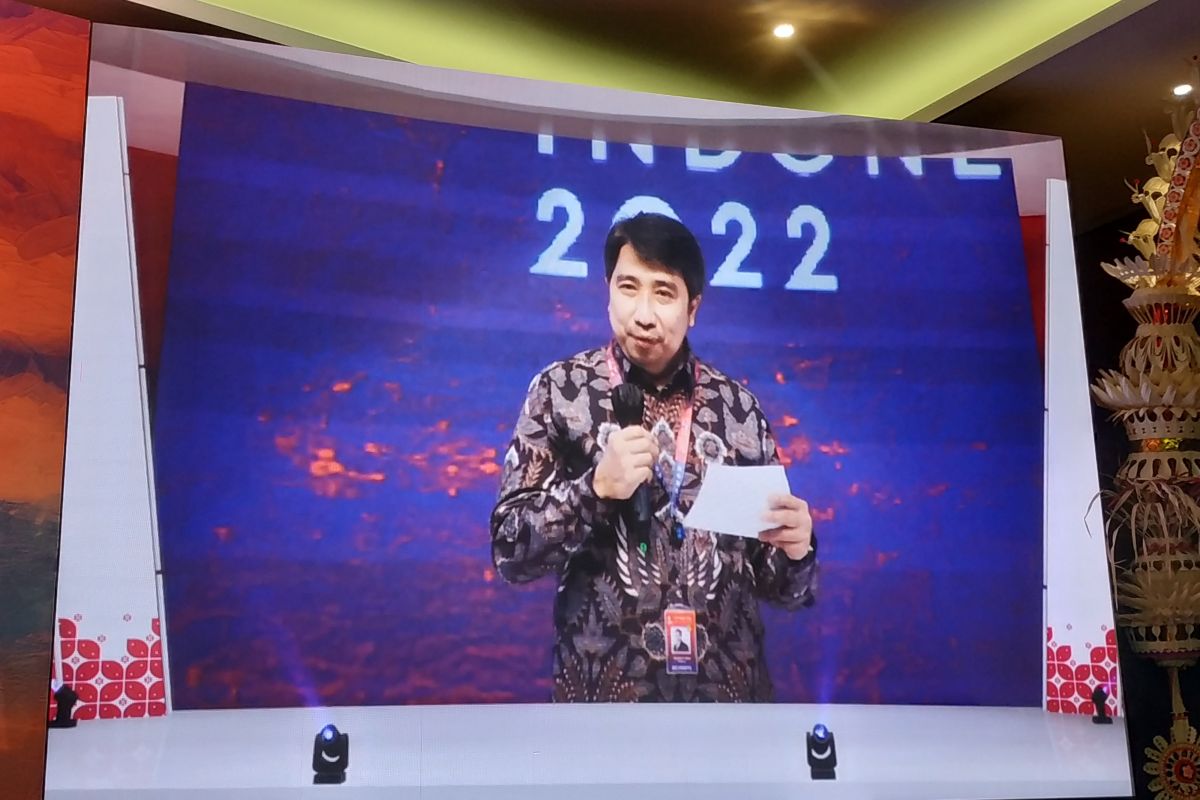

"This is an important aspect. This is what the central bank and every authority had striven to fight," he noted at the G20 side event titled "Central Bank Policy Mix for Stability and Economic Recovery" in Nusa Dua, Badung, Bali, on Wednesday.

The risk of stagflation varies from country to country. Thus, the risk should be studied further since the monetary policy in some larger countries had been stricter, thereby placing the global economy at a much worse, unstable condition.

Juhro spoke of having observed a prolonged, contagious crisis. If a country could not commit to address that issue properly, then there would be even more risks in the next crises.

After some countries give up on handling the COVID-19 pandemic, which had seen some improvement, more conflicts arose in the form of geopolitical issues and protectionism. However, none of those could be resolved singlehandedly by a country.

Related news: Bappenas readies strategies for economic transformation in Indonesia

"We cannot work alone. We have to have better collaboration in terms of policies, not only on the national scale but also the global scale," he stated.

Due to the complexity of challenges faced by Indonesia, the central bank could not solely rely on the benchmark interest rate, he stated. Other instruments were also utilized in order to address the problem.

Monetary policies would be geared towards economic stability in 2022. With regard to other matters, comprising macroprudential policies, payment system, and everything else, the economic growth aspect would be considered.

"These are what we have, and we will become a relevant central bank to face many complex challenges," he said.

Related news: Global stagflation risk to cast shadow on national economy: BI

Translator: Mecca Yumna Ning Prisie

Editor: Rahmad Nasution

Copyright © ANTARA 2022