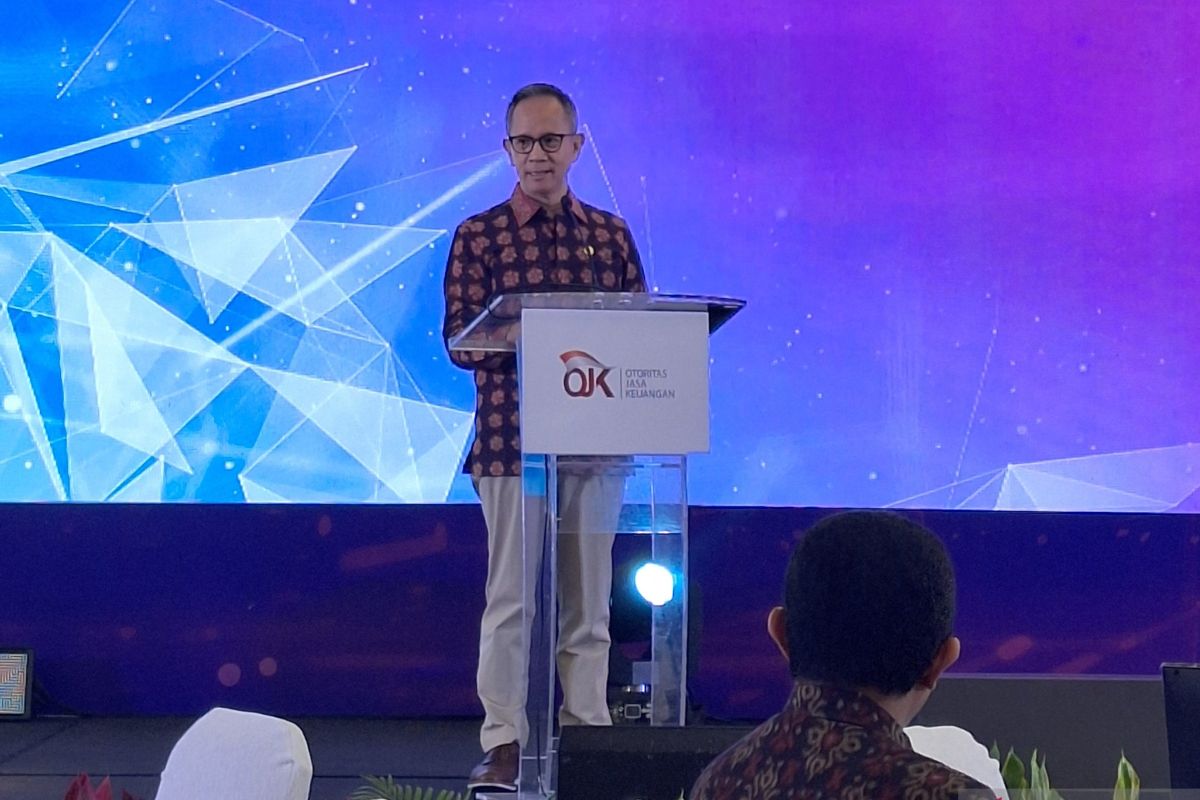

"We are still in the process of developing this center. It's a collaborative effort involving government agencies and the financial services industry," said OJK Chairman Mahendra Siregar on Friday.

Siregar explained that the OJK is currently crafting the optimal structure for the Anti-Scam Center, considering factors like participation, technology, and investment.

"Ideally, we want as many financial service institutions as possible to join the team to monitor emerging risks effectively," he stated.

He noted that online fraud and transaction issues were handled individually by each financial institution.

"We had to address each case separately," he pointed out.

With the Anti-Scam Center, the OJK aims to tackle multiple problems simultaneously.

"However, this requires the full support and participation of all financial service institutions and government agencies," he emphasized.

Siregar also announced that online gambling account holders could be blacklisted by financial service institutions if found guilty.

"If account holders are proven to have violated the law, they can be blacklisted, but this process must be followed," Siregar clarified.

To date, the OJK has ordered banks to block approximately 6,000 accounts linked to online gambling activities. However, the total transaction value from these accounts has not yet been assessed.

The OJK, together with banks and other stakeholders, remains committed to identifying bank accounts involved in online gambling.

Translator: Martha S, Kenzu

Editor: Aditya Eko Sigit Wicaksono

Copyright © ANTARA 2024