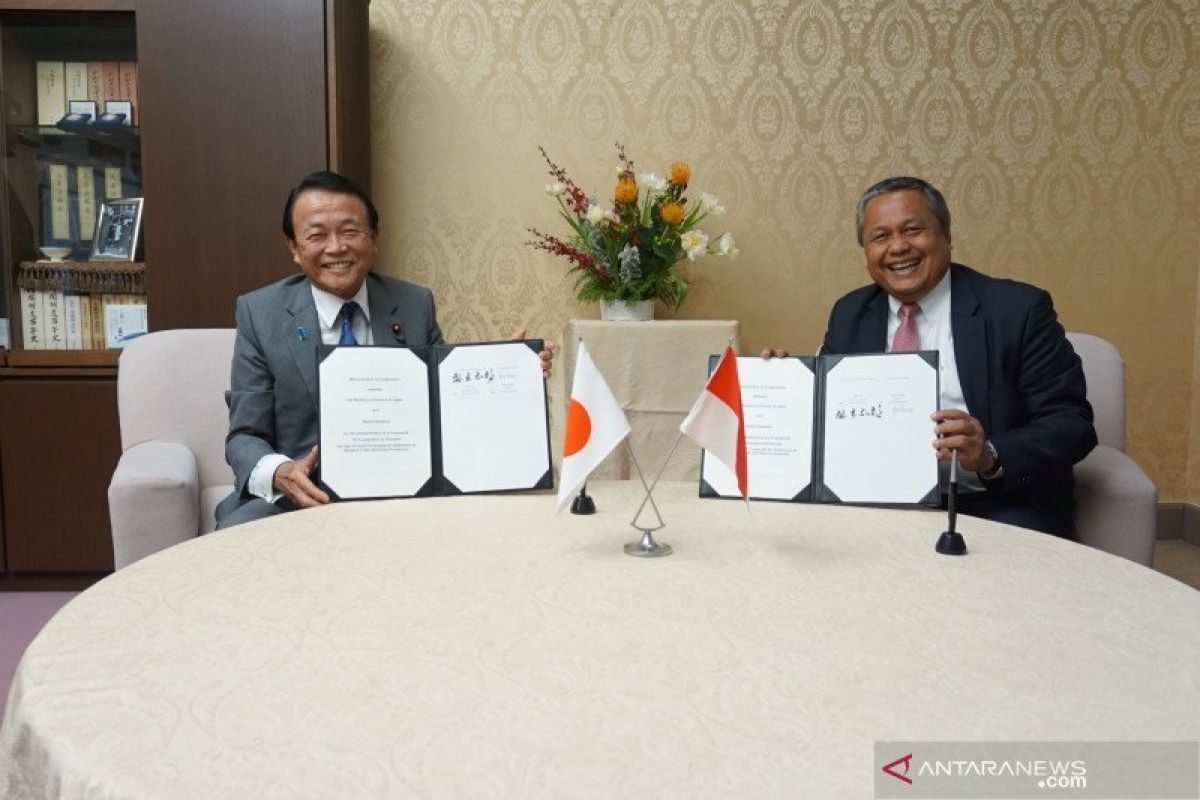

The strengthening is meant to provide an easing of rules for foreign exchange transactions in the framework of settling bilateral transactions between the two countries with the rupiah-yenJakarta (ANTARA) - Bank Indonesia and Japan’s Ministry of Finance (JMOF) have agreed to strengthen the framework for local currency settlement (LCS) transactions between the two countries in rupiah-yen which has been implemented since August 31, 2020. "The strengthening is meant to provide an easing of rules for foreign exchange transactions in the framework of settling bilateral transactions between the two countries with the rupiah-yen," quoted an official statement from Bank Indonesia on Thursday.

The strengthening includes the expansion of hedging instruments, implementation of hedging based on trade and investment projections, increased flexibility in transfers for IDR accounts in Japan, and the increased threshold value for transactions without underlying documents up to US$500,000 per transaction.

Related news: Indonesia-Japan support wider local currency use for trade transaction

The strengthening of the cooperation framework, which will take effect on August 5, 2021, is part of ongoing efforts to encourage trade and investment as well as strengthen macroeconomic stability by encouraging wider use of local currencies for trade settlements and direct investment between Indonesia and Japan.

It is also in line with the Memorandum of Understanding signed by BI and the JMOF on December 5, 2019.

The strategy for strengthening the LCS framework is part of the joint efforts of BI and the JMOF in encouraging the wider use of local currency for businesses and individuals to facilitate and increase trade, direct investment, and other transaction activities such as remittances between Indonesia and Japan.

Related news: BI, 3 ASEAN central banks cooperate over local currency transactions

Translator: Kuntum K, Azis Kurmala

Editor: Rahmad Nasution

Copyright © ANTARA 2021