Many parties are concerned that Indonesia will be affected. However, it may be time for the country to make it an opportunity to secure a new strategic position amid the current situation.

The Asian Development Bank (ADB) assessed that the reciprocal tariff of 32 percent imposed by the US on Indonesia is unlikely to have a significant qualitative impact on Indonesia's economy.

According to ADB's Southeast Asia Economist Nguyen Ba Hung, this is because Indonesia's total exports to the US remain relatively small.

Therefore, Indonesia does not need to be overly concerned. This nation could draw lessons from the experiences of Cambodia and Vietnam. Although both nations are known to be politically close to China, their responses to US tariff pressures highlight an important aspect that, in global trade, loyalty is determined not by diplomatic history but by economic calculations.

When US tariffs on China increased, Cambodia and Vietnam reduced tariffs on American products. This was not an act of betrayal but a rational choice demonstrating that export-oriented countries will always prioritize buyers over sellers.

Buyers are sources of foreign exchange, the foundation of economic growth, and are essential for the continuity of domestic industries.

For export-oriented countries, losing buyers means losing sources of income, while losing sellers may raise supply chain costs, but it is not something that cannot be replaced.

Although Chinese products have high economic value, they are not the only option in the global market. Cambodia can fully import the same products from Vietnam, India, or even Eastern European countries. While prices may be slightly higher, operations can continue as usual.

However, losing the US market means losing a vital source of foreign exchange earnings and the main foundation for export orders. Meanwhile, China's excessive production capacity has become a global consensus, and as a result, China neither needs nor will it purchase Cambodia's products in large quantities.

Thus, from the perspective of national strategy and real economic interests, although politically closer to China, Cambodia and Vietnam still choose the US without hesitation in the face of tariffs and export risks. This is a rational response to real pressure based on national interests.

Indonesia's position

The question is: What about Indonesia? Indonesia's trade position with the US and China is fairly clear.

Each year, Indonesia imports a large number of products from China, resulting in a trade deficit to some extent. Meanwhile, Indonesia consistently maintains a trade surplus with the US through its exports.

This means that losing access to the US market will have a direct impact on Indonesia's balance of payments and the stability of its export industry.

While disruptions in supplies from China would be troublesome, these imports could potentially be substituted by sourcing from other countries.

Admittedly, this would not be easy, but it is still possible. This simple logic leads to one conclusion: in the long run, buyers have greater negotiating power than sellers, especially if the goods in question are highly substitutable, such as textiles, inexpensive electronics, or fast-moving consumer goods.

China is known as the “world’s factory,” but it is not the only supplier. Moreover, due to its excess production capacity, China is unable to become a major buyer for countries such as Indonesia.

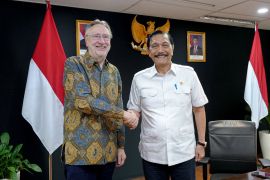

Chairperson of the National Economic Council (DEN), Luhut Binsar Pandjaitan, even assessed that the US reciprocal tariffs against Indonesia are not entirely negative.

The repositioning of global trade could present an opportunity for Indonesia to attract foreign investment, making the country a production hub.

That is why the current situation should be viewed as an opportunity. As global supply chains are reshuffled and investors seek new, more stable locations, Indonesia has several advantages that cannot be overlooked.

Indonesia's geopolitical neutrality, competitive labor costs, and active participation in various regional cooperation frameworks make it a leading candidate to become a new hub in the global industrial network.

At the end of the day, capital always seeks destinations where it can grow. As growth space narrows in China due to external pressures and domestic stagnation, capital will look for new locations, and Indonesia appears well-positioned to become a prime destination.

Clear signs indicate that global capital is starting to show interest in Indonesia. While stock markets in Japan and Hong Kong have experienced corrections of over 20 percent in a short period, and South Korea's market has also seen a sharp decline, Indonesia's market has demonstrated resilience.

A decline still occurs, albeit not as deep as in other major countries. This is not coincidental. It reflects growing confidence that Southeast Asia, and Indonesia, in particular, is the next key region with systemic investment value.

In this context, the downturn provides an opportunity for capital to enter further, laying the foundation for long-term growth.

Three main sectors

Then, where should the investment be directed? Analyses consistently identify three main sectors currently emerging as the leads: infrastructure, finance, and energy-mineral resources.

Infrastructure forms the backbone of domestic growth, bolstered by long-term policies and stable cash flows.

The financial sector, particularly large banks, serves as the primary gateway for foreign capital. When capital flows in, banks are the first to receive funds, manage them, and distribute them.

Meanwhile, the energy and mineral resources sectors, which hold an irreplaceable role in global supply chains, will be the most strategic, in line with the increasing demands from the two great powers, China and the US.

Indonesia's status as a major exporter of energy and mineral resources strengthens the country's position.

As demand rises with each power aiming to boost its domestic growth, Indonesia will hold a strategic role in distribution.

Even when the energy sector experiences fluctuations in financial markets, the industry remains resilient. The most noticeable proof is the surge in the steel sector in the US while other market indexes weakened, indicating that real demand persists and will continue to grow.

Therefore, rather than being trapped by fear over the impact of China-US trade tensions, all parties should adopt a clearer perspective. This is not a disaster, but the beginning of a new chapter.

The world is transforming, and in every large transformation, there is always room for countries that are ready and can seize opportunities.

The bravery to think calmly, comprehend economic logic clearly, and to act rationally is the strongest weapon.

The real winners are not those who wait for things to be certain, but those who dare to take risks based on sharp understanding and confidence for future potential.

Related news: Indonesia's Prabowo orders tariff talks with US to safeguard interests

Related news: Indonesian govt urged to engage both China and US on tariff policy

Related news: Indonesia, EU discuss Comprehensive Economic Partnership Agreement

Translator: Hanni Sofia, Raka Adji

Editor: Primayanti

Copyright © ANTARA 2025