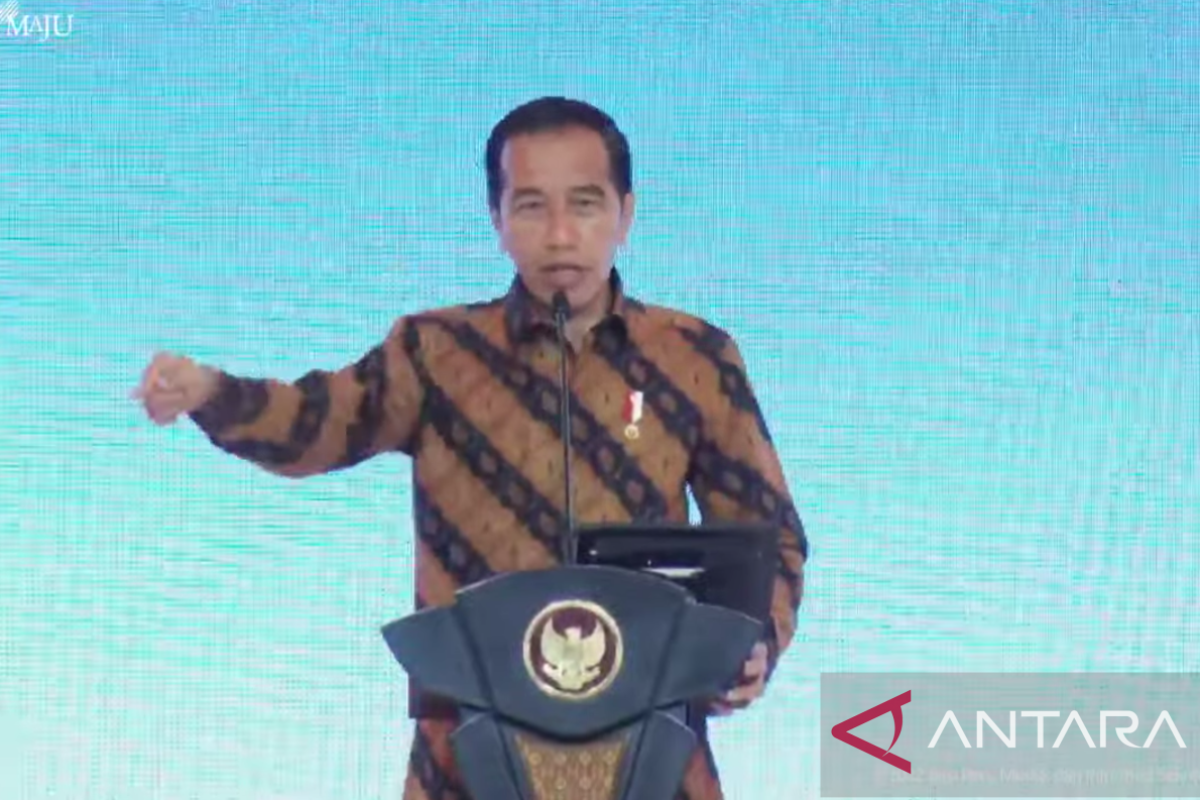

“At that time (2014-2015), 38.5 percent were controlled by foreigners, and now, only 14.8 percent are controlled by foreigners," President Jokowi stated at the Indonesia Economic Outlook 2023 event in Jakarta, Wednesday.

According to the head of state, if foreign investors control SBN ownership, then the rupiah exchange rate will be vulnerable to volatility when the domestic macro economy is shaken.

In addition, the head of state noted that currently, Indonesia's current account balance in the third quarter of 2022 has recorded a surplus of US$8.9 billion, or 0.9 percent of the gross domestic product.

The government continues to conduct structural reforms to strengthen economic stability.

The head of state noted that during the 2014-2015 period, Indonesia was still included as the fragile five. The term refers to developing countries that are vulnerable to economic shocks due to the large influence of foreign investment.

During the 2014-2015 period, there were also taper tantrums or conditions of global economic turmoil caused by the US central bank's tight monetary policy.

In 2014, the current account deficit, or an indicator of the flow of trade in goods and services between Indonesia and foreign countries, showed a deficit of US$27.5 billion and decreased to US$17.5 billion in 2015.

The president compared the data with Indonesia's current account balance that currently recorded a surplus of US$8.9 billion in the third quarter of 2022.

"Hence, at that time, I said that we must have the courage to change this, our structural reforms, so that we can do (anticipate) things that endanger our macro economy," the president noted.

Every morning, the president always seeks the latest data related to the economy from ministers. He was reluctant to just accept normative statements without concrete evidence and data regarding economic improvement.

"'Sir this is better', what is the number? I asked for the number, because it is very important," President Jokowi remarked.

Bank Indonesia (BI) earlier bought government bonds, or SBN, worth Rp974.09 trillion in the primary market during the period from 2020 to November 15, 2022, to support the state budget (APBN) financing.

"Support for state budget (APBN) financing is needed to implement the national economic recovery program and handle humanitarian and health issues during the COVID-19 pandemic," BI Governor Perry Warjiyo stated.

Warjiyo noted that the support aligns with the mandate of Law No. 2 of 2020. To follow up on the mandate, the BI governor and the finance minister signed a joint decree.

The purchase of SBN for COVID-19 handling comprised SBN KB I worth Rp266.11 trillion, SBN KB II worth Rp397.56 trillion, and SBN KB III worth Rp310.42 trillion.

Meanwhile, the purchase of SBN KB III was specifically designed to handle humanitarian and health issues during the COVID-19 pandemic. The remaining Rp128.58 trillion of SBN KB III will be realized until the end of this year.

Warjiyo echoed BI's commitment to purchasing the remaining Rp128.58 trillion, so that the value of SBN purchased in the primary market would reach Rp1,444 trillion at the end of 2022.

"Hence, the value of SBN that we bought in the primary market for three years will reach Rp1,444 trillion to support APBN for COVID-19 handling and economic recovery in accordance with Law No. 2 of 2020," he stated.

He said the support for APBN financing is one of the central bank's monetary policies to maintain stability and support national economic recovery.

In addition to purchasing SBN in the primary market, the other monetary policy is raising the key interest rate, strengthening stability of the rupiah's exchange rate, and maintaining loose liquidity policy.

Related news: UU P2SK to maintain BI, OJK, LPS independence, minister assures

Related news: BI buys Rp974.09-trillion SBN in primary market until Nov 15

Related news: BI buys SBNs worth Rp65.03 trillion in primary market

Translator: Indra AP, Azis Kurmala

Editor: Sri Haryati

Copyright © ANTARA 2022