The finance Ministry adjusted or raised the income tax tariffs on imports of goods under 1,147 tariff categories aimed mainly to reduce the current account deficit.

The measure followed the widening deficit in the country`s current account balance in the second quarter of this year resulting in rupiah losing more of its value against the U.S. dollar lately.

The country`s current account deficit has hit the level of 3.04 percent of its Gross Domestic Product (GDP) widening beyond the level of 3 percent considered safe.

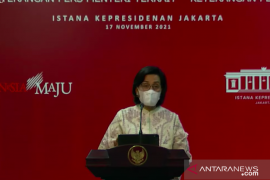

"We hope the public could see that the government wants to move fast under the situation not normal. We have to do something we would not do in a normal situation," Finance Minister Sri Mulyani said when announcing the decision to `adjust` the import duties last Wednesday.

Based on the official data of Bank Indonesia (BI), the country had a current account deficit of US$8 billion in the second quarter of this year or 3.04 percent of the GDP.

The deficit widened from US$5.7 billion or 2.21 percent of the GDP in the previous quarter.

In the first two quarters of the year, however, the current account deficit was only 2.6 percent.

Meanwhile, over the past week, the national currency rupiah had tended to be more vulnerable weakening to a level almost 15,000 per U.S. dollar.

Some observers especially government critics have triggered panic by dramatizing the rupiah fall as if the country`s economy is about to go bankrupt. They compared the rupiah fall to the condition in 1998`s monetary crisis when rupiah sank to the same level.

Coordinating Minister for Economy Darmin Nasution said it was not fair to compared the present condition with that in 1998.

"The condition was more than five times worse in 1998 when rupiah sank from the level of 2,400 to around 15,000 per dollar. Now the rupiah fell in value from the level of more than 13,000 to more than 14,000 per dollar. In addition, our inflation is only 3.5 percent or the lowest ever," Darmin said

He said the country still had strong economic fundamental, adding "our problem is only in current account deficit."

Last week, Bank Indonesia recorded the rupiah exchange rate at around 14,700-14,900 to close at 14,884 at the end of the week. On the spot market rupiah closed at the level of 14,820 after intervention by the Central Bank.

In a working meeting with the Commission XI of the House of Representatives (DPR) in middle of last week, Bank Indonesia Governor Perry Warjiyo said fundamental step to stabilize rupiah exchange rate is by slashing the current account deficit.

Current account balance is the main component of balance of payments that include exports and imports of goods and services, primary and secondary income. Current account balance is an indicator to see supply and demand for foreign exchange of a country`s international trade in goods and services. Deficit in the current account balance indicates that the country is falling short of foreign exchange supply.

The country has continued to have deficit in current account balance since the last quarter of 2011. At that time the country`s current account deficit was US$1.6 billion or 0.7 percent of the GDP caused by an increase in domestic demand especially for investment that resulted in a surge in imports amid weak global demand for commodities other than oil and gas.

In addition, the country`s crude oil production has continued to shrink when domestic consumption of oil fuels (BBM) grew fast. Meanwhile, global oil price rose that the country was beset by greater burden of oil imports.

Normally, the current account deficit is covered with foreign capital inflows to the country either through state bond market or stock market that would improve the domestic foreign exchange liquidity.

However, the prevailing condition in the world has triggered the return of dollar back home to the United States. Amid the global uncertainties, investors tend to put their money in a safer market and currently the U.S. dollar is the haven currency.

The dollar appreciation and the trade war between the United States and China has weakened the currencies of developing economies.

A number of developing economies are already reeling and collapsed such as Turkey and Argentina on problem in balance of payments after large capital flights.

Indonesia fared better with strong economic fundamental, but the government is forced to shelve a number of big projects to keep from falling to bigger financial problem.

As long as there is still deficit in current account balance, rupiah will remain weak and vulnerable, former Bank Indonesia Governor Agus Martowardojo has said.

"Therefore, the country has to end the years of deficit in current account balance and inflation must be kept under control," Agus said.

He said during his five year term as Central Bank governor in 2013-2918, rupiah weakened from 9,700 to 14,000 per dollar partly on current account deficit.

Bank Indonesia has raised its benchmark interest rate (BI-7RR) several times over the past few months hoping to forestall the impact of the rise in the fund rate of the U.S. Central Bank, the Federal Reserve, which has been one of the causes of the global financial turbulence.

From May to August this year, the Indonesian Central Bank raised its benchmark interest rate by 125 basis points from 4.25 percent to 5.5 percent.

The rise in the BI-7RR, however, was not effective enough to prop up rupiah.

Abra Talattov, an economist from the Institute for Development of Economics and Finance (INDEF), said further increase in the central bank`s benchmark interest rate is not expected to help much in strengthening rupiah.

The Central Bank would only lose more of its foreign exchange reserve, he said, adding the best the Central Bank could do is to send signal encouraging credit expansion for the real sector, he said.

In addition, the Central Bank should seek to improve liquidity in financial market to be more resistant to financial turbulence in the event of capital outflow, he said.

Coordinating Minister for Economy Darmin Nasution said the new regulation requiring the substitution of automotive diesel oil (AD) with use of biodiesel 20 (B20) will help reduce current account deficit.

B20 is a mixture of palm oil making up 20 percent and automotive diesel oil making up 80 percent.

Effective implementation of the regulation requiring the use of B20 would save the country around US$2 billion in the remaining 4 months of the year, he said. (T.C005/AS)

Reporter: Citro and A Saragih

Editor: Fardah Assegaf

Copyright © ANTARA 2018