Services Authority (OJK) Inarno Djajadi, fintech has offered innovative financial solutions that have transformed the way people manage their finances.

By utilizing technology such as the Internet, mobile computing, cloud computing, Big Data, blockchain, and artificial intelligence (AI), fintech companies can provide financial services that are better, quicker, and more affordable.

This can certainly boost the efficiency, effectiveness, and coverage of services as well as help create financial products and services that are more inclusive and suited to the needs of the community. In Indonesia, fintech development has been increasingly supported by the rise in the use of digital technology by the community.

Based on the results of a 2024 survey released by the Indonesian Internet Service Providers Association (APJII), Internet penetration in Indonesia has reached 79.5 percent, with Internet users accounting for 221.5 million out of the total population of 278.7 million.

This progress has been reflected in the value of Indonesia's digital economy, which reached US$77 billion in 2022, and is estimated to reach US$130 billion in 2025.

Specifically, crypto assets have seen exponential development since their emergence in 2008.

As of April 2024, the value of crypto asset transactions was recorded at Rp211.10 trillion (around US$12.94 billion), with the number of users reaching 20.16 million. The highest transaction value was recorded in 2021 at Rp859.4 trillion (around US$52.71 billion).

In line with this progress, the Indonesian government has shown a strong commitment to supporting the development of fintech by developing and strengthening the national digital financial ecosystem.

This has been outlined in the 2045 Digital Indonesia Vision, which has three main pillars — digital government, digital economy, and digital community — supported by strong digital infrastructure and digital ecosystem.

The government, the OJK, and stakeholders are also continuing to improve financial literacy and education to support the development of the digital economy.

The implementation of financial education to improve people's financial literacy is very necessary because based on a survey conducted by the OJK in 2022, the financial literacy index of Indonesians stood at 49.68 percent, an increase compared to 2013, 2016, and 2019, when it was recorded at 21.84 percent, 29.70 percent, and 38.03 percent, respectively.

Financial literacy and education are expected to help the community choose financial products and services that are suited to their needs. The public must understand the benefits and risks involved properly, know their rights and obligations, and believe that the financial products and services they choose can improve public welfare.

By optimizing digital development and the demographic dividend as well as synergy between stakeholders, strengthening infrastructure, improving investment attractiveness, supporting human resources development and credible policies, as well as promoting financial literacy and education, Indonesia can comprehensively accelerate digital economic development.

This would allow it to derive greater benefits from the development of the digital economy to achieve its vision of becoming a developed and prosperous country.

Related news: Reaping demographic dividend in the digital era

Related news: Minister Setiadi, DCO discuss digital economy

Related news: Indonesia pushes to accelerate digital economy development

Translator: Martha Herlinawati, Raka Adji

Editor: Azis Kurmala

Copyright © ANTARA 2024